Claims Still Strong

Seasonally adjusted initial jobless claims remain off of the low from one month ago, but this week did see a sequential improvement. Claims dropped by 2K to 184K from last week’s slightly upwardly revised level of 186K. That is the ninth week in a row with sub-200K prints as claims sit at some of the lowest levels on record.

Before seasonal adjustment, claims were also impressive falling from 224.1K to 196.9K as the brief seasonal uptick at this point of the year unwinds. As shown in the second chart below, the current week of the year has only seen claims rise week over week 12% of the time historically. Claims will likely continue to see seasonal tailwinds through the next several weeks before a seasonal increase in the late spring and summer.

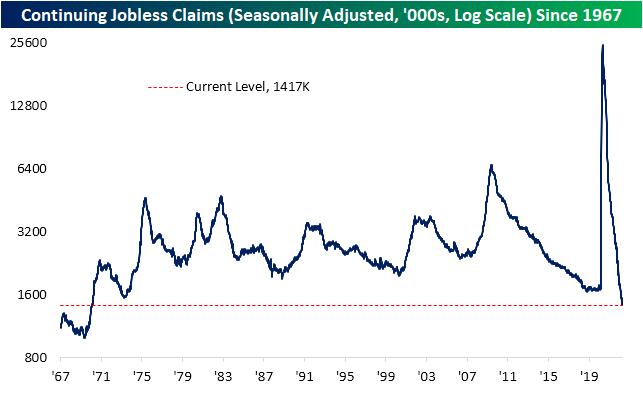

Lagged one week to initial claims, continuing claims came in below expectations of 1.459 million, reaching a new low of 1.417 million. That sets the lowest level since February 1970. Click here to view Bespoke’s premium membership options.

Chart of the Day: Megacaps Finally Weighing

The Bespoke 50 Growth Stocks — 4/21/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup — 4/21/22

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

Bespoke’s Quote of the Day: “In trading, you have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep the money.” – Ray Dalio

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

As shown below, the 8 largest US stocks are all in the red so far this month for an average decline of 8.2%. The rest of the stocks in the large-cap Russell 1,000 are only down an average of 8 basis points.

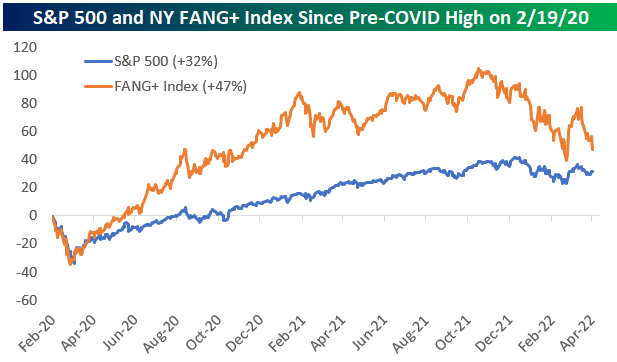

The FANG+ Index is made up of 7 of the 8 largest stocks listed above (excluding BRK/B), but it also includes Netflix (NFLX), Alibaba (BABA), and Baidu (BIDU). Since April 4th, the FANG+ index is down 17%, and it’s down 28% from its highs.

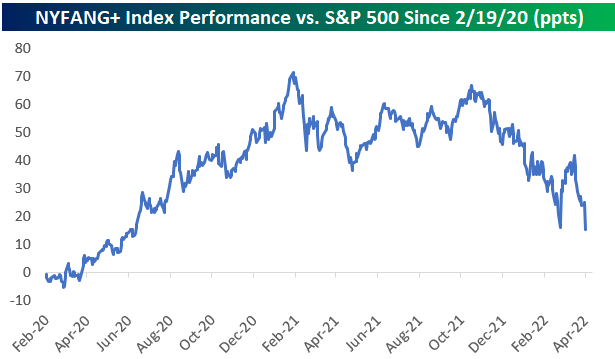

Below we show how the FANG+ index has performed versus the S&P 500 since 2/19/20 – the peak day for the US stock market before the COVID pandemic hit. FANG+ stocks exploded higher in late 2020 and peaked versus the S&P in early 2021 with an outperformance spread of more than 70 percentage points. That outperformance has been eroding rapidly since last November and the spread is only +15 percentage points now.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: April Decile Analysis

Bespoke Baskets Update — April 2022

Are The Best Days Behind for Mortgage Activity?

US Treasury yields have continued to move higher with mortgage rates rising in tow (we explained some key distinguishing characteristics of mortgages versus Treasuries in last night’s Closer). Bankrate.com’s national average for a 30-year fixed rate mortgage has now eclipsed 5.25% in the past week which is an over 2 percentage point increase year over year. Since the start of this series on mortgage rates going back to the late 1990s, that is by far the largest year-over-year increase on record.

Higher rates mean less attractive affordability so purchase applications have continued to fall per the latest Mortgage Bankers Association data. Seasonally adjusted purchase applications dropped 3% this week and are hovering just above the February lows.

The spring is often the hottest time of the year for housing activity. As shown below, the few weeks surrounding the current one have often marked the annual high (blue dots in chart below) in non-seasonally adjusted purchase applications over the past decade. This year that might not be the case. Activity has been running below that of the prior year and has plateaued more recently as mortgage rates have taken off. At the moment, this year’s high was set a little over a month ago in the second week of March. While a new high for the year is still within tangible reach from current levels—meaning upcoming weeks could still very well experience an uptick to a new high—this year has the potential to see a much earlier than usual high in mortgage purchases.

Refinance applications meanwhile are far weaker with unrelenting declines recently. This week marked the sixth week over week decline in a row leaving the MBA’s refinance index at the lowest level since February 2019. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup — 4/20/22

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

Bespoke’s Quote of the Day: “Companies rarely die from moving too fast, and they frequently die from moving too slow.” – Reed Hastings

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

We certainly aren’t going to see rotation into the Communication Services sector at the open this morning with Netflix (NFLX) trading down 25% on earnings. Based on where NFLX shares are trading pre-market, the stock will be in a 63% drawdown from its high just last November. As shown below, this is the fourth time since going public in 2002 that NFLX will have experienced a drawdown of at least 60%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: Mega Cap Earnings On Deck

Triple Play Comedown

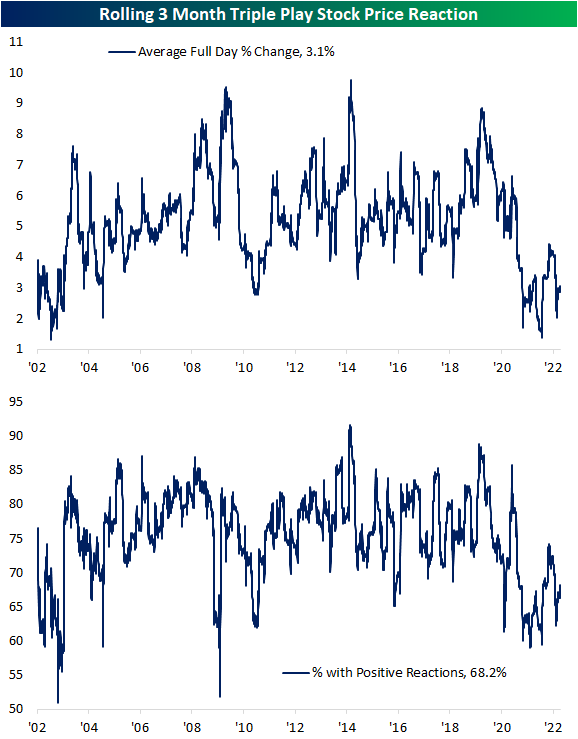

An earnings triple play is when a company beats analyst earnings estimates, beats analyst sales estimates, and also raises guidance. We consider these the gold standard for earnings as these type of results show fundamental strength and are often met with higher share prices. Using data from our Earnings Explorer database, the pandemic years have seen an explosion of triple plays as analyst estimates were too pessimistic/companies rebounded more solidly than expected. As shown below, at the highs last fall, a record of more than 18% of companies reporting earnings (on a rolling 3 month basis) reported a triple play. Over the past several months, though, that reading has pulled back considerably and today is only at 10.5%. While down from its highs, a reading of 10.5% is still elevated relative to history.

As we have noted in the past, when triple plays have been more commonplace, the market response to individual stocks reporting triple plays has been less cheerful. When the rate at which triple plays exploded earlier in the pandemic, the average full-day change on earnings days tanked to some of the weakest in the history of our data. At the low last July, the average stock that reported a triple play over the prior three months only gained ~1.5% on its earnings reaction day. For all earnings triple plays since 2002, the average one-day share price response has been roughly +5%. Recently, stock price reactions to triple plays have been improving with an average gain of 3.1% over the past three months and a little better than two-thirds of triple plays moving higher. As with the triple play rate, that is not fully back to pre-pandemic levels, but it is trending in that direction. With the number of triple plays expected to be light this season, the stocks that do manage to report them should start to be rewarded again. Click here to learn more about Bespoke’s premium stock market research service.