Chart of the Day: Less Consumer ‘Calls’ to Dealer ‘Raises’

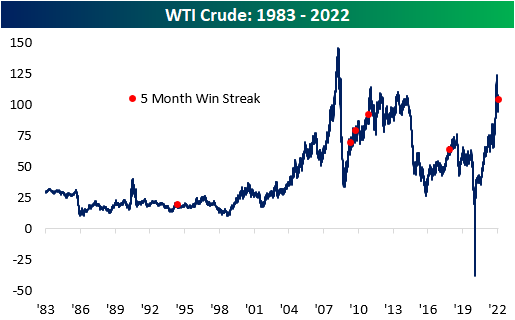

WTI Monthly Win Streak

It’s been a monster year for cruse oil and it continued in April. For the month, WTI rallied 4.4% and finished the month at $104.7 per barrel. This comes as Russian supply has been essentially cut off from Western markets, the Saudis hold back supply, and US drillers are in the process of ramping up capacity to meet demand, which is a process that takes several months to complete. Most notable about April’s rally was that it marked the fifth consecutive month in which WTI rallied, which is tied for the second-longest streak on record (since 1983). The only streak that was longer was in late 2010/early 2011 when WTI notched eight straight months of gains.

The chart below outlines the long-term price chart of WTI Crude. Two aspects stand out in the chart. First, crude oil tended to see additional gains in the short term following these five-month streaks. Secondly, it is also worth noting that three of these occurrences happened within two years (2009 – 2011), which was likely due to aggregate demand ticking higher as the economy emerged from the Global Financial Crisis. The current period is relatively similar, as the global reopening has put upward pressure on the demand curve after oil producers lowered output during COVID. That increased demand has also been exacerbated by supply constraints following the Russian invasion of Ukraine.

The table below outlines the performance of WTI after the fifth straight month of prior five-month win streaks. WTI tended to trade down over the following month but reversed course to book gains in the following three and six months. In the month following these streaks, WTI averaged a loss of 4.4% (median: -4.8%), booking gains just one time (20%). After three months, WTI averaged a gain of 5.1% (median: 5.5%), performing positively 80% of the time. Over the next six months, average performance and positivity rates declined to 1.9% and 60%, respectively.

Higher oil prices affect energy prices, shipping rates, and the cost of so many more secondary products. Therefore, higher oil prices tend to be inflationary and crimp corporate margins as well as consumer buying power. Historically speaking, though, the S&P 500 has averaged a gain of 8.3% (median: 12.1%) during these streaks, which is 420 basis points higher than the average performance for all five-month periods since 1983. In the month following these streaks, the S&P 500 has averaged a gain of 1.4% (median: 3.2%), which is higher than the historical average as well. In the next three months, the index has averaged a gain of 4.5% (median: 4.9%) with positivity rates higher than that of all periods. Similar to what we see in the six-month performance of WTI, positivity rates moderate for the S&P 500, with average six-month gains of 3.2% (median: 0.2%) versus around 5% for all six-month periods since 1983. Click here to view Bespoke’s premium membership options.

Berkshire’s Annual Conference

Warren Buffett’s Berkshire Hathaway (BRK/B) is hosting its annual investor conference this weekend, and investors who don’t make the pilgrimage to Omaha will tune in from around the world to hear Buffett and Munger provide their insights into the economy and the market. You can tune in here. We often hear that Berkshire’s stock gets a lift coming out of the annual meeting, but a look at the stock’s performance leading up to and after the annual meeting suggests otherwise.

Over the last 20 years, BRK/B stock has averaged a gain of 1.0% (median: 80 bps) in the week leading up to the meeting with gains 71% of the time. That average is higher than the average of all periods by a factor of just over four, with positivity rates 18 percentage points higher than that of all periods.

Immediately coming out of the conference, Berkshire has also tended to get a lift with the stock averaging a gain of 40 bps (median: 80 bps) the day after the conference, but that bounce didn’t tend to last long. As shown in the table, on both an average and median basis, returns over the following week were lower than the following day. Buffett would be the last person to advocate a strategy of short-term trading of Berkshire stock, so it’s only fitting that there isn’t a clear pattern of performance leading up to or immediately after his annual “Woodstock for Capitalists”. Click here to view Bespoke’s premium membership options.

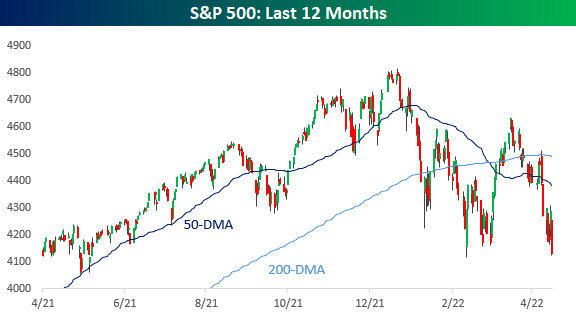

Historic End to a Down Month

It was a rough finish to the month of April. Not only did the S&P 500 (SPY) finish the month with an 8.78% decline month to date, the biggest one-month decline since March 2020, but the last trading day of the month was one for the record books. Since SPY began trading in 1993, the only bigger drop on the final trading day of the month was in August 1998. Back then it was a much larger 7.13% decline.

In the table below, we show all months since 1993 that SPY declined at least 2% on the last trading day of a month. Behind April, the next worst final day of a month and the only other month with an over 3% decline was September 1998, but back then, SPY had still managed to finish up MTD. Finishing up MTD has been the exception rather than the rule of these occurrences, though, as November 1998 and October 2011 were the only other times that SPY fell over 2% on the last trading day of the month but still finished with a MTD gain.

As for where the S&P 500 has typically gone from there, the first trading day of the new month has only seen a move higher 46% of the time as the index has averaged a 30 bps decline. For the full month, though, performance is generally more positive with an average gain of 2.75% and positive returns almost 70% of the time. Click here to learn more about Bespoke’s premium stock market research service.

The Bespoke Report – 4/29/22 – Is That Blood in the Streets?

This week’s Bespoke Report newsletter is now available for members.

An appointment for a root canal has sounded better than having to watch this stock market lately. Just when you think things can’t get any worse in this market, they do, as every bounce has been quickly repudiated with stocks grinding down to new lows for the year.

It’s never a good feeling when equities close out the week at their lows, but we’ve now had that happen two weeks in a row. The S&P 500 has now declined at least 1% for four straight weeks while the Nasdaq has been down at least 2.5% for four straight weeks. Since 1971, there have only been four other times where the Nasdaq experienced a similar streak, so this kind of persistent weakness doesn’t occur very often.

When the markets start acting like this, it’s incredibly difficult to make any sense of the day-to-day moves, so for us or anyone to say anything about what to expect in the short-term would be foolish. Long-term investors have experienced worse and the market will eventually turn, but until it does, that root canal doesn’t look all that bad.

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.

Amazon (AMZN) Shares Now Barely Up Post-COVID

Amazon (AMZN) was one of the primary beneficiaries of the pandemic as consumers were forced to engage in commerce digitally and corporations became increasingly willing to migrate to the cloud. In the first year or so after the March 2020 COVID Crash, AMZN shares soared from $2,000 up to $3,700. Since peaking in mid-2021, however, it has been a different story. Since AMZN reported earnings last night, shares have fallen another 15%. This leaves AMZN up just 13.5% from the level it was trading at right before the pandemic began on 2/19/20.

Although the stock is now barely higher versus pre-COVID levels, revenues continue to climb. Relative to pre-pandemic levels, trailing 12-month revenues have increased by 70.3% (CAGR of 27.2%). As implied, the price to sales multiple has compressed considerably relative to pre-pandemic levels. At the highs, AMZN was trading 3.8 times sales. The highest P/S multiple for the stock since the start of 2020 occurred in September of 2020, when the multiple hit 5.5. As it currently stands, the price to sales multiple is at new lows relative to the start of 2020 at just 2.7.

While AMZN revenues are up 70% from pre-COVID levels, margins have compressed considerably. In Q1 2020, AMZN posted operating margins of 9.5%. In Q1 2022, AMZN reported operating margins of 3.2%. These results can be attributed to inflationary pressures, labor challenges, supply chain constraints and foreign exchange headwinds. As you can see in the chart below, margin compression has hampered EPS, resulting in a decline in trailing 12-month EPS over the last three quarters. Relative to pre-pandemic levels, EPS have risen by 52.5% (CAGR: 21.1%), but they’ve declined by 38.8% over the last three quarters. Click here to become a Bespoke Institutional subscriber and gain access to our Conference Call Recaps.

The Bespoke 50 Growth Stocks — 4/28/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There was one change to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Historically Bearish Investor Sentiment

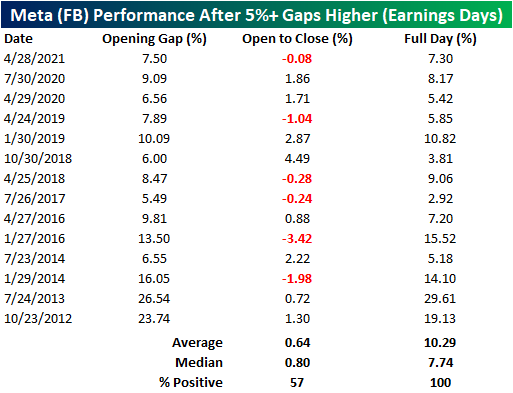

Meta (FB) Intraday Performance Following Strong Earnings

Yesterday, Meta Platforms (FB) reported earnings. In the report, the company noted a sequential rise in both daily and monthly active users in every region apart from Europe, which can be attributed to the effects of the war in Ukraine. This gave investors a sigh of relief, sending shares up over 14% in premarket trading.

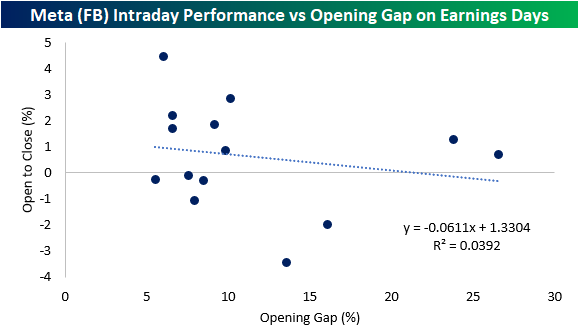

FB has gapped higher by 5%+ in reaction to earnings fourteen times since its IPO. Historically, when this occurs, the stock’s performance from the open and close has been modestly positive, booking gains 57% of the time. The average performance was a gain of 64 basis points (median: 80 bps). The worst intraday performance came in 2014 when the stock traded down by 2.0% percentage points intraday after gapping up 16.05%. On the other hand, the best intraday performance in these time periods occurred in 2018, when the stock gained 4.5% after gapping up 6.0% at the open.

Today marks the fourth-best opening gap since FB went public. This is particularly interesting, as the y/y revenue growth rate in this quarter was the slowest seen since the company went public in 2012. Notably, the opening gap does not seem to be a determining factor for the opening to close performance. As you can see from the chart below, only 3.9% of the variation in the open to close performance can be explained by the size of the opening gap (for 5%+ opening gap gains on earnings). Click here to view Bespoke’s premium membership options.