Bespoke’s Morning Lineup – 9/27/22 – No Safety In Treasuries

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Treasury securities are considered a safe and secure investment” – treasurydirect.gov

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are attempting to rebound this morning after yet another decline in the equity market yesterday. It’s a busy day for economic data as Durable Goods Orders were just released and came in roughly in line with expectations, but there are still several more indicators on the calendar with FHFA House Prices and Case Shiller at 9 AM Eastern and then Consumer Confidence, Richmond Fed, and New Home Sales all at 10 AM.

Treasuries took another pasting yesterday as yields once again surged to new multi-decade highs. Every day there’s another way to show the carnage, so here’s the one for today. The iShares Long Term Treasury ETF (TLT) fell nearly 2% yesterday taking its YTD decline to more than 30%. 30%. In Treasuries! Weren’t they supposed to be safe and boring? For most of our entire investment careers, when markets hit turmoil, market commentary would include something along the lines of “investors rotated into the safety and security of Treasuries. Even Treasurydirect.com, which is run by the Treasury Department says as much on its website.

2022’s word of the year could very well be turmoil, yet US Treasuries are having a down year for the ages. Even on a y/y basis, since its inception in 2003, TLT’s performance over the last 12 months has been the worst on record. It’s even down more than the Nasdaq!

The weakness in Treasuries is not to say that the performance of US equities has been positive this year. With the exception of the Dow ETF (DIA), every other ETF that tracks a major US index is down more than 20%, and every single one of them closed yesterday at ‘extreme’ oversold levels (more than two standard deviations below 50-DMA).

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day – 10-Day Advance/Decline Drops to Record Low

Bespoke’s Morning Lineup – 9/26/22 – Still Falling

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“But I do think that we’re going to do all that we can at the Federal Reserve to avoid deep, deep pain. And I think there are some scenarios where that’s likely to happen.” – Raphael Bostic

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You know it’s bad out there when a Fed official ‘thinks’ that the Fed will do all it can do to avoid ‘deep, deep pain’. Early on in the tightening cycle, Fed Chair Powell said that the Fed’s path to higher rates could result in a ‘softish landing’ for the economy. A few weeks later, he noted that the policy could be accompanied by ‘some pain’. Last week, the Fed chair told reporters that no one knows if this process will result in a recession. Over the weekend, it wasn’t the Fed chair speaking, but Atlanta Fed President Raphael Bostic had the comments above in an interview on ‘Face the Nation’. In the span of five months, Fed officials have gone from describing the impact of tighter policy on the US economy as a softish landing to short of ‘deep, deep pain’.

If there’s anything positive to say this morning, at least September has only a week left. Heading into the last trading week of the month, the S&P 500 has already shed 6.6% which ranks as one of the worst MTD performances heading into the last week of the month in the post-WWII period. The table below lists each year where the S&P 500 was down over 5% on the month heading into the last week of September along with how the index performed in the final week of the month.

In the 12 prior months where the S&P 500 was down over 5%, the final week of the month experienced a median decline of 0.44% with positive returns just 42% of the time. That’s hardly anything to get excited about, but it is also not much worse than the average performance for the final week of the month in all years since WWII (-0.34%). One thing you can probably count on is volatility. To close out the month. In 7 of the 11 prior years show, the S&P 500 was up or down at least 1% in the final week of the month. The most extreme downside move was 2.2% in 2002 while the most positive upside move was 7.8% in 2001.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 9/25/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Russia

Russia’s underperforming military capability may be key to its downfall by Jack Watling (The Guardian)

A comprehensive framework for understanding why the much larger, more expensive, and ostensibly more capable Russian military is underperforming so dramatically versus Ukraine. [Link]

Russia to conscript 1.2 million people (Meduza)

Dissident Russian outlet Meduza reports that the “partial mobilization” announced this week plans to intake more than 1mm soldiers, though the Russian Defense Ministry later denied the reporting. [Link]

‘They Are Watching’: Inside Russia’s Vast Surveillance State by Paul Mozur, Adam Satariano, Aaron Krolik and Aliza Aufrichtig (NYT)

A massive leak of detailed documents casts a light on the bureaucracy that manages the Russian populace’s social media censorship. [Link; soft paywall]

Commuting

U.S. Return-to-Office Rates Hit Pandemic High as More Employers Get Tougher by Peter Grant (WSJ)

Office use for a sample of 10 major metros was back to just below half of 2020 levels, the highest level since late-March 2020 as managers demand more time at the office and the population moves on from the pandemic. [Link; paywall]

Can You Actually Ditch Your Car for an E-Bike? Maybe by Brigid Mander (WSJ)

Surging e-bike adoption is helping more Americans go from car to bike, putting more range in the pedals of commuters and errand-runners alike. [Link; paywall]

Real Estate

Potential home buyers and sellers continue to hesitate, prices continue to soften (August 2022 Market Report) (Zillow)

Zillow’s data shows the largest monthly price drop since 2011 as affordability concerns amidst high mortgage rates hamper demand and drive up time on market. [Link]

Central Banking

Does the UK need an emergency rate hike? by Louis Ashworth (FTAV)

Collapsing sterling and soaring rates has the market wondering if the BoE can or maybe needs to raise rates on an emergency basis. [Link; reservation required]

The Fed Is Getting Even Tougher on Inflation. Here’s What To Watch First. by Christopher Leonard (Politico)

A long-form thesis arguing that the Federal Reserve actually faces a much tougher set of trade-offs than the ones faced by the famed Volcker Fed which today’s FOMC is trying to emulate. [Link]

Social Media

‘The Chaos Machine’ author on celebrity hacks and how social media threatens IT security by Eoin Higgins (IT Brew)

An interview of a Max Fisher, NYT reporter and author of a book that delves into the darkest recesses of social media business models as well as the catastrophic externalities that support them. [Link]

Supply Chains

Ford’s Latest Supply-Chain Snarl: Not Enough Blue Oval Badges by Nora Eckert (WSJ)

Even the iconic Blue Oval badges which denote a Ford have disappeared from inventories, a relatively simple and straightforward part that has still run into a wall amidst disruptions to value chains throughout the auto industry. [Link; paywall]

‘Crippling’ Energy Bills Force Europe’s Factories to Go Dark by Liz Alderman (NYT)

It’s hard to melt glass to manufacture tableware when you don’t have enough natural gas, or run steel blast furnaces, smelt aluminum, or produce zinc. [Link; soft paywall]

High Natural-Gas Prices Push European Manufacturers to Shift to the U.S. by David Uberti (WSJ)

As factories and smelters shut down in Europe due to energy constraints, companies are looking to the US with cheap and reliable energy supplies being the primary attraction. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 9/23/22 – Hike It ‘Til You Break It

This week’s Bespoke Report newsletter is now available for members.

There’s no sign of a let-up in Fed tightening plans this week, leaving investors to ask the question: how much further does the Fed have to hike before the economy breaks? Yet another FOMC press conference with novel arguments for hawkishness leads to the inescapable conclusion that the FOMC will keep tightening until something breaks. So far nothing has, though catastrophic price action in interest rates, a disastrous week for UK assets on the back of a new fiscal package, and a ripping US dollar are all the sorts of events that would lead to a breakdown in the financial system that might cause the Fed to hold off. We discuss all the implications for markets as well as sector-level analysis of the US and Europe, a look at seasonality, a review of falling inflation in the Great White North, comprehensive analysis of US economic data from this week, and much more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke’s Morning Lineup – 9/23/22 – Not Another Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Price is what you pay. Value is what you get.” – Warren Buffett

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Down and down she goes, where she stops, nobody knows. Global equities are tanking this morning as interest rates surge at what, in some cases are unprecedented rates. In Europe’s STOXX 600, just 19 stocks are currently higher on the day, and the UK government’s 5-year gilt has seen its yield surge by nearly 100 bps this week alone. Over at least the last 30+ years, there has never been that large of an increase in the 5-year gilt yield in such a short period of time. Fixed-income markets around the world are caught in an upward spiral of yields that most of the traders trying to navigate them have never seen. Alongside the surge in rates, stocks are flushing, and while the magnitude of the decline is not as severe as the move in fixed-income markets, good luck convincing anyone to step up and buy on a Friday against a backdrop where the Federal Reserve is getting exactly what it wants. If today’s declines hold at 1% for the S&P 500, it will be the twelfth 1% to close out a week this year which would already rank as the sixth most since at least 1952 and there are still another 14 weeks left in the year.

With the 2-year yield surging another 7 basis points (bps) on Thursday and another 13 bps this morning, it is trading more than 2.5 standard deviations above its 50-day moving average (DMA). Since 1976, there have only been 288 other trading days where the 2-year yield finished the day more than 2.5 standard deviations above its 50-DMA, and six of those occurrences have been in the last nine trading days!

The 2-year yield is also on pace to finish the day at ‘overbought’ levels (more than 1 standard deviation above its 50-DMA) for 24 straight trading days. As shown in the chart below, though, overbought closes for the 2-year yield have been a regular occurrence lately, and there have been two other streaks this year that have lasted considerably longer. Maybe a better question is how often this year has the two-year yield not finished a trading day at overbought levels?

The answer to that question is less than 25%. Of the 182 trading days this year, there have only been 41 where the two-year yield closed the day less than one standard deviation above its 50-DMA. Flipping that around, the yield has finished the day at overbought levels 77.6% of the time. Going back to 1977, there has never been another year where there was a higher percentage of days that the two-year yield finished the day at overbought levels. The only two years that were even close were 1978 (72.7%) and 1994 (71.6%). There’s still a quarter of the year left, so this percentage could decline, but at the current pace, the pace of relentless increase in the two-year yield has been unprecedented.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

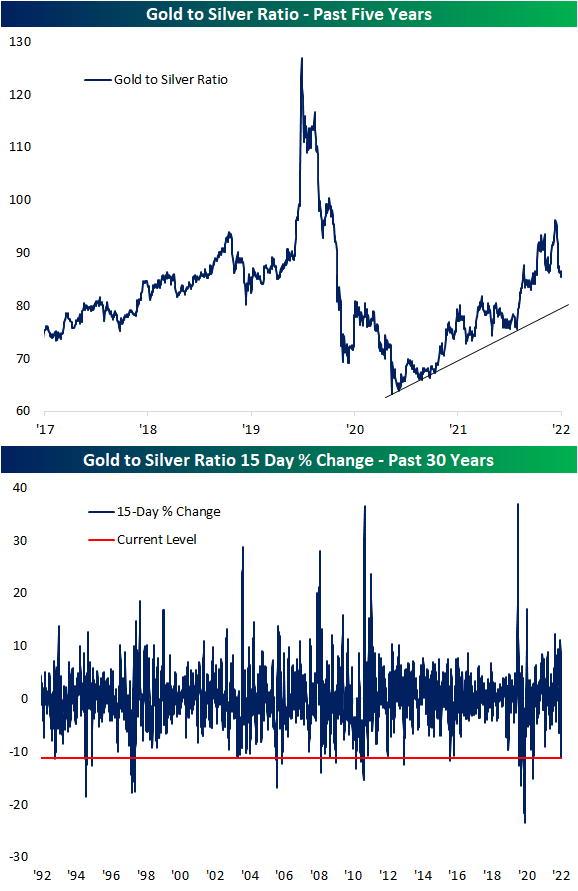

Gold to Silver Ratio Plummeting

In spite of it being considered a safe haven asset and inflation hedge, gold has had a rough year with a nearly 10% decline year to date. The yellow metal has consistently traded below its 50-DMA over the past few months while the 200-DMA is fairly flat. Over the past several days, gold has been trending sideways right near 52-week lows.

Silver has not avoided declines and like gold has largely remained below its moving averages. However, its sideways action in recent days has proven a bit more constructive. Unlike gold, silver rallied in the first half of September moving back above its 50-DMA in the process. Since then, there has not been a massive degree of follow-through, but it has managed to hold above that moving average.

For the past year and a half, gold has generally outperformed silver as shown in the uptrend of the ratio of the two metals since early 2021. However, the underperformance of gold in recent weeks has led the ratio to pivot sharply lower. Over the past 15 days, the ratio has fallen 11%; the first double-digit decline since February 2021. Looking back through the early 1990s, there have only been a handful of other periods in which the gold-to-silver ratio has fallen by a similar degree or more in the same span of time. Outside of last year, the only other occurrences in the past decade were 2013, 2016, and 2020. Click here to learn more about Bespoke’s premium stock market research service.

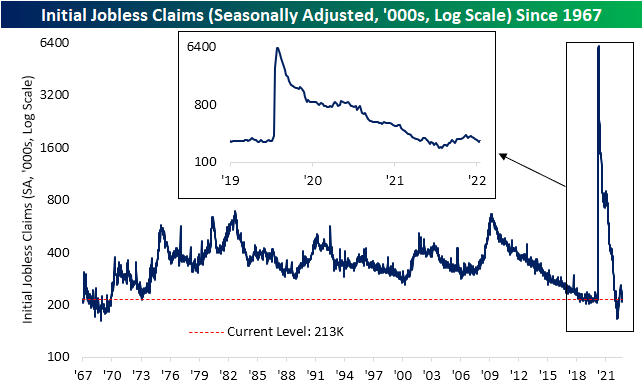

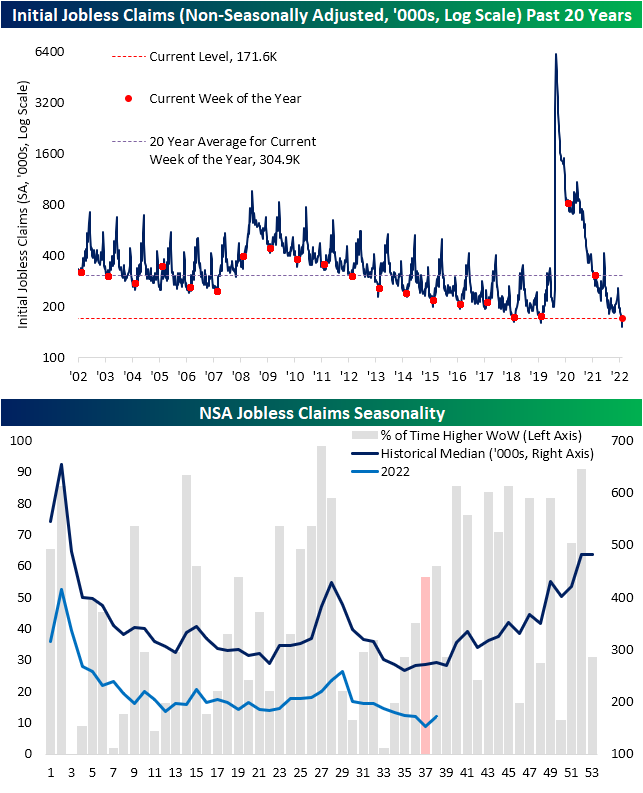

Claims Staying Low

Initial jobless claims came in at 213K this week. That would have been unchanged versus the prior week, but last week’s print was revised down by 5K to 208K. That modest uptick versus the revised number marked the first increase in claims in five weeks. Albeit higher, that level is still within the range of readings from the few years prior to the pandemic.

On a non-seasonally adjusted basis, claims were also higher week over week moving up to 171.6K. That increase could be expected as claims have been overdue to bottom out from a seasonal perspective as we discussed last week. That increase also does not steal from the fact that initial claims remain at historically strong levels. From here, claims are likely to continue to face seasonal headwinds through the end of the year.

As initial claims have come off of recent highs, continuing claims likewise hit the lowest level in several weeks. Seasonally adjusted continuing claims (lagged an additional week to the initial claims number) fell from 1.40 million down to 1.379 million for the lowest print since mid-July.

Earlier in the summer, we had noted how initial claims had appeared to have gotten ahead of continuing claims with the former at a comparatively higher level than the latter. That was evident by the ratio of the two surging to some of the highest levels on record. The past several weeks’ decline in initial jobless claims and the little change in continuing claims have resulted in that ratio turning lower. In fact, the latest release marked the fifth consecutive decline in that ratio. As shown in the second chart below, that now stands out as one of the longer such streaks of declines on record. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Bearish Sentiment Soars…But Might Not Have Peaked

Bespoke’s Morning Lineup – 9/22/22 – Central Bank – Palooza

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No one knows whether this process will lead to a recession.” – Jerome Powell

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are modestly higher following a slew of central bank rate hikes around the world and a currency intervention from the BoJ. Jobless Claims were just released for the latest week and came in at 213K which was 4K below consensus forecasts. Continuing claims were likewise lower than forecasts coming in at a level of 1.379 million versus forecasts for a level of 1.418 million. While yesterday’s close at the lows was disheartening for the bulls, when you consider how the market has performed following positive initial reactions to the Fed this year, maybe the Fed day weakness wasn’t so bad.

Years before he became Chairman of the Federal Reserve, Jerome Powell received an undergraduate degree from Princeton, a law degree from Georgetown, was a partner at the Carlye Group, and even served as under-secretary of the Treasury for domestic finance. He’s not only extremely intelligent, but unlike many of his colleagues on the FOMC, he has real-world experience of how the private sector and financial markets work.

Given his experience, we’re sure Powell is familiar with the yield curve and how its shape impacts the economy. Specifically, when the curve inverts and short-term interest rates rise above long-term rates, it tends to slow down economic activity. While at the Carlyle Group and the private equity firm that he started after (Severn Capital Partners), he probably experienced these slowdowns firsthand and was able to make investments on good terms for his clients.

The Federal Reserve’s preferred measure of the yield curve is the spread between 3-month and 10-year US Treasuries, which still has a modestly positive slope at about 25 basis points (bps). Besides that, another widely followed point on the curve is the spread between the 2-year and 10-year US Treasuries (2s10s). As of yesterday’s close, the 2s10s curve inverted to the tune of 52 bps making it the most inverted it has been since 1982! It was nearly as inverted in April 2000, but back then the maximum point of inversion was 51 bps. Think about that for a minute. A lot of people – maybe up to half- reading this right now weren’t even alive the last time the 2s10s curve was as inverted as it is now! Looking at the chart below, since the mid-1970s, there has never been a period when the 2s10s yield curve was as inverted as it is now that a recession wasn’t just over the horizon.

Getting back to Chair Powell, at one point in his press conference yesterday, he responded to one question with the answer that “No one knows whether this process will lead to a recession.” Let’s get this straight. The yield curve is extremely inverted, GDP growth in the first two quarters of this year has already been negative, and forecasts for growth in Q3 have been steadily declining as we close out the month. All this is before the recent unprecedented round of 75 bps rate hikes have had the opportunity to filter through the economy, and yet the Fed Chair is unsure of whether the US economy is either already in or on pace for a recession. Now we know that it’s not a good look for a Fed Chair to forecast a recession as the base case scenario, but does he really believe what he’s saying?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.