The Closer – Tesla Earnings, 5 Fed, Dollar Reserve – 4/22/25

Log-in here if you’re a member with access to the Closer.

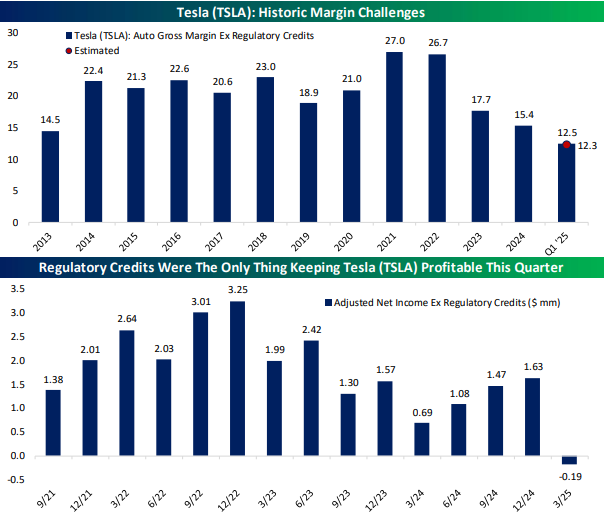

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with an earnings rundown including results from Tesla (TSLA) (page 1). We then update our 5 Fed Manufacturing Composite (page 2) in addition to a closer look at the Philly Fed’s Services component (page 3) and the service readings for Richmond too (page 4). Next, we discuss the theme of the dollar’s reserve currency status (page 5) before closing out with an update on Bitcoin (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Records in Richmond

US economic data was again light this morning with the only releases of note being regional Fed activity indices: a services index out of the Philly Fed and the manufacturing and services indices out of Richmond. As we noted through our Five Fed Composite last week, regional Fed releases have shown a significant deceleration in activity, and today’s release out of Richmond reaffirmed that. For the headline manufacturing number, there was a decline from -4 in March down to -13 this month. That indicates moderate contraction in activity, albeit similar and lower readings were observed from July to November last year.

Although the composite has seen lower readings relatively recently, April’s reading is still a bottom decile print for the history of the data going back to the 1990s. Breadth this month was also horrible with only six categories rising (not all of which are positives like inventories and prices) versus 10 categories falling month over month. In addition to weakness in current condition categories, expectation indices were especially weak. Across expectation indices, there were multiple record lows or near record lows. Those same sorts of records could also be observed for month over month changes. For example, expectations for number of employees had never fallen by more in a single month.

Perhaps one of the more concerning readings is in regards to demand adjacent categories. New Orders fell 11 points month over month down to -15 (an 11th percentile reading) while shipments also fell double digits to a 5th percentile reading. The expectations counterparts of those categories were even worse as both registered record lows. In other words, at no point of COVID, the Financial Crisis, or the 2001 recession were the region’s firms this pessimistic regarding future demand.

Paired with the weakness in demand expectations was a concerning pickup in inflation which has also been seen across a range of other indicators. Current conditions of prices paid have already picked up materially, rising to a 5.37% annualized rate. While that series did see readings that were roughly three times higher at the post-pandemic peaks in inflation a few years ago, expectations at 8.38% are sitting at a new record. Prices received have also been on the rise but are currently much lower. Current conditions are only at a 2.65% rate whereas expectations are surging to 5.6%, the most elevated reading since March and April 2022.

In addition to the record lows in demand expectations, expenditures have also taken a big hit. The Richmond report includes expenditure readings for three separate categories: Equipment & software, capex, and business services. Each of those three have been in decline since interest rates began ticking higher in early 2022, and since tariff news came to the forefront this year, they have taken a sharp leg lower (reversing post-election gains) and now have only been lower during the depths of COVID.

Click here to find out how to receive Bespoke’s premium stock market research.

Chart of the Day – Sectors and Stocks vs Early April Lows

Bespoke’s Morning Lineup – 4/22/25 – One Step Forward, Three Steps Back

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I don’t wanna be a product of my environment; I want my environment to be a product of me.” – Jack Nicholson

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After plunging to start the week yesterday, US futures are attempting to continue the late-day rebound that began in yesterday’s last hour of trading. With an indicated gain of about 0.8%, though, that would only be enough to erase a third of yesterday’s losses. With one step forward for every three steps back, it’s not an environment that leads to meaningful gains. European equities are all lower this morning after being closed for Easter yesterday, and with the STOXX 600 down only 0.70%, it’s down less since last Thursday’s close than the S&P 500.

Outside of equities, US Treasury yields are modestly lower, erasing earlier increases. Crude oil is up close to 2% and over $64 per barrel, while Bitcoin is up 1.5% and back near $89,000. Finally, the unstoppable freight train of gold is up another 1% to another record high – its 16th in the last 30 trading days!

The rise in gold prices has been nothing short of amazing, with the safe-haven asset seemingly hitting record high after record high, and today’s 1.15% advance marking yet another one. Yesterday’s 3%+ rally was the fifth time in the last ten trading days that gold rallied at least 2% in a single day. In the last 50 years, the only periods that experienced a higher frequency of 2%+ daily moves were in January and June of 1980. Since then, there have only been a handful of periods where gold experienced as many 2% daily moves in a ten-trading-day span, with the most recent occurring more than 15 years ago in September 2008. Also, keep in mind that the most recent five daily 2%+ gains occurred over an eight-trading-day span, so there are still two more trading days to increase that total!

With the high frequency of big daily gains, gold now trades more than 27% above its 200-day moving average. That’s the most extended traded relative to its 200-DMA since 2011. Like the high frequency of 2% daily moves in the 10-trading day period, there have only been a handful of other periods when gold traded more than 25% above its 200-DMA, and the most extended it ever got was an astonishing 130%+ in early 1980. To trade at similarly extreme levels now, gold would trade above $6,200 per ounce.

The Closer – 60/40 Smashed, Gold, Admin Bad Starts – 4/21/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with an overview of the brutal performance of 60/40 portfolios (page 1) followed by some commentary regarding the pros and cons of gold (page 2). We then take a look at how it’s been the worst start to a Presidential administration on record with regards to stock performance (page 3) and also show the performance so far of a number of other assets (pages 4-6). We close out with an update on positioning data (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Q1 2025 Earnings Conference Call Recaps: DR Horton (DHI)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers DR Horton’s (DHI) Q2 2025 earnings call.

DR Horton (DHI) is the largest homebuilder in the United States by volume. The company serves primarily first-time and entry-level buyers but also builds for move-up and rental markets. With operations in 36 states, DHI offers unique insight into both national housing demand and land acquisition dynamics. DHI reported EPS of $2.58, a miss of five cents, and revenues of $7.7 billion, missing the $8 billion estimate and down 15% YoY. Elevated mortgage rates and affordability pressures continued to weigh on demand, leading the company to increase incentives, particularly through mortgage rate buydowns. Cycle times improved roughly three weeks YoY, allowing faster inventory turns and leaner spec holdings. Management expects incentive costs to remain elevated but is confident in hitting Q3 guidance of 22,000–22,500 closings. Tariff uncertainty and rising land costs remain risks. DHI shares were up 3.1% on 4/17…

Continue reading our Conference Call Recap for DHI by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: UnitedHealth (UNH)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers UnitedHealth’s (UNH) Q1 2025 earnings call.

UnitedHealth (UNH) in the largest health care company in the United States by revenue, operating through two primary platforms: UnitedHealthcare, which provides health insurance to individuals, employers, and government programs, and Optum, which delivers health services including pharmacy benefits, care delivery, and technology-enabled solutions. It serves over 150 million individuals globally and is a key player in shaping how care is accessed, priced, and delivered. UNH lowered its full-year EPS outlook to $26–$26.50 following a spike in Medicare Advantage care utilization, with Q1 activity running at twice the expected rate, particularly in physician and outpatient services. The Optum Health segment was also pressured by poorly engaged new patients from exited plans and complexities transitioning to CMS’s V28 risk model. Group MA members facing steep premium hikes showed unexpected behavioral shifts, further driving costs. Still, the company pointed to strong growth in MA enrollment (+800k), pharmacy services (Optum Rx revenue up 14%), and AI use in call routing and claims management. The stock fell 22.4% on 4/17 after missing estimates…

Continue reading our Conference Call Recap for UNH by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: Netflix (NFLX)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Netflix’s (NFLX) Q1 2025 earnings call.

Netflix (NFLX) is the world’s largest subscription-based video streaming service, offering a vast catalog of films, series, documentaries, and original content across more than 190 countries. With over 260 million paid memberships and an estimated 700 million global viewers, NFLX serves a highly diverse audience. The company is also expanding into adjacent categories like live sports, gaming, and advertising supported by significant investments in proprietary technology, AI-driven personalization, and global production infrastructure. NFLX delivered 13% revenue growth in Q1, topping estimates thanks to stronger-than-expected subscription and ad revenue. Global hits like Adolescence and Back in Action powered content engagement, while its newly launched Netflix Ads Suite began rolling out across markets. Executives emphasized pricing resilience and stable consumer behavior, even amid macro uncertainty. The company doubled down on live programming (WWE, NFL, boxing) and confirmed the June 27th return of Squid Game. After reporting earnings after the close last Thursday, the stock was up around 1% on 4/21 following the long Easter weekend…

Continue reading our Conference Call Recap for NFLX by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Chart of the Day: Gold Ratios

Bespoke’s Morning Lineup – 4/21/25 – Picking Up Where Last Week Left Off

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The world in which we live is collapsing and may be nearing the breaking point,” – Pope Francis

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Maybe US markets should have followed the US lead and stayed closed for Easter today. US futures are sharply lower to kick off the week as investors face the uncertainty of US economic, trade, and monetary policy. There’s always uncertainty, but investors have a lot to contend with right now as there has been little evidence of progress on trade deals with the 70+ countries eager to “make a deal”, heightened concerns over the Fed’s independence, and how these policies will impact the economy. And, oh yeah, we’re just getting into the peak of earnings season.

Outside of the equity market, long-term treasury yields are modestly higher, the dollar is lower, and gold is surging. Even Bitcoin is starting to show signs of life as dollar weakness becomes more ingrained into global markets.

It may have been a short week, but US stocks still found a way to fall last week, with the S&P 500 dropping 1.5%. While the index declined, five sectors finished the week higher, and only three – Technology, Consumer Discretionary, and Communication Services – underperformed the S&P 500. Overall, the eleven S&P 500 sectors had an average change of 0.00%, which was much better than the index itself.

Since 1990, it hasn’t been particularly common to see such a wide disparity between the weekly performance of the S&P 500 and the average performance of its sectors. Last week was just the 19th time that the S&P 500 fell more than 1%, and the average sector’s performance was either positive or less than a decline of 0.5%. In the chart below of the S&P 500, we have included a red dot to indicate each occurrence.

From 1990 through 1998, there was never a single weekly occurrence, but from 1999 through 2000, there were eight separate occurrences. Since then, the occurrences have been relatively spread out, the most recent being in March and April 2022. The fact that most of the prior occurrences came in 1999, 2000, and 2022 can be explained by the fact that those were other periods where there was a high level of concentration in the market, and more specifically in the Technology sector. When one sector has such a large weight in the overall index, it creates a backdrop where one sector can have a big impact on the index itself, even as other sectors hold up relatively well.