Nasdaq Leaves the S&P in the Dust

Looking at the major US index ETF screen of our Trend Analyzer shows just how disconnected the Nasdaq 100 (QQQ) has become from other major index ETFs recently. As shown below, as of Friday’s close, QQQ actually finished in overbought territory (over 1 standard above its 50-DMA) whereas many other major index ETFs were oversold, some of those to an extreme degree. On a year to date basis, the Nasdaq 100 (QQQ) has rallied more than 14% compared to low single digit gains or losses for the rest of the pack.

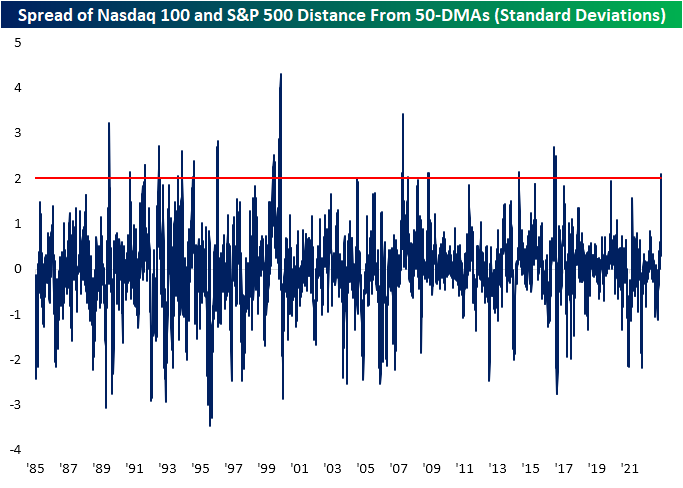

Historically, the major indices, namely the S&P 500 and Nasdaq, tend to trade at similar overbought and oversold levels. In the chart below we show the Nasdaq 100 and S&P 500’s distance from their 50-DMAs (expressed in standard deviations) over the past five years. As shown, typically the two large cap indices have seen similar albeit not identical readings. That is until the past few weeks in which the two have diverged more significantly.

On Friday there was more than 2 standard deviations between the Nasdaq’s overbought 50-DMA spread and the S&P 500’s oversold spread. As shown in the chart below, that surpassed recent highs in the spread like the spring of 2020 to set the highest reading since October 2016.

Going back to 1985, the spread between the Nasdaq and S&P 500 50-DMA spreads diverging to such a degree is not without precedent, but it is also not exactly common. Friday marked the 16th time that spread eclipsed 2 standard deviations for the first time in at least 3 months. Relative to those prior instances, the current overbought and oversold readings in both the S&P 500 and Nasdaq are relatively middling. However, only the instance in early 2000 similarly saw the Nasdaq technically overbought (trading at least a standard deviation above its 50-DMA) while the S&P 500 was simultaneously oversold (at least one standard deviation below its 50-DMA). Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Semis Leading

Bespoke’s Morning Lineup – 3/20/23 – “Merger” Sunday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You’re finished…When you’re down by half, people figure you can go down all the way. They’re going to push the market against you.” Vinny Mattone, When Genius Failed: The Rise and Fall of Long-Term Capital Management

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After opening higher last night, futures gave up all of their initial gains and sold off sharply as Asia opened for trading. Shortly after the European open, though, buyers stepped back in and futures have rebounded back to the flat line. Outside of the Credit Suisse/UBS arranged marriage by Swiss Bank regulators that was announced on Sunday afternoon, there really hasn’t been much in the way of market-moving news, and there are no economic reports on the US calendar. Regional banks have been rallying, but First Republic (FRC) is down sharply again after it had its second ratings downgrade in a week.

In the press conference on Sunday discussing the shotgun ‘merger’ between Credit Suisse and UBS, regulators and officials of the banks cited the turmoil in the US banking sector as the reason for Credit Suisse’s demise. There’s always a need for a scapegoat, but to blame regional US banks for Credit Suisse’s downfall is a stretch. For now, let’s put aside the fact that just last week Credit Suisse announced an $8 billion loss in its delayed annual report. The bank noted that “the group’s internal control over financial reporting was not effective,” and its auditor PriceWaterhouse Coopers gave the bank an ‘adverse opinion’ with respect to the accuracy of its financial statements. Well before the SVB failure, Credit Suisse was already a dirty shirt.

Just look at the stock price. From its peak of over $77 per ADR in 2007, Credit Suisse (CS) has been in a long downtrend. After bottoming at just under $19 in early 209, the share price quickly tripled over the last six to seven months, but the bounce was short-lived. By 2012, the share price was back below its Financial Crisis lows and in the ensuing years, any rally attempt quickly ended with a lower high followed by a lower low. The collapse of SVB and stresses on other US banks may very well have been the straw that broke Credit Suisse’s back, but if the bank had proper internal controls in the first place maybe it would have noticed the pile of hay on its back in the first place.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke Report — Something Broke

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Back in September of 2022, we published a Bespoke Report entitled “Hike It ‘Til You Break It” (link). In that report we characterized the Powell Fed as seeming “committed to breaking either the financial system or economy…whichever it can mangle first”. Stocks made their major bear market low about three weeks later, on October 12th. The Fed Funds rate has been raised another 225 bps since that point, while the 2 year yield (a proxy for the Fed Funds rate a year ahead) went up another 90 bps to a peak of 5.07% on March 8th. The result? The Powell Fed absolutely broke something.

During the pandemic, enormous fiscal transfers and Federal Reserve QE of government bonds meant an enormous buildup of deposits in the banking system. Those deposits were created by either issuance of government bonds or by purchases of those bonds, financed by bank reserves which match with deposits. Banks faced with those massive inflows of deposits generally bought government bonds. Unable to invest in riskier securities or grow loans rapidly thanks to macroprudential regulation, banks were forced to buy low credit-risk government bonds.

While those bonds don’t have a credit risk, they do have duration risk. As long as banks aren’t forced to sell them thanks to ample deposits, they do not have to recognize a mark-to-market loss on those holdings. But for banks that are under deposit pressure, things can get out of hand quickly. Concentrated crypto deposits (like at Silvergate or Synchrony) or exposure to specific demographics (like at Silicon Valley Bank or to a lesser extent First Republic) that fled quickly led to stress and ultimately a need to wipe out equity, though for now the total losses remain unclear.

It remains to be seen whether this effort to break the financial system will have a large macro-economic feedback, but the Federal Reserve has certainly at least managed to create collateral damage via interest rate markets that has dominated headlines this week.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Nasdaq 100 Steadily Outperforms

Everywhere you look these days, you can find crazy things going on with the market. A case in point is the Nasdaq 100’s performance relative to the performance of the S&P 500. In early afternoon trading, the Nasdaq 100 is on pace for its 12th straight day of outperforming the S&P 500. That’s a streak that has only been exceeded two other times (July 2005 and July 2017) since 1996, and there have only been a total of six streaks where the Nasdaq 100 outperformed the S&P 500 for ten or more trading days.

During this 12-day span of outperformance for the Nasdaq 100, it has rallied 4.7% compared to a decline of 0.73% for the S&P 500 for a gap of 5.4%. That may sound like a pretty wide spread, but it has hardly been out of the norm in the post-COVID period. As shown in the chart below, there have been several times over the last three years where the 12-day performance spread has been as high or higher than it is now. During the post-Financial Crisis period from 2010 up until the end of 2019, the spread oscillated in a relatively tight range. Before that, though, the performance spread between the two indices was also routinely as large as it is now, especially in the late 1990s and early 2000s when it dwarfed the current range. While the steady pace of days where the Nasdaq 100 has outperformed the S&P 500 has been unusual, the performance gap between the two has been anything but. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 3/17/23 – An Irish Morning

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Being Irish, he had an abiding sense of tragedy, which sustained him through temporary periods of joy.” —William Butler Yeats

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

President Eisenhower once said that everyone is Irish on St. Patrick’s Day, and most investors probably consider themselves Irish today. Even on a good day like yesterday, they can’t shake the feeling that there’s still more pain to come, especially heading into another weekend. Maybe that just comes with the territory after a year-long bear market, a war in Europe, and the most aggressive Fed tightening cycle since the early eighties. But a banking crisis is only the newest entry on to the growing list of worries.

Futures are in the red this morning and have been drifting lower all morning ahead of a busy day for economic data. European stocks opened higher, and traded up over 1%, but are now in the red. At 9:15, we’ll get updates on Industrial Production and Capacity Utilization for February, and then at 10 AM, we’ll close out the week with Leading Indicators and Michigan Confidence. Leading indicators have been in recessionary territory for months now, and in the Michigan report, the key area of focus will be inflation expectations following the NY Fed’s update earlier this week which showed a significant decline in one- and three-year inflation expectations.

Given it’s St Patrick’s Day, it’s an appropriate time to highlight the stocks deepest in the green this year that investors would be the luckiest to have in their portfolios. The table below lists the 20 stocks in the S&P 500 that are up the most YTD. Topping the list, NVIDIA (NVDA) and Meta (META) have already rallied 70% in the first two and a half months of the year. After these two stocks, eight others are up over 40%, and all 20 are up over 25% on the year. Looking at where each of these stocks is trading relative to their trading ranges, most are at overbought levels, but there are a handful like Tesla (TSLA), Warner Bros (WBD), Royal Caribbean (RCL), and Wynn Resorts (WYNN) that are trading relatively close to or even below their 50-day moving averages.

Usually, when you look at a list of best (or worst) performing stocks in an index, smaller names dominate the list as they are the most prone to large swings in either direction. What stands out about this list is the fact that some of the best performers are also among the largest stocks in the index. The two top performers – NVDA and META – both have market caps of more than $500 billion, and when you take Tesla (TSLA) into account, three of the top four have market caps of greater than $500 billion. Lastly, of the top ten performers, half of them have market caps of over $100 billion. In other words, these are some big leprechauns!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

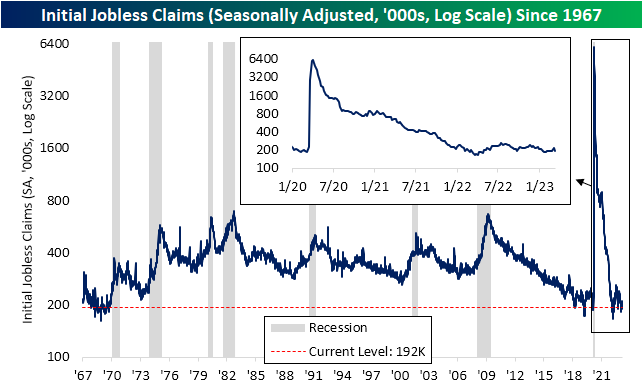

Claims Come in Strong

After disrupting the trend of lower readings last week, this week’s reading on initial jobless claims returned to improvements as the print totaled 192K. That means eight of the last nine weeks have seen claims come in below 200K as the indicator continues to show a historically healthy labor market.

Before seasonal adjustment, claims are sitting at 217.4K. That marked a slight decline from 238.8K the previous week and little change versus the comparable week last year. From this point of the year, based on seasonal patterns claims are likely to continue falling through the spring albeit at a slower rate than what has been observed over the past few months.

Not only were initial claims strong, but so too were continuing claims. The seasonally adjusted number fell back into the 1.6 million range after topping 1.7 million (the highest level since mid-December) last week. Like initial claims, continuing claims remain at healthy levels consistent with the few years prior to the pandemic. Click here to learn more about Bespoke’s premium stock market research service.

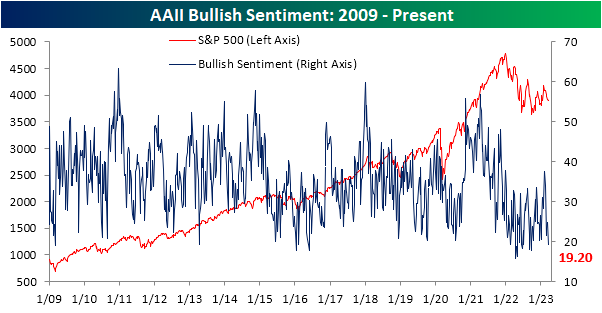

Bulls Back Below 20%

The fallout from bank failures over the past week has put a major dent in investor sentiment. Since the week of February 23rd, optimism has been muted with less than a quarter of respondents to the weekly AAII sentiment survey having reported as bullish. That includes a new low of 19.2% set this week. That is the least optimistic reading on sentiment since September of last year.

The drop in bullishness was met with a corresponding jump in bearish sentiment. That reading climbed from 41.7% up to 48.4%, the highest level since the week of December 22nd. While close to half of respondents are reporting as bearish, that remains well below the much higher readings that eclipsed 60% last year.

Last month saw the end to a record streak in which bearish sentiment outweighed bullish sentiment. However, the bull bear spread has now been negative for four weeks in a row once again. In fact, this week was the most negative reading in the spread since late December.

Factoring in other sentiment readings like the Investors Intelligence survey and the NAAIM Exposure Index—both of which similarly saw sentiment pivot toward more bearish tones this week—our sentiment composite is once again below -1, meaning the average sentiment indicator is reading extremely bearish sentiment. While prior to 2022 such depressed levels of sentiment were not commonplace, it has been the norm over the past year or so. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: $550bn Global Bank Wipeout

Bespoke’s Morning Lineup – 3/16/23 – Better Data Ahead of ECB

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The Federal Reserve, in close consultation with the Treasury, is working to promote liquid, well-functioning financial markets, which are essential for economic growth.” – Ben Bernanke 3/16/2008

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The quote above could have easily been made this week, but it was actually fifteen years ago today when Bear Stearns, the fifth largest US investment bank, avoided bankruptcy in what was an arranged sale to JP Morgan for $2. While a number of other smaller players in the subprime housing business had already folded, Bear was the first of the major dominoes to go. The emergency takeover of Bear staunched the wound for a time, but it was only a matter of weeks before the cockroaches on bank balance sheets came out from the walls. We all know what happened from there. 15 years to the day later, the question every investor is trying to answer is whether SVB Bank is this generation’s Bear Stearns or just a headline that most will forget all about a year from now.

Futures are mixed this morning as the S&P 500 and Dow are indicated modestly lower while the Nasdaq is in positive territory. European stocks are bouncing ahead of the ECB decision at 9:15 Eastern and on the news that Credit Suisse has taken a $54 billion loan from the Swiss National Bank to improve its liquidity position. US equities aren’t seeing the same lift since they rallied after Europe’s close yesterday on rumors of the SNB loan that European stocks are rallying on now.

The economic calendar is busy this morning as Jobless Claims, Import Prices, Housing Starts, Building Permits, and the Philly Fed all just hit the tape. Jobless Claims on both an initial and continuing basis were lower than expected, Import Prices dropped less than expected, and Building Permits and Housing Starts both came in significantly better than expected. The only report that missed forecasts was the Philly Fed manufacturing which came in at -23.2. Surprisingly, there has been little reaction (so far) in equity futures or the treasury market as attention will now shift to the ECB decision.

What started as a bank run on a regional bank in California last week quickly spread to regional and money center banks around the country and then this week across the Atlantic to European banks. But the weakness in equities hasn’t been confined to just the Financials sector. In the US, the Financials sector is down just over 10% over the last five trading days, but other cyclical sectors have also been pounded as Energy is down 9%, Materials is down 7.5%, and the Industrials sector is down over 5%. Around the world too, equities are down over the last week.

The snapshot below from our Trend Analyzer shows the performance of international regional ETFs. Over the last week, every single one of them is down with declines ranging from a loss of 1.42% for the Global 100 ETF (IOO) to a loss of 7.6% for the Latin America 40 ETF (ILF). Over the last three years, we’ve become all too familiar with the process of disease and virus transmission, and what we’ve seen over the last week is the very definition of contagion. Whether or not it’s just a cold or something worse like the flu will become more apparent in the coming weeks.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.