Bespoke’s Morning Lineup – 9/6/23 – Living at the Woodshed

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s not what you look at that matters, it’s what you see.” – Henry David Thoreau

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

It’s another weak morning for US equity futures as the backdrop of higher rates and oil prices weigh on sentiment. Futures are lower across the board, but not by a large amount. The key report of the day will be ISM Services at 10 AM. Plus, there are a number of conferences today, so be on the look out for individual company news throughout the day.

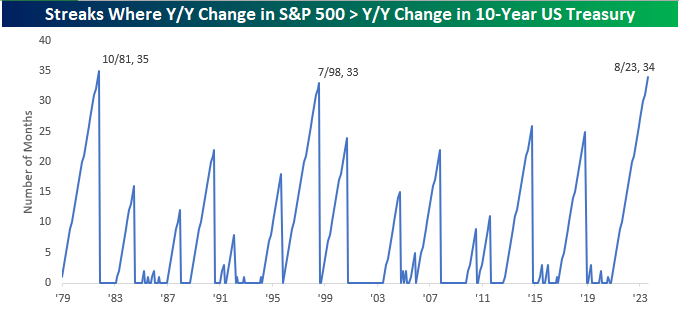

176 years ago today, Henry David Thoreau moved in with Ralph Waldo Emerson and his family after living in a woodshed on Walden Pond for two years. Two years in a shack is a long time, but bonds have been out behind, or maybe more accurately, in front of the woodshed for even longer. As measured by the Bank of America 10+ Year US Treasury Index, August was the 31st straight month that the year/year total return for US Treasuries was negative, easily surpassing the 15th month streak than ended in December 1980. Not only has the y/y change in long-term Treasuries been negative for more than two and a half years, but the y/y change has also lagged the y/y total return of the S&P 500 for 34 straight months.

Since 1979, there have only been two other periods where the 10-year underperformed the S&P 500 on a y/y basis for more months. The most recent ended in July 1998 at 33 months while there was a 35-month streak ending in October 1981. Given the way the numbers work out, unless treasuries stage a monster rally and/or stocks take a sharp leg lower this month, it’s almost a guarantee that the current streak will at least tie, if not exceed, the 35-month streak from 1981. In at least the last forty years, there hasn’t been a worse time to be creditor of Uncle Sam.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day – Smart Money Stays on Vacation

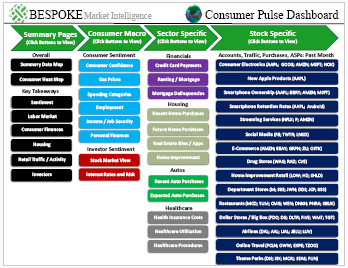

Bespoke’s Consumer Pulse Report — September 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 9/5/23 – Sluggish

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I anticipate sluggish growth in the second half of this year” – Janet Yellen, 9/5/08

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

It may be Tuesday, but equity markets have a case of the Mondays today as equity futures are lower across the board with the Nasdaq leading the way lower. The catalyst for the weakness this morning appears to be weaker economic data out of China and Europe, but the reason for saying ‘appears’ is that sluggish growth would suggest a rally in bonds, but that hasn’t been the case as Treasury yields are higher across the curve. There’s not a lot of economic or earnings data to deal with today, but conference season is kicking off on Wall Street, and that can often be a time where companies lower forecasts, so be on the lookout for that throughout the day.

The quote above came just over two months into what was the second half of the year that then San Francisco Fed President Janet Yellen was referring to when she forecasted ‘sluggish’ growth. Sluggish would never be considered an adjective with a positive connotation, but it still doesn’t imply contraction. During the third quarter of 2008, though, the US economy contracted 2.1%, which was the largest decline in US economic activity since Q4 1990. Keep in mind that when Yellen made that comment, the third quarter was already more than two-thirds into what was a 2.1% quarterly decline in GDP, and yet Fed officials along with their counterparts in the White House, as well as most Wall Street economists were still forecasting growth! If you think that was bad, Q4 was even worse as the economy fell off a cliff. In the wake of the Lehman bankruptcy, GDP declined 8.5% for its largest decline since 1958! By the end of 2008 ‘sluggish’ growth wouldn’t have just been good, it had become a pipe dream!

This brings us to one of the morning’s lead headlines across just about every financial media outlet we have scanned, and that is the fact that Goldman Sachs has lowered its odds of a recession in the next 12 months down from 20% to 15%. Giving odds for a recession in such a precise manner certainly makes for great headlines and it’s always good to have baseline forecasts but to think that something as complicated as the US economy can be forecasted with such precision is at best naïve.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Brunch Reads – 9/3/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

On This Day in History:

Labor Day’s Launch. On September 3rd, 1894, American’s celebrated Labor Day for the first time. Before it became a federal holiday, Peter J. McGuire, a union leader, suggested that there be a day to celebrate American workers, roughly between Independence Day and Thanksgiving. Labor activists and others in support paraded in New York City and the day slowly gained traction throughout the states. In 1894, the same year as the Pullman Strike and May Day riots, President Grover Cleveland suggested a bill that was made into law and thus Labor Day was made official. Enjoy the long weekend!

Health & Wellness

Screens, Lack of Sun Are Causing an Epidemic of Myopia (WSJ)

The growing epidemic of nearsightedness in children is associated with their reduced exposure to sunlight and increased screen time. Kids these days spend an average of more than seven hours a day on various types of screens, which studies suggest will result in half the global population being nearsighted by 2050. Tech companies like Apple are employing a range of features to encourage spending time outdoors while doctors are recommending similar action to avoid this issue going forward. [Link]

To Pay for Weight Loss Drugs, Some Take Second Jobs, Ring Up Credit Card Debts (WSJ)

Many are paying thousands of dollars for popular weight-loss drugs like Mounjaro, a diabetes treatment from Eli Lilly (LLY), highlighted in our Triple Play Report last week week, that is being used off-label for weight loss. While they can result in significant weight loss, they are often not covered by insurance plans. As a result, patients are taking on extra jobs, using credit cards, and making other financial sacrifices to afford these medications. Can’t there be an easier way? [Link]

Housing

Americans Are Bailing on Their Home Insurance (WSJ)

Speaking of hurricanes this week, homeowners are increasingly choosing to go without home insurance due to rising premiums and the belief that the likelihood of a disaster is low. What many don’t know is that insurance goes beyond covering the cost of a destroyed home and its contents. Without insurance, homeowners could be liable for debris removal and rebuilding. Mortgage lenders often require insurance as well, and the lack of insurance can impact the ability to qualify for a mortgage. [Link]

Hong Kong Is Building Public Housing on a Golf Course in a Snub to the Old Elite (Bloomberg)

The Hong Kong government is set to reclaim a portion of the Fanling Golf Course near the mainland Chinese border to build 12,000 public housing units in one of the world’s least affordable housing markets. The move highlights the government’s commitment to addressing housing issues despite opposition from the city’s powerful business elites. The decision also reflects the shifting political landscape in Hong Kong from old elites towards Beijing loyalists. [Link]

Ethics & Practices

FBI Hoovering Up DNA at a Pace That Rivals China, Holds 21 Million Samples and Counting (The Intercept)

The FBI now has 21.7 million DNA profiles, or the equivalent of 7% of the US population, and the agency will continue to expand its efforts with the help of an budget increase request. Substantial growth is partly due to a Trump-era rule mandating DNA collection from migrants detained by immigration authorities that President Biden has not reversed. Critics argue that this rapid expansion raises concerns about the creation of a universal DNA database, potentially infringing on civil liberties and privacy rights. [Link]

At Taser maker Axon, ex-staff say loyalty meant being tased, tattooed (Reuters)

Axon (AXON), who recently received a feature in our Triple Play Report on August 28th, has a corporate culture that some have now described as toxic and extreme. Loyalty is tested in unusual ways, including “exposures” to the company’s Taser product and even tattoos of the Axon logo. Claims have surfaced that those who do not participate face unfavorable treatment or risk being fired, all of which Axon denies. This information also raises concerns about workplace diversity and other cultural issues. [Link]

Recent Developments in Hedge Funds’ Treasury Futures and Repo Positions: is the Basis Trade “Back”? (The Federal Reserve)

Hedge funds appear to be increasing their positions in the Treasury cash-futures basis trade, which involves shorting Treasury futures while holding a long Treasury cash position and using repo borrowing for leverage. Hedge funds have increased their repo borrowing in the sponsored segment by $120 billion between October 2022 and May 2023. Short futures positions in 2-year, 5-year, and 10-year contracts have also risen by $411 billion over the same period. While this trend suggests increased basis trade activity, the full scale cannot be determined conclusively due to limited data availability. [Link]

‘Doing the right thing’ earned this ex-Marine mom of three $40 million (NBC News)

A former US Marine and employee of Booz Allen Hamilton exposed a civil fraud scheme at the consulting firm that overcharged taxpayers to subsidize its losing contracts, including contracts with foreign governments like Saudi Arabia. Booz Allen’s settlement goes down as the third-largest contract fraud settlement in history for which the whistleblower, Sarah Feinberg, was awarded $40 million. The moral decision to do right, Feinberg says, is attributed to her time in Iraq with the Marines. [Link]

A Private Phone. Secret Recordings. Inside One CEO’s Relationship with a TV Anchor (WSJ)

Under Armour’s founder, Kevin Plank, provided anchor Stephanie Ruhle with private communication devices to disclose confidential financial information in return for her help with poor sales. The documents detailing this relationship stem from a lawsuit alleging that Under Armour inflated its share price by using improper methods to uphold a 26-quarter streak of at least 20% YoY revenue growth. Ruhle contributed by countering a report from early 2016 that exposed the realistically weakening sales along with other efforts. [Link]

Technology

An AI pilot has beaten three champion drone racers at their own game (Engadget)

Researchers from the University of Zurich, in collaboration with Intel, have developed an AI piloting system called “Swift” that outperformed world champion drone pilots in a race. Its technology calculated the fastest path around the track, but humans showed that they can better adapt to changing conditions during the race. While it doesn’t look great from a man versus machine perspective, the AI piloting system does have potential in search and rescue operations, forest monitoring, space exploration, and film production. [Link]

Google’s new AI tool may save your skin if you’re running late for a meeting or terrible at taking notes — here’s how it works (Business Insider)

Duet AI, Google’s new tool, allows users to send AI to meetings in their place and take notes for them. Duet AI will also be able to translate and use face-detection, all in an effort to improve worker’s productivity. This is perhaps just the next step in the AI race between Alphabet and Microsoft. How long before meetings are majority attended by AI tools? [Link]

Food

The best pizza in America, by region and style (Washington Post)

If you’re looking to find the best pizza around, this article will give you the full run down. New York, Chicago, Detroit, New Haven, and California Neapolitan are some of the most highly regarded pizzas in the US, all boasting their own styles. You’ll get the history of each pizza, what makes it so special, and the best places to go. Positioned right between New York City and New Haven here at Bespoke, we might have it best! What’s your favorite place for a slice or a pie? [Link]

The Race to Breed a Better Potato Chip (Ambrook Research)

The National Chip Program (NCP) is investing $1 million annually for the competition to breed potatoes suited for potato chips. The potato chip industry may seem small, but the US is the world’s leading chip producer valued at $22 billion. Efforts in the competition and collaboration aim to evaluate potato prospects based on factors like yield and disease resistance, and address water scarcity issues crucial for sustainability. The work has broad implications for supporting potato growers and the agricultural system as a whole. [Link]

Automotive

Success: Drivers are Slowing Down on Streets with 24/7 Speed Cameras (Streetsblog New York City)

New York City has been implementing speed cameras which has led to a 30% decline in violations in areas where the cameras are posted. The automated system has issued millions more speeding tickets than cops, year-to-date, and traffic deaths are down because of it. That data largely eliminates the “cash grab” narrative around the cameras. [Link]

China’s gasoline demand could peak as early as this year (Quartz)

Sinopec, China’s largest oil and gas company, predicts that combined demand for gasoline and diesel in China will peak in 2025, with gasoline demand peaking this year. As EVs become more popular in China, oil products are displaced. The increasing demand in the EV market in China is helping improve its infrastructure with charging stations and other advancements as it overtakes Japan in EV sales and strengthens partnerships with foreign carmakers. [Link]

Environmental

America Is Using Up Its Groundwater Like There’s No Tomorrow (NYT)

Groundwater supplies 90% of the nation’s water systems and is vital for agriculture; however, that water is being depleted into a crisis. The overuse is reducing crop yields, threatens drinking water supplies, and can even cause land subsidence and earth fissures. Rising temperatures and volatile precipitation patterns are making the problem worse, forcing us to be increasingly reliant on groundwater. There is also a lack of federal regulation and often weak state laws. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report Newsletter — 9/1/23

To read our weekly Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium. Check out two new Triple Play Reports and our Economic Indicators Matrix as well if you missed them earlier this week.

Bespoke’s Morning Lineup – 9/1/23- The One That Got Away

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Security is mostly superstition. It does not exist in nature, nor do the children of men as a whole experience it. Avoiding danger is no safer in the long run than outright exposure. Life is either a daring adventure or nothing.” — Helen Keller

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

It may be the Friday before Labor Day weekend (doesn’t it seem like we were just saying Memorial Day?), but it’s a bananas day for economic data with Non Farm Payrolls and ISM Manufacturing both being reported on the same day. Not only that, but there’s a couple of Fed speakers on the calendar as well. Bostic already spoke, and the key item from his speech was that there is “a shaking out that’s about to happen” in the debt markets which hardly sounds like an endorsement of higher rates. Shortly after the open, we’ll also hear from the usually hawkish Cleveland Fed President Mester.

Leading up to the Non Farm Payrolls report, futures have actually been picking up steam and are firmly in positive territory as treasury yields fall. The catalyst has been some better than expected earnings after the close on Thursday. In Europe, the major indices are higher despite a weaker than expected manufacturing PMI for August. It’s a good start, but the upcoming data is likely to have more of an impact on where things go from here. Investors have been encouraged by secondary employment reports suggesting some slack in the labor market, so a much stronger than expected report this morning would be a disappointment but could also be viewed as an outlier.

If you’ve been paying attention to the market this year, you know that Nvidia has been the biggest market winner by far, gaining over 230% through the end of August. Not only has it led every other S&P 500 stock, but its 13,275% gain also easily makes it the best performing stock over the last ten years. The next closest behind Nvidia during the last decade was AMD with a gain of ‘only’ 3,120%. If you really want to kick yourself heading into the weekend, just think, if you had invested $10,000 in Nvidia ten years ago, you’d have more than $1.3 million today. Now that’s an inflation hedge!

Realistically, even if you had the foresight to buy it ten years ago, would you really have had the stomach to hold it for ten years? The chart below shows the stock’s distance from all-time highs dating back to its IPO in 1999. Look at the swings. In October 2002 at the depths of the dotcom bust, Nvidia was down 90% from its all-time high. It recovered all those losses and more in the subsequent bull market, but during the Financial Crisis, it fell more than 85%. In its entire history as a public company, Nvidia’s average distance from an all-time high has been 40%. How many investors are willing to hold on to a stock in a 40% drawdown, let alone a drawdown of 90%?

Even in the last ten years, Nvidia has caused more stress than most doctors would consider healthy. The average distance it has traded from an all-time high is over 25%, and there have been two different periods when the stock fell over 50%, including a 66% drawdown as recently as last October. It’s always nice to dream of what could have been, but in some ways maybe it’s better if you never owned it at all. Think about it, how frustrated would you be if you bought NVDA ten years ago only to sell it after a 20% gain thinking you were smart, or even worse, selling it at a 15% or even 30% loss before it turned around. And if you did buy it ten years ago and managed to hold it all this time? Congratulations! You made the investment of a lifetime.

When hearing stories like this, the first thing most of us ask is, “What’s the next Nvidia?” The most important takeaway of the story, though, isn’t how Nvidia did from point to point but how it did in between. The biggest rewards in the market go hand in hand with the biggest risks, and if you want the former, make sure you’re prepared for the latter.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Market Calendar — September 2023

Please click the image below to view our September 2023 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Q2 2023 Earnings Conference Call Recaps

Bespoke’s Conference Call Recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call Recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call Recaps published during the Q2 2023 and Q1 2023 earnings reporting periods.

Q2 2023 Recaps:

Chewy: Q2 2023

NVIDIA: Q2 2024

Walmart: Q2 2024

Target: Q2 2023

Home Depot: Q2 2023

YETI: Q2 2023

Disney: Q3 2023

Rivian: Q2 2023

Palantir: Q2 2023

Elanco: Q2 2023

Amazon: Q2 2023

Apple: Q3 2023

Visteon: Q2 2023

Caterpillar: Q2 2023

Aercap: Q2 2023

McDonald’s: Q2 2023

Lennox: Q2 2023

Meta: Q2 2023

Chipotle: Q2 2023

Microsoft: Q4 2023

Alphabet: Q2 2023

Lamb Weston: Q4 2023

Corning: Q2 2023

General Electric: Q2 2023

NXP Semiconductors: Q2 2023

Domino’s Pizza: Q2 2023

Philip Morris: Q2 2023

D.R. Horton: Q3 2023

Tesla: Q2 2023

Netflix: Q2 2023

Lockheed Martin: Q2 2023

JB Hunt Transport: Q2 2023

Bank of America: Q2 2023

Charles Schwab: Q2 2023

Big Banks (JPM, C, WFC): Q2 2023

Fastenal: Q2 2023

Delta Air Lines: Q2 2023

PepsiCo: Q2 2023

Nike: Q4 2023

Greenbrier: Q3 2023

Micron: Q3 2023

General Mills: Q4 2023

AeroVironment: Q4 2023

Walgreens: Q3 2023

TD Synnex: Q2 2023

Darden Restaurants: Q4 2023

CarMax: Q1 2024

Winnebago: Q3 2023

Accenture: Q3 2023

KB Home: Q2 2023

FedEx: Q4 2023

Adobe: Q2 2023

Kroger: Q1 2023

Lennar: Q2 2023

Q1 2023 Recaps:

Oracle: Q4 2023

Broadcom: Q2 2023

Dollar General: Q1 2023

Lululemon: Q1 2023

Nordstrom: Q1 2024

Salesforce: Q1 2024

NVIDIA: Q1 2024

RH: Q1 2023

Home Depot: Q1 2023

Tyson: Q2 2023

TreeHouse Foods: Q1 2023

Palantir: Q1 2023

Generac: Q1 2023

Visteon: Q1 2023

Meta: Q1 2023

Alphabet: Q1 2023

Spotify: Q1 2023

McDonald’s: Q1 2023

Tesla (TSLA): Q1 2023

Procter & Gamble (PG): Q1 2023

Big Banks (JPM, C, BAC, GS): Q1 2023

JB Hunt Transport: Q1 2023

BlackRock: Q1 2023

Delta: Q1 2023

Conagra Brands: Q3 2023

Lululemon: Q4 2022

Lennar: Q1 2023

Recaps published during Q1 2023 are available with a Bespoke Institutional subscription

The Triple Play Report — 8/31/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with better-than-expected results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 13 new stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Alarm.com (ALRM) is an example of a company that reported an earnings triple play recently back on the evening of August 9th. As shown below, ALRM’s share price has been in an uptrend since May and is now trading above both its 50 and 200-day moving averages after its triple play earnings report on the 9th sent shares up 24% on the day.

As shown in the snapshot from our Earnings Explorer below, Alarm.com (ALRM) has now posted 33 straight EPS and revenue beats! This quarter the company also raised guidance, which represented its first triple play in two years. Investors reacted positively to the report as the company introduced new products like the first battery free video doorbell and efforts to make inroads in the commercial sector. You can read more about ALRM and the 12 other triple plays in our newest report by starting a Bespoke Institutional trial today.

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.