Continuing Claims Keep On Rising

Following up on yesterday’s slowing ADP and JOLTS numbers, today’s release of weekly jobless claims likewise showed a cooling labor market. Initial claims were revised up by 2K last week to 212K, and this week’s number came in higher at 217K. That was 7K above expectations which would have assumed no change to claims. With the rise over the past two weeks, claims have now rounded out a bottom but still have significant headroom until reaching the highs from earlier this year.

Before seasonal adjustment, claims were slightly higher at 196.8K. That increase is consistent with seasonal patterns as claims tend to rise throughout Q4. For example, the current week of the year has historically seen claims rise week over week 83.9% of the time; one of the most consistent weeks of increases of the year. Granted, claims are experiencing the usual seasonal increase and have bottomed after seasonal adjustment, but current levels remain historically strong. For instance, this week’s NSA number is right inline with those readings of the comparable week of the couple of years before the pandemic and 2022.

Continuing claims are a less rosy picture with a much greater and more consistent increase over the past several weeks. Since the recent low of 1.658 million put in place in early September, continuing claims have risen 9.65%. As shown below, that is certainly on the large side of historical increases in such a time span. In fact, most other times (though not always) claims have risen that rapidly, the economy has been in recession. Given that rise, seasonally adjusted continuing claims topped 1.8 million this week, which is the most elevated reading since April 15th and is only 43K below the recent high from the spring. Zooming further out, though, claims remain at historically strong levels.

Chart of the Day – Bond Yields Collapse

Bespoke’s Morning Lineup – 11/2/23 – Was it Something He Said?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Once you consent to some concession, you can never cancel it and put things back the way they are.” – Howard Hughes

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

Stocks are poised to trade higher for the fourth day in a row this morning continuing the positive momentum from yesterday’s trading and a strong session in Europe. Movement in the fixed-income space is also helping as the 10-year yield drops below 4.70%. There’s still a lot of economic data to get through today, and after what has already been a busy day of earnings, there’s still a ton of reports after the close including the biggest of them all – Apple (AAPL) – after the close today. On the economic calendar, we just got a slug of data. Non-farm productivity came in higher than expected, Unit Labor Costs were lower than expected, and both initial and continuing jobless claims were higher than expected.

We’ve all become painfully aware of the typical “Powell Pattern” on Fed days where the S&P 500 finishes near its lows of the day following an afternoon swoon that seems to always take place right after the Fed President starts speaking. Yesterday, the S&P 500 went in the opposite direction as the Powell pattern was completely reversed.

When the closing bell rang yesterday, the S&P 500 tracking ETF (SPY) was up 1.07% making it the best Fed Day since July 2022 when SPY rallied 2.60%. In the nine meetings between yesterday and July 2022, SPY declined an average of 0.78% on Fed days and was only up three times.

The fact that the market finished higher on a Fed Day yesterday was surprising enough. Even more impressive though was the fact that it finished near its highs for the day. When the closing bell rang, SPY was down 0.2% from its intraday high. That was the closest it finished to an intraday high since the May 2022 meeting, and in the eleven meetings between yesterday and May 2022, SPY’s average close relative to the intraday high was a decline of 1.5%. Did Powell get up on the right side of the bed yesterday?

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Chart of the Day – October Sees Some Rotation

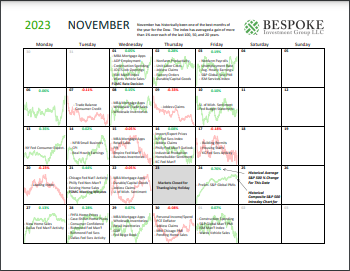

Bespoke Market Calendar — November 2023

Please click the image below to view our November 2023 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/1/23 – A Work of Stagnation

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you knew how much work went into it, you wouldn’t call it genius.” – Michelangelo Buonarroti

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

A 2.4% rally overnight in Japan hasn’t been enough to help the picture for US futures this morning, but we have seen some improvement following a slightly weaker-than-expected ADP report and the refunding announcement from the US Treasury. It’s a busy day of economic ahead with Construction Spending, JOLTS, and ISM Manufacturing. Then, at 2 PM we’ll get the interest rate decision from the FOMC. While the market is all but certain that there will be no change in rates, you never know what Powell will say at 2:30. Once we get through all of that, we’ll get earnings from Apple (AAPL) after the bell.

In yesterday’s Chart of the Day, we discussed the “Nowhere Nasdaq” as the index is basically unchanged since the start of 2021 – a period just two months short of three years! The S&P 500 has fared modestly better during this span, but overall returns have been, at best, ordinary.

The chart below shows the annualized performance of the S&P 500 on a total return basis over the last one, two, five, ten, and twenty years (green bars) and compares those returns to the long-term historical average (blue bars). Outside of the five- and ten-year time windows, returns through the end of October have been weaker than average with the weakest results over the last two years (-3% vs 10.6%). Over the last twenty years, the S&P 500’s average annualized return of 9.3% is 1.6 percentage points below the long-term average, and while that doesn’t sound like much, it adds up over time. For example, $100 invested 20 years ago that compounded at 9.3% is worth $592 today while that same $100 compounded at 10.9% would be worth $792 today.

As ‘meh’ as equity returns have been over time, they blow the returns of long-term US Treasuries out of the water. The BofA 10+ Year US Treasury Index has now had negative 1-year rolling total returns for a record 33 straight months.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Chart of the Day – “Nowhere Nasdaq”

Net Short No More

In last night’s Closer, we discussed the latest positioning data from the weekly Commitments of Traders report published by the CFTC. Released last Friday with data as of the prior Tuesday, the report would have captured October options expiration, and likely thanks to this, there were a number of significant changes to positioning across assets. As we discussed last night, one key area that saw big changes was equities.

Perhaps the most notable of these was in S&P 500 futures. Whereas this past summer saw positioning shift to the most net short (meaning a higher share of open interest is positioned short versus long) levels in over a decade, the past few months have seen those readings steadily unwind, and last week marked the first net long reading since June 14, 2022. Meanwhile, the small-cap Russell 2,000 still remains deep in net short territory, although there was some improvement. The Russell went from a recent low of 14.3% net short five weeks ago to 8.53% net short last week. That’s the highest reading since March.

As previously mentioned, the S&P 500 is back to net long for the first time in well over a year. In fact, the streak of net short readings concluded at 70 straight weeks. That is now the longest such streak in the record of the data dating back to the late 1990s. The only other streak that comes close in length ended at 60 weeks in April 2016.

As for the Russell 2,000, its streak of net short positioning has also been impressive at 135 weeks. However, that is not even half the length of the previous record that lasted from the back half of the 2000s through the early 2010s. Put differently, positioning in Russell 2,000 futures has historically held a more pessimistic tilt with net short readings 72.5% of the time since data for the index begins in August 2002. Although current readings indicate there continues to be more speculators betting against rather than for the index, the recent rise also indicates there has been some improvement in optimism towards small caps.

Bespoke’s Morning Lineup – 10/31/23 – Two in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You cannot keep birds from flying over your head, but you can keep them from building a nest in your hair.” – Martin Luther

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

It’s been a while and it’s still early in the day, but with futures trading higher as we head into the opening bell, the S&P 500 is on pace for its first back-to-back run of gains in three weeks. Treasury yields are moving lower this morning, and the 10-year yield is barely hanging onto the 4.8% level after breaking above 5% just over a week ago. In international economic data, China released some weak PMI data, and GDP in Europe missed expectations.

Back here in the US, the Employment Cost Index came in slightly higher than expected at 1.1% versus forecasts for an increase of 1.0%. Besides that report, we still have home price data at 9 AM, Chicago PMI at 9:45, and Consumer Confidence at 10 AM.

There’s never a shortage of strange when it comes to the markets, and October has been no exception. In a month where geo-political uncertainty in the Middle East moved to the front burner, gold surged (which you would expect), but crude oil, which you would also expect to rally, quickly ran out of steam. The fact that crude oil was unable to get going given the geo-political backdrop reinforces the view that the market isn’t expecting a major escalation/spillover of the current unrest.

With crude oil down just under 9% this month and gold up just under 9%, October is on pace to be just one of 20 other months in the last 40 years that crude fell at least 5% in the same month that gold rallied more than 5%. In the table below, we list each of those prior periods along with each commodity’s forward three-month performance. Going forward, crude oil has tended to largely recoup the ground it lost, averaging a three-month gain of 8.9% (median: +5.3%) with positive returns just over two-thirds of the time. Gold, however, was not as strong. Over the next three months, it averaged a gain of just 1.2% with gains less than half of the time (42%) On a median basis, though, gold’s forward three-month performance was a loss of 0.2%.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

A Slow Correction

On Friday, the S&P 500 joined the Nasdaq in officially entering a correction having fallen over 10% from its July 31st high without a 10% rally in the interim. That is the 55th correction since 1952 when the five day trading week began, and as shown below, it was one of the longer streaks for the index to officially hit that 10% threshold. The median number of trading days across all corrections since 1952 to reach that 10% decline has been 32 days, about half the time the current correction took to hit 10%. That makes this the slowest (for lack of a better term) correction since May 2015 and April 2011 when it took 65 and 67 trading days, respectively. However, looking further back, there were much longer periods like 1980 when it took half a year.

As we have noted in the past, the S&P 500 entering correction is not exactly as scary as it may sound with regard to performance going forward. While there is always the chance that a correction will extend further (potentially becoming a bear market), historically, returns have been solid once the index first enters correction. In the chart below, we show the average one and five-year annualized performance of the S&P 500 from the day the index first enters correction territory (the day the S&P closes 10% from a high without having a 10% rally in between). As shown, whereas any normal one-year period has seen the S&P average a gain of close to 9%, after the first close down 10% from a high, it has averaged an even stronger 10.6% gain over the following year. As for five-year annualized performance, periods after a correction tend to outperform the norm albeit by a much smaller margin.