Chart of the Day – Fool’s Gold

Seasonal Surge in Claims

This morning’s release of Jobless claims came right in line with estimates of 220K and is only marginally higher than last week’s upwardly revised number of 219K. On a four-week moving average basis, claims have totaled 220.75K, matching the level from three weeks ago.

As we noted last week, before seasonal adjustment, claims usually increase throughout the final months of the year, but the Thanksgiving holiday likely caused an unusual drop off in claims last week. Claims were back up this week with an increase to 293.5K which is the highest level since the start of the year. Versus comparable weeks of the year, that is the highest reading since 2018.

Over the past few months, continuing claims have more consistently been grinding higher with last week marking the highest level in two years. The latest reading showed a modest pivot lower in continuing claims down to 1.861 million and matches the April high of 1.861 million.

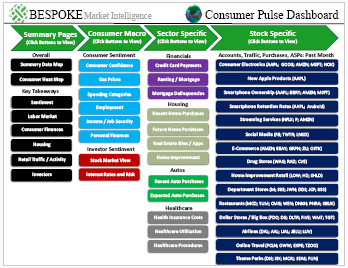

Bespoke’s Consumer Pulse Report — December 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 12/7/23 – Bad Gas

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“With confidence in our armed forces with the unbounding determination of our people we will gain the inevitable triumph so help us God.” – Franklin D. Roosevelt

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

It’s been a mixed start to the week for indices like the Nasdaq and Russell 2000 while the S&P 500 has been down for three straight days. This morning, futures are flat with a slight positive bias. Overnight in Asia, stocks traded lower on reports that the BoJ is gearing up for rate hikes. That led to a spike in yields and the yen and a decline of over 1% in the Nikkei. In Europe, the declines haven’t been as steep as GDP for the region declined 0.1% which was in line with forecasts, although Industrial Production in Germany unexpectedly declined.

Less than three months ago, the price of a gallon of gas in the US was pushing $3.90 and was up 21% on the year, and the price of crude oil was near $95 per barrel. Since then, crude oil prices have tumbled below $70 per barrel (as of yesterday’s close), and a gallon of gas is $3.20 which is down 17.5% from its peak and down slightly on the year. Next week’s CPI report on Tuesday and the subsequent FOMC report should be interesting.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

“big” Drops in Treasury Yields

Relative to where they were just over a month ago, Treasury yields are down sharply as bond prices have rallied. Earlier today, we posted on X that the iShares 20+ Year Treasury ETF (TLT) has nearly fully erased what was a 14% YTD decline as of 10/19 on a total return basis. The Treasury rally can also be seen loud and clear in the chart of the 10-year yield below where yields have gone from just over 5% to just over 4.1%.

Although yields are down sharply, the current decline in yield for the 10-year still doesn’t rank as the largest since the Fed first started hinting at higher rates in late 2021. In both August 2022 and April 2023, the 10-year yield experienced a drawdown of more than 90 bps, although neither of those declines in yield reached triple digits (one full percentage point). For this current rally in Treasuries to translate into the largest decline of the current cycle for the 10-year, it would need to fall to 4.05%, or seven basis points (bps) from current levels.

Chart of the Day: Retail Investors Back Down and S&P 500 Flies

Bespoke’s Morning Lineup – Weak ADP, Strong Russell 2000

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is not heroes that make history, but history that makes heroes.” – Joseph Stalin

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Futures have caught a bid this morning following overnight strength in Asia and also in Europe this morning. The just-released ADP report didn’t do anything to alter that positive mood either, as the headline report came in modestly weaker than expected (103K vs 128K). Non-farm productivity and Unit Labor Costs are just hitting the tape as we type this. It looks like Productivity was higher than expected (5.2% vs 4.9% estimate) and the best since Q3 2020 while Unit Labor Costs fell more than expected (-1.2 vs -0.9%).

Outside of equities, mortgage applications were up for the fifth week in a row, gold is slightly higher, crude oil is slightly lower, bitcoin is above $44K, and Treasury yields have a positive bias with the largest moves at the shorter end of the curve.

After a two-day rally north of 4%, the Russell 2000 gave back about 1.4% on Tuesday but still managed to close above both its 50 and 200-day moving averages for the third day in a row – something we haven’t been able to say since early August.

Whenever a major equity index trades at ‘extreme’ overbought or oversold levels (two or more standard deviations above or below the 50-DMA), it tends to be a sign of overwhelming bullishness or bearishness in the market. These types of readings are mutually exclusive and rarely occur close to each other. The last six weeks for the Russell 2000 have been an exception to that norm. As shown in the trading range chart below, after closing at extreme oversold levels on 10/27, the Russell surged over the next five weeks and closed at extreme overbought levels last Friday (12/1). With just 24 trading days separating the most recent extreme oversold reading from the first extreme overbought reading, it was the quickest that the Russell shifted between the two ranges since June 2021.

In the Russell 2000’s history since 1978, there have only been 16 other times that it went from the oversold extreme to the overbought extreme in 30 trading days or less, and in today’s full post for subscribers, we provided an analysis of the index’s performance following these prior periods. Sign up for a two-week trial to Bespoke Premium to view the full report.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Sideways

The S&P 500 Equalweight index, which gives each stock in the index an equal 0.2% weighting, is currently trading at the same level it was at back in April 2021. Investors used to getting the standard 8-10% per year in the US stock market have gotten far less than that over the last two and a half years.

Below is a five-year price chart of the S&P 500 Equalweight index showing the sideways range it has been in for the last few years.

The spread between the S&P 500 Equalweight’s highest and lowest closing price over the last three years currently stands at 31%. As shown below, 31% is an extremely low 3-year high/low range; well below the average of 75.5% seen across all rolling 3-year periods going back to 1992. The tight spread now, though, comes after a period in which the high/low range had gotten well above its historical average. And the pendulum continues to swing…

Gamers Now Play the Waiting Game

Take-Two Interactive’s (TTWO) subsidiary, video game publisher Rockstar Games, has created some buzz in the past 24 hours. Originally scheduled for this morning, the company released the first trailer for the next installment of their popular Grand Theft Auto (GTA) series early last night after the video was leaked on X (formerly Twitter). The game will be set for a 2025 release and will be titled Grand Theft Auto 6 (GTA VI). The trailer has already broken the record for the most views of a YouTube video in under 24 hours (as of this writing it 77.3 million), and mind you, it hasn’t even been a full 24 hours since the video was put up.

There is a lot of interest in GTA VI, especially seeing as the previous installment from over a decade ago ranks as the second best-selling video game of all time; grossing over a billion dollars in sales in the first three days of its release. Additionally, the upcoming game follows the publisher’s last major title release, Red Dead Redemption 2, in 2018 which has earned the rank of the eighth best-selling game of all time. Despite any excitement from gamers, investors have been less receptive to TTWO’s trailer as the stock is trading down 1.7% today. Below we show the performance of the stock surrounding other debuts of Rockstar Games’ trailers and title releases going back to GTA: San Andreas in 2004 (this was the earliest example of a debut trailer for a game that we could find).

The GTA VI trailer targeted a 2025 release date for the game, which follows the formula of other recent releases with a roughly two-year lag time between a trailer and a game’s debut. As shown, performance in the year following a trailer debut has been somewhat mixed, but TTWO has often traded higher between a Rockstar game’s first trailer and when the game was released. So with the trailer out, investors and gamers alike will now be playing the waiting game until 2025.