A Boomerang Bounce for US Stocks

It has been a great week for the US stock market with the S&P 500 ETF (SPY) up 5.9%. Unfortunately, that only gets the market back to where it was trading just over two weeks ago on October 17th! That’s because SPY fell 5.9% from 10/17 through last Friday (10/27).

Right now SPY is stuck in a short-term downtrend after making a series of lower highs and lower lows since the end of July. From a technical perspective, SPY needs to make a “higher high” for things to look more positive. Today, the ETF got stuck as it approached its highs from mid-October, so it’s not going to be easy.

The rally this week has been broad based, but the best performing stocks have been the names that did the worst in the 10 days prior. Below we’ve broken the large-cap Russell 1,000 into deciles (10 groups of 100 stocks each) based on stock performance during the market’s decline from 10/17 to 10/27 (last Friday). As shown, the decile of the worst performing stocks during the 10/17-10/27 pullback is averaging the strongest gains during this week’s rally.

Looking at individual stocks, below are the 30 best performing names this week in the Russell 1,000. At the top of the list is Roku (ROKU), which is up more than 50%! Another eight stocks are up more than 25% this week, including names like DoorDash (DASH), DraftKings (DKNG), Pinterest (PINS), Paramount (PARA), and Palantir (PLTR). Other noteworthy stocks up big this week include Wayfair (W), Block (SQ), Avis (CAR), Warner Bros. (WBD), Coinbase (COIN), TopBuild (BLD), and even Peloton (PTON).

We’ve got much more coverage of this week’s rally and it’s underlying strength in our weekly Bespoke Report newsletter. The Bespoke Report is available with a 30-day trial to Bespoke Premium, which you can sign up for quickly and easily here.

Bespoke’s Morning Lineup — Doing the Impossible — 11/3/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is nothing wrong with change.” – Joe Maddon

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

Seven years ago today, the world woke up to what had been previously thought impossible as the Cubs won the World Series for the first time in 108 years. In typical Cubs style, they didn’t make it easy on themselves; the win came in extra innings of game seven…after a rain delay! There was a lot of excitement in Chicago on November 3, 2016, but no one was happier than Steve Bartman who became the scapegoat of the team’s collapse in game six of the 2003 NLCS when the Cubs blew a 3-0 lead in the eighth and then went on to lose in game seven after blowing a 5-3 lead and losing 9-6 to the Marlins.

The Marlins then went on to win the World Series in six games over the Yankees. Naturally, since the Cubs should have beaten the Marlins, who then went on to beat the Yankees, the Cubs should have won the World Series, and it was all Bartman’s fault. It makes perfect sense, and if you ask any Met fan, they’ll agree.

While not quite as impressive as the Cubs winning the World Series, the market did what seemed impossible on Wednesday by rallying at least 1% on a Fed Day and then rallying more than 1% the next day as well. Fed days lately have been anything but bullish, and like clockwork, you can usually depend on the market selling off right when Chair Bartman steps up to the podium. Wait, does that say Bartman? On Wednesday, though, the S&P 500 traded higher into the press conference and then kept rallying from there and finished near the highs on both days!

In reality, the S&P 500’s two-day rally on Wednesday and Thursday was only the strongest gain on a Fed Day and the day after since the day of and day after the July 2022 meeting. Just like Bartman, Powell probably doesn’t deserve all the blame, but just like Cubs fans when things didn’t go their way, investors are always looking for a scapegoat, and Powell has become the obvious choice. As bad as it has been for Powell over the last two years during this hiking cycle, at least he can go out to dinner this weekend without fearing the mob. It took Bartman 13 years!

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Bears Shrug Off a Rally

Even though the S&P 500 has moved decisively higher over the past week, sentiment has entirely shrugged off price action. The percentage of respondents reporting as bullish to the AAII’s weekly sentiment survey dropped back below 25% versus a reading of 29.3% last week. Bullish sentiment has now dropped for three straight weeks, having fallen 15.7 percentage points in that span for the largest three-week decline since August 24th. That has also resulted in the lowest bullish sentiment reading since May 18th.

That was matched with a rise in bearish sentiment back above 50%. That was the first time a majority of respondents reported as bearish since last December. As shown in the second chart below, the 44 consecutive weeks weeks without such a reading is sizeable, but far from any sort of record.

With new near-term lows in bulls and highs in bears, the spread between the two widened to 26 points in favor of bears. That is the most negative bull-bear spread reading since March

Other sentiment surveys echoed that negative tone among investors. The NAAIM Exposure Index was actually slightly higher week over week, although it continues to show low levels of long equity exposure. Meanwhile, like the AAII Bull-Bear spread, the Investors Intelligence survey also indicated the most bearish reading since March. Put together, our sentiment composite is now back below -1. That means the average sentiment reading is a full standard deviation more bearish than its historical average for the weakest reading since the first week of the year. Although current readings are rather pessimistic, due to the timing of data collection, the results would not have captured any response in sentiment following the FOMC on Wednesday. In other words, next week we will get a read if the latest updates on monetary policy had any effect on investor pessimism.

Continuing Claims Keep On Rising

Following up on yesterday’s slowing ADP and JOLTS numbers, today’s release of weekly jobless claims likewise showed a cooling labor market. Initial claims were revised up by 2K last week to 212K, and this week’s number came in higher at 217K. That was 7K above expectations which would have assumed no change to claims. With the rise over the past two weeks, claims have now rounded out a bottom but still have significant headroom until reaching the highs from earlier this year.

Before seasonal adjustment, claims were slightly higher at 196.8K. That increase is consistent with seasonal patterns as claims tend to rise throughout Q4. For example, the current week of the year has historically seen claims rise week over week 83.9% of the time; one of the most consistent weeks of increases of the year. Granted, claims are experiencing the usual seasonal increase and have bottomed after seasonal adjustment, but current levels remain historically strong. For instance, this week’s NSA number is right inline with those readings of the comparable week of the couple of years before the pandemic and 2022.

Continuing claims are a less rosy picture with a much greater and more consistent increase over the past several weeks. Since the recent low of 1.658 million put in place in early September, continuing claims have risen 9.65%. As shown below, that is certainly on the large side of historical increases in such a time span. In fact, most other times (though not always) claims have risen that rapidly, the economy has been in recession. Given that rise, seasonally adjusted continuing claims topped 1.8 million this week, which is the most elevated reading since April 15th and is only 43K below the recent high from the spring. Zooming further out, though, claims remain at historically strong levels.

Chart of the Day – Bond Yields Collapse

Bespoke’s Morning Lineup – 11/2/23 – Was it Something He Said?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Once you consent to some concession, you can never cancel it and put things back the way they are.” – Howard Hughes

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

Stocks are poised to trade higher for the fourth day in a row this morning continuing the positive momentum from yesterday’s trading and a strong session in Europe. Movement in the fixed-income space is also helping as the 10-year yield drops below 4.70%. There’s still a lot of economic data to get through today, and after what has already been a busy day of earnings, there’s still a ton of reports after the close including the biggest of them all – Apple (AAPL) – after the close today. On the economic calendar, we just got a slug of data. Non-farm productivity came in higher than expected, Unit Labor Costs were lower than expected, and both initial and continuing jobless claims were higher than expected.

We’ve all become painfully aware of the typical “Powell Pattern” on Fed days where the S&P 500 finishes near its lows of the day following an afternoon swoon that seems to always take place right after the Fed President starts speaking. Yesterday, the S&P 500 went in the opposite direction as the Powell pattern was completely reversed.

When the closing bell rang yesterday, the S&P 500 tracking ETF (SPY) was up 1.07% making it the best Fed Day since July 2022 when SPY rallied 2.60%. In the nine meetings between yesterday and July 2022, SPY declined an average of 0.78% on Fed days and was only up three times.

The fact that the market finished higher on a Fed Day yesterday was surprising enough. Even more impressive though was the fact that it finished near its highs for the day. When the closing bell rang, SPY was down 0.2% from its intraday high. That was the closest it finished to an intraday high since the May 2022 meeting, and in the eleven meetings between yesterday and May 2022, SPY’s average close relative to the intraday high was a decline of 1.5%. Did Powell get up on the right side of the bed yesterday?

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Chart of the Day – October Sees Some Rotation

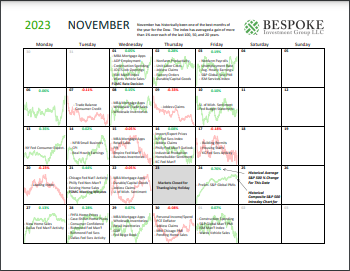

Bespoke Market Calendar — November 2023

Please click the image below to view our November 2023 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 11/1/23 – A Work of Stagnation

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you knew how much work went into it, you wouldn’t call it genius.” – Michelangelo Buonarroti

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

A 2.4% rally overnight in Japan hasn’t been enough to help the picture for US futures this morning, but we have seen some improvement following a slightly weaker-than-expected ADP report and the refunding announcement from the US Treasury. It’s a busy day of economic ahead with Construction Spending, JOLTS, and ISM Manufacturing. Then, at 2 PM we’ll get the interest rate decision from the FOMC. While the market is all but certain that there will be no change in rates, you never know what Powell will say at 2:30. Once we get through all of that, we’ll get earnings from Apple (AAPL) after the bell.

In yesterday’s Chart of the Day, we discussed the “Nowhere Nasdaq” as the index is basically unchanged since the start of 2021 – a period just two months short of three years! The S&P 500 has fared modestly better during this span, but overall returns have been, at best, ordinary.

The chart below shows the annualized performance of the S&P 500 on a total return basis over the last one, two, five, ten, and twenty years (green bars) and compares those returns to the long-term historical average (blue bars). Outside of the five- and ten-year time windows, returns through the end of October have been weaker than average with the weakest results over the last two years (-3% vs 10.6%). Over the last twenty years, the S&P 500’s average annualized return of 9.3% is 1.6 percentage points below the long-term average, and while that doesn’t sound like much, it adds up over time. For example, $100 invested 20 years ago that compounded at 9.3% is worth $592 today while that same $100 compounded at 10.9% would be worth $792 today.

As ‘meh’ as equity returns have been over time, they blow the returns of long-term US Treasuries out of the water. The BofA 10+ Year US Treasury Index has now had negative 1-year rolling total returns for a record 33 straight months.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.