Not Necessarily the Mega Caps and Everyone Else

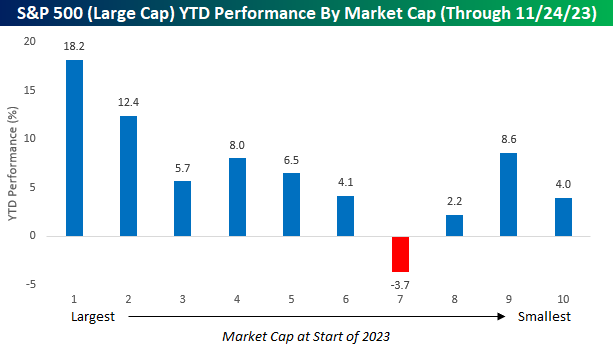

You would have to be living under a rock this year to not know that the performance of US stocks has been driven in large part by companies with the highest market caps. To illustrate it again, the chart below summarizes the YTD performance of stocks in the S&P 500 based on where their market caps stood at the beginning of the year. The first decile on the left in the chart contains the 50 stocks in the S&P with the largest market caps at the start of 2023, and so on and so forth until you get to the last decile which contains the 50 stocks in the index with the smallest market caps at the start of the year. As shown, the 50 stocks with the largest market caps at the beginning of the year are up an average of 18.2% YTD, and a lot more than any other of the nine deciles. In the S&P 500, this year has been all about the largest stocks and everybody else.

With the largest stocks in the S&P 500 trouncing the rest of the index, we were curious to see if there was a similar dynamic at play among mid-cap stocks (S&P 400) and small-caps (S&P 600), and we were surprised to see the opposite trend at play. Starting with stocks in the S&P 400 Mid Cap index, the 40 largest stocks in that index are down an average of 0.3% YTD, and every other decile of stocks in that index is up YTD. In fact, the three deciles comprising the stocks with the smallest market caps at the start of the year are all up by double-digit percentages YTD. Some reports would have you believe that the mega-caps are the only area of the market that has rallied this year, but stocks in the decile of the smallest stocks in the S&P 400 are actually up more, on average, than the stocks that make up the 50 largest stocks in the S&P 500.

Within the small-cap space, stock performance by market cap has been somewhat less correlated, although we would note that four of the six deciles with the largest stocks by market cap at the start of the year are down YTD. Meanwhile, deciles seven through ten, which are comprised of the 240 stocks in the index with the smallest market caps, are all up YTD.

Chart of the Day: It’s Good to Be Young

Dallas Fed Still In Contraction

Economic data was light this morning, but both US releases were disappointing with new home sales and the Dallas Fed’s reading on manufacturing activity coming in worse than expected. For the latter, the General Business Activity Index dropped to -19.9 from -19.2 the previous month. That was also 3.9 points below expectations.

With another negative reading, this headline index has now been in contraction for 19 straight months. That makes it the second-longest such streak on record (since 2004), surpassing the 18-month streak ending in June 2016. However, it would still need to last another six months to match the previous record streak of contractionary readings that occurred during the Global Financial Crisis.

Breadth in this month’s report was terrible with only two indices – inventories and capital expenditures – moving higher on a sequential basis. To make matters worse, with further declines across a number of categories, just under half of them now find themselves in the bottom deciles of their respective historical ranges. Expectations are similarly depressed with only three categories rising on a month over month basis.

Formerly, production and capacity utilization were two of the few indices that remained in positive territory as of last month. But steep declines meant both indices tipped into contraction in November. While production is nearing its recent low from August, capacity utilization’s enormous 15.5-point drop month over month was the largest one-month decline since June 2022 to leave the index at the lowest level since the spring of 2020. While the manufacturing sector has been weak for months, the now resolved auto strike didn’t help matters, so it will be interesting to see if December’s readings show any bounceback as workers come off the picket lines.

Readings on demand hit similar recent or post-pandemic lows. New orders have been in contraction since last June with this month’s reading of 20.5 marginally above the low from one year ago. But the order growth rate is down to -25.4 which is the lowest since April and May of 2020. Even though new orders and the order growth rate are at post-pandemic lows, current readings are much higher than they were in the spring of 2020. However, that margin is not as wide for unfilled orders. The new low of -18.1 is only 8.4 points below the April 2020 low.

Prices have also seen an interesting dynamic recently. Prices Paid are well off the highs and have been falling in the past couple of months, but readings are still positive meaning prices for raw materials are rising at a slower pace than other points of the past couple of years. Prices Received, on the other hand, are not exactly showing manufacturers passing on those higher prices. With demand showing weakness, prices received are falling sharply as the index re-entered contraction in November. In fact, outside of the onset of the pandemic, it was the most negative reading since April 2016.

Bespoke’s Morning Lineup – 11/27/23 – Heading into the Home Stretch

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I’ve been imitated so well I’ve heard people copy my mistakes.” – Jimi Hendrix

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

There are just 24 trading days left in the year, but as we head into the home stretch of trading for the year, it’s hard to imagine a quieter start to the week of trading as there is very little in the way of corporate or economic news to speak of this morning. The only economic report on the calendar today is New Home Sales at 10 AM, but as the week progresses, the pace of reports will pick up steam. One change though is that even as Friday is the first Friday of December, because of where the reference week for November falls on the calendar, the monthly Non-Farm Payrolls report won’t be released until the following Friday (12/8). Outside of the US, it’s also been relatively quiet, but the tone is generally to the downside with modest losses across the board.

November and December have historically been one of the stronger times of year for the market, so as the calendar transitions from the Thanksgiving to Christmas/New Year’s holiday seasons, this morning we looked at market seasonality in the first full week of trading after Thanksgiving. This is usually (although not always) a time of year that includes the last days of November and the first day(s) of December.

The chart below shows the performance of the S&P 500 from the close on the Friday after Thanksgiving through the close on the following Friday. For all years since 1945, the S&P 500’s median gain during the post-Thanksgiving week has been a modest gain of 0.19% with positive returns 55% of the time; that’s slightly weaker than the 0.24% median gain for all five trading day periods since 1945. In years when the S&P 500 was already up at least 15% YTD, the median gain was an even weaker 0.16%. Over the long term, it appears as though bulls come out of the Thanksgiving holiday season a little hungover and sluggish following all the festivities.

While the period after Thanksgiving has been weak for the entire post-WWII period, as you can see in the chart, performance in more recent history has been stronger. In the last twenty years, for example, the S&P 500’s median gain during the current trading week has been 0.44% with positive returns 70% of the time.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Bespoke’s Brunch Reads – 11/24/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

On This Day in History:

Here’s Looking at You, Kid: On November 26, 1942, the movie Casablanca premiered in theaters. Regarded as one of the greatest movies of all time, Casablanca is a blend of romance and moral complexity set against the backdrop of World War II. The movie’s enduring popularity lies in its exploration of major timeless themes such as love and sacrifice, the conflicts between personal desire and the greater good, as well as the struggles and moral ambiguities of wartime.

The film features unforgettable performances by Humphrey Bogart and Ingrid Bergman, following the story of Rick Blaine, an American expat who runs a popular nightclub. Rick’s life becomes complicated when his former lover, Ilsa Lund, arrives in the Moroccan city of Casablanca with her husband, Victor Laszlo, a Czech resistance leader. Ilsa seeks Rick’s help in obtaining exit visas to escape to America. Torn between his love for Ilsa and the need to do the right thing, Rick must navigate love, jealousy, and moral dilemmas in a time of war and political turmoil. The story culminates in a bittersweet finale at the airport, where Rick makes a selfless decision that alters their destinies.

AI & Technology

An equation co-written with AI reveals monster rogue waves form ‘all the time’ (Popular Science)

Rogue monster waves, previously thought to be rare, are now found to occur frequently, as revealed by a new AI-assisted study. Researchers from the University of Copenhagen and the University of Victoria analyzed over 1 billion wave patterns, amounting to hundreds of years of data, to create an algorithm that predicts rogue wave formation. The findings challenge previous beliefs about oceanic patterns, showing that rogue waves, defined as being at least twice the height of the significant wave height of a wave formation, are not as rare as once thought, with about one monster wave occurring daily at random ocean locations. This research is significant for maritime safety, as it can help forecast where rogue waves are likely to occur, potentially saving lives in the shipping industry. [Link]

Why $1 per year won’t solve Twitter/X’s bot problem (Fast Company)

Bot traffic is a pervasive issue on social media platforms like X (formerly Twitter). Some bots have legitimate tasks, while others are malicious as they can inflate user metrics like followers, views, and likes. It’s even easy to pay to inflate these metrics on your own account, a popular phenomenon for internet influencers especially. Bots also contribute to advertising fraud and the influence of public opinion. Elon Musk has suggested the new “Not A Bot” program to combat the bot issue by enforcing a $1 annual fee to use the social platform X. While it would largely take care of smaller, mass-produced bots, more sophisticated and well-funded bots would likely persist. [Link]

Meet ‘Bo-Linda,’ Bojangles’ AI drive-thru order-taker (Charlotte Ledger)

“Bo-Linda” is a new AI voice bot taking orders at drive-thrus in an expanding number of Bojangles locations, with a high success rate in handling orders. Bo-Linda has improved the speed of drive-thru service by allowing employees to focus on other aspects of their work. Her introduction reflects a growing trend in the fast-food industry, as noted in Quick Service Restaurant magazine, where AI technologies are being explored for operational efficiency, menu suggestions based on supply levels, and capturing transaction data. [Link]

Exclusive: Sam Altman’s ouster at OpenAI was precipitated by letter to board about AI breakthrough -sources (Reuters)

Before OpenAI CEO Sam Altman was ousted, staff researchers at the company wrote a letter to the board of directors, warning about a powerful AI discovery that could potentially threaten humanity. This letter and an AI algorithm, known as Q*, were key factors in the board’s decision to remove Altman. The researchers believe Q* might be a breakthrough in achieving artificial general intelligence (AGI), capable of surpassing humans in most economically valuable tasks. Despite its current capability to solve only grade-school level mathematics, its success in these tasks sparked optimism about its future potential. [Link]

EVs & Energy

280 million e-bikes are slashing oil demand far more than electric vehicles (Ars Technica)

In wealthy countries like the US, a significant proportion of car trips are of a short distance. Those short trips contribute to emissions more than you’d think when greener options are available for shorter distances. Although EVs are a greener alternative, they still contribute to emissions and pollution with their heavy batteries and extraction of rare earth elements. So, electric bikes and mopeds are gaining popularity, especially for short trips. They are much cheaper to run than cars, use less energy, and have the potential to significantly reduce urban emissions. They could also cut oil demand even faster than expected. [Link]

Sodium-ion batteries are real in China. BYD to build 30 GWh sodium battery plant (CarNewsChina)

BYD, a Chinese auto and electronic manufacturing company, signed a contract to build the world’s largest sodium-ion battery plant in Xuzhou, China, with an investment of 10 billion yuan (approximately 1.4 billion USD). The plant will focus on producing batteries for micro vehicles and scooters, a sector where sodium-ion batteries are particularly effective. Sodium-ion batteries are gaining attention for their safety, performance in cold temperatures, slower discharge rate, lower production cost, and environmental benefits. However, they have a slower charge rate, lower attainable voltage, and lower energy density compared to lithium batteries. [Link]

‘Energy independent’ Uruguay runs on 100% renewables for four straight months – The Progress Playbook (The Progress Playbook)

Uruguay has successfully generated all of its electricity from renewable sources for nearly four months as of September 2023, primarily using wind power. Historically reliant on hydro and oil & gas-based power, Uruguay shifted towards renewables to meet growing electricity demands and reduce dependence on volatile oil & gas imports. The country facilitated this transition through clean power auctions, attracting $6 billion in investments, equivalent to 12% of its GDP. This shift to renewables has halved power production costs, created 50,000 jobs, and turned Uruguay into a net electricity exporter. This shift also makes the country less vulnerable to geopolitical events affecting energy commodities. [Link]

Health & Wellness

Behold the Ozempic effect on business (Financial Times)

Weight-loss medications, particularly semaglutides like Wegovy and Ozempic, which not only result in significant weight loss but also reduce the risk of diabetes and improve heart health, have become a frenzy. The pharmaceutical industry is experiencing a surge in prescriptions for these drugs, with projections suggesting that 48 million Americans may be using them by 2030. The widespread adoption is not limited to those with obesity or diabetes but includes various demographics, including Hollywood stars. This trend is disrupting multiple industries, from pharmaceuticals and healthcare to food, with potential consequences for companies and markets. The long-term health and societal implications of these weight-loss drugs remain uncertain.[link]

It’s Time to Log Off (Wired)

The title of this article may say it best. There’s a psychological impact to “doomscrolling,” particularly in the context of current global crises and negative news prevalent on social media. Constant exposure to distressing news about world events like the Israel-Hamas war, the Ukraine-Russia conflict, climate change, and political instability is contributing to heightened stress and mental health issues. This cumulative stress can impair interpersonal communications and skew perceptions of reality, leading individuals to view the world as more dangerous than it is. Make sure you’re unplugging from the internet from time to time. [Link]

Economic Trends

Most Americans tip 15% or less at a restaurant — and some tip nothing, poll finds (CNBC)

According to Pew Research, many Americans tip less than the traditional 15% to 20% at restaurants. 18% of adults tip less than 15%, 2% don’t tip at all, and 37% say 15% is their standard. The trend of declining tip amounts, termed “tip fatigue,” is noted, with the average tip at full-service restaurants dropping to 19.4% in 2023. Factors influencing this decline include increased tipping prompts for various services and financial strains from recent inflation. The article also highlights that while service quality is often cited as a key factor in tipping, social approval plays a more significant role in determining tip amounts. [Link]

Foreign direct investment is exiting China, new data show (PIIE)

On his visit to San Francisco, China’s Xi Jinping assured US corporate and big tech CEOs of China’s readiness to partner with the US, amidst new data showing a decline in foreign investments in China. Foreign firms operating in China are not only refraining from reinvesting their earnings but are also selling off their investments due to increased US-China tensions, Beijing’s regulatory environment, and restrictions on cross-border data flows [Link].

Antitrust Enforcement Increases Economic Activity (NBER)

A study analyzing the impact of 3,055 antitrust lawsuits between 1971 and 2018 found that DOJ antitrust enforcement actions resulted in a significant and lasting increase in employment (by 5.4%) and business formation (by 4.1%) in targeted industries. Additionally, these actions lead to a substantial increase in payroll, suggesting an increase in average wages. The findings imply that DOJ antitrust actions not only boost employment and wages but also likely lead to an increase in the quantity of output and a decrease in output prices, thereby enhancing overall economic activity in the affected industries. [Link]

Divorce

A divorce could cost you more than $140,000. Here’s how to prevent a costly split (CNBC)

In 2021, there were about 700,000 divorces across 45 states, against 2 million marriages. The cost of divorce varies significantly; an uncontested divorce averages between $1,500 to $5,500, while a contested one can range from $40,000 to $140,000, and may increase if the case goes to trial. Divorce also brings significant life changes, such as splitting homes and bills and possibly custody battles. While divorces can be financially burdensome, options like prenuptial agreements can help manage costs. [Link]

Thanksgiving Aftermath

‘Brown Friday’ is the worst plumbing day of the year — how to prep your toilet for it (New York Post)

The day after Thanksgiving, known as “Brown Friday,” is the busiest day of the year for plumbers in the US due to a surge in plumbing issues following Thanksgiving feasts. Yelp’s data shows a 99% increase in plumbing service requests on this day. The most common issues are clogged toilets and drains, backed-up pipes, and overflowing dishwashers. To avoid plumbing emergencies, Yelp’s trend expert Tara Lewis recommends preventative pipe checks, reminding guests about bathroom etiquette, using all available toilets in the home, and carefully cleaning off plates to prevent food scraps from clogging drains. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Flash PMIs Mixed

Predicting the direction of the US or global economy has always been a humbling profession, but doing it in the post-Covid economy where monetary and fiscal activity has gone into ‘Ludicrous’ mode only makes an impossible job even harder. The latest releases of global flash PMI readings for November from S&P Global only add to the already long list of examples. As discussed with the overseas releases in The Morning Lineup (link) earlier today, these indices make up about 85% of responses for the final PMI reading in a given month. As for the US, manufacturing activity, as measured by the PMIs, slipped back into contraction during November. Manufacturing PMI has now been at or below 50 for 12 of the last 13 months and the last 7 straight, and S&P Global noted that “demand conditions stagnated” at US factories. As for Services, activity beat and rose sequentially, marking the 10th straight month of expansion (a reading above 50).

As shown in the charts below, historically US PMIs have been a solid guide to global activity, explaining about 80% of the variation in global manufacturing and services activity. When we do the same analysis for the average across flash economies, we do even better as these readings explain 89% or more of the variation (0.89 for manufacturing and 0.94 for the services sector).

While the US readings and the average of the global flash readings have both done a good job as a guide to the global economy, their short-term moves in November were contradictory. In the charts below, we show the US, global, and an average of all the readings for economies that report flash PMIs. As shown, for both the manufacturing and services sectors, average flash data tends to be a pretty consistent guide to where global final data (green line) for a given month ends up and confirms the results from the chart above. For this month, though, in both the manufacturing and the services sectors, the direction of the US reading was in the opposite direction as the average flash readings of its global peers. This is hardly the first (or the last) time these readings will move in opposite directions on a month-to-month basis, but it doesn’t help what is an already confusing environment to navigate.

Happy Thanksgiving! 2023 YTD Winners

The average Russell 3,000 (a combination of the large-cap Russell 1,000 and the small-cap Russell 2,000) stock is up just over 5% year-to-date on a total return basis. Below is a list of the best performing stocks in the index so far in 2023. All 28 stocks are up more than 200%.

The problem with some of this year’s big winners is that they’re still down significantly from highs made a couple years ago. For example, below is a list of stocks that are up more than 100% this year but still down at least 25% over the last two years. If you managed to buy these names in early 2023, congrats. If you bought them towards the end of 2021, however, you’re still not even close to getting back to even.

To weed out this year’s winners that are still in massive drawdowns, below is a list of stocks that are up more than 100% this year and also up more than 75% over the last two years. The list below contains the 27 stocks in the Russell 3,000 that fit this bill. As shown, Super Micro Computer (SMCI) is on top with a 249% gain in 2023 and a 583% gain over the last two years. Other names on the list that you might know include elf Beauty (ELF), Vita Coco (COCO), Abercrombie & Fitch (ANF), Duolingo (DUOL), and Builders FirstSource (BLDR). The rest of the names on the list are more than likely names you haven’t read much about before. If you have some time over the long Thanksgiving weekend, though, give them a look!

Market Cap Less of a Factor In Performance

One trend investors have become used to over the last year is the outperformance of mega-cap stocks while seemingly every other stock in the S&P 500 struggles. In the four weeks since the October low on 10/27, though, there has been more uniformity in the gains.

The chart below breaks out the performance of S&P 500 stocks by decile with the largest stocks by market cap in decile one and the smallest in decile ten. Across the S&P 500, the average performance of stocks in the index is a gain of 9.5% since the 10/27 close, and no decile is outperforming the average gain by more than 1.7 percentage points. Yes, the decile of the largest stocks is outperforming every other decile (when you look at performance out to two decimal places), but there hasn’t been an overwhelming leader in terms of performance.

The charts below show the same analysis for mid (S&P 400) and small (S&P 600) cap stocks. For the S&P 400, while there is a wide disparity between performance across different deciles, outside of the smallest decile also being the decile with the worst average performance, there’s been no correlation between market cap and performance. Finally, in the small-cap space, there has been even less correlation between performance and market cap as three of the four worst-performing deciles are right in the middle of the pack when it comes to market cap (Deciles 4, 5, and 7). Are the days of simply buying the largest stocks and watching them trounce the rest of the market numbered?

Bespoke’s Morning Lineup – 11/24/23 – Preparing For Takeoff (Still)

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.” – Warren Buffett

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

As you might expect, it’s a snoozer in US markets this morning. There are no earnings reports to speak of, and the only economic data on the calendar are preliminary PMI readings for the US Manufacturing and Services sectors. US equity markets will close at 1 PM this afternoon in what is likely to be a very quiet session.

Overnight in Asia, we saw a mixed but mostly lower session. The Nikkei was up 0.5% after a lower-than-expected reading in CPI, but Chinese, India, and South Korean stocks were all lower. For the entire week, though, the tone was more positive. Moving over to Europe, trading is more positive as the UK is the only major benchmark in the red for the day while most other countries are modestly higher. On the rates front, Bank of France Governor Villeroy de Galhau said that barring an unexpected event, there will be no further rate hikes while BoE economist Huw Pill commented that even with economic data weakening, high inflation is keeping the central bank from cutting rates.

For this Thanksgiving weekend, more Americans than ever were expected to fly providing more evidence that the world is finally back to normal (or as normal as it will ever be) after three years of various Covid restrictions and precautions. While air traffic has more than fully rebounded, though, the same can’t be said for airline stocks. As shown in the chart below, while the US Airlines ETF (JETS) initially plunged 65% from its 2019 highs in the early days of COVID, three and a half years later, it’s still down 48% and in what has been a long and turbulent downtrend.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.