Futures may be trading pretty flattish ahead of the open, and the S&P 500 may be right at its 50-day moving average, but don’t let the sense of calm fool you. There’s still a lot of rotation and big swings underneath the surface.

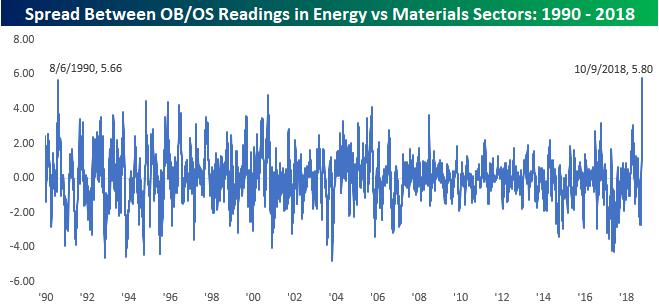

One example of that rotation is evident in the Materials and Energy sectors. As of yesterday, the Materials sector closed 3.83 standard deviations below its 50-DMA after dropping more than 3% yesterday. Meanwhile, the Energy sector has been acting well and finished the day 1.97 standard deviations above its 50-DMA. Going all the way back to 1990, there has never been a point where the spread between the two sectors Overbought/Oversold readings was wider. The prior record spread between the two sectors was in August 1990 just after Iraq invaded Kuwait. Talk about a divergence!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.