For the second day in a row, US equities are poised to open higher on positive trade headlines regarding the US and China. Hopefully today these gains can hold. The dollar is down, once again failing to break out higher from the top of its recent range, while interest rates are starting to firm up a bit with 1-2 bps of yield gains across the curve and a bias towards steepening. Crude oil is up a healthy 1.8% with gasoline rallying as well. Since OPEC announced output curbs last week, things have been mixed but generally positive for Texas Tea, with products basically staying on top of the raw oil price

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/12/18

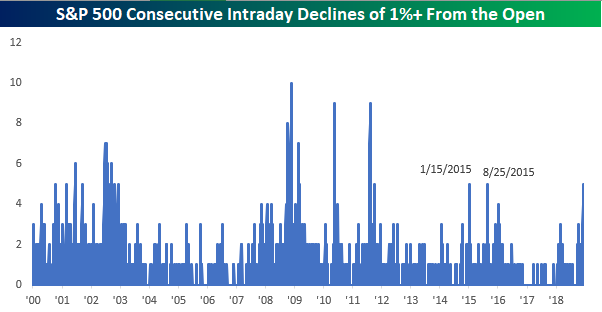

As mentioned above, the S&P 500 has had trouble lately holding onto gains. In fact, yesterday was the fifth straight trading day that the S&P 500 traded down 1% or more from its opening level at some point in the trading day. That doesn’t tend to happen often, and the last time we saw a similar string of consecutive intraday selloffs from the open was back in August 2015 when China devalued. We’re still far from really extreme levels in this streak, though. Back during the financial crisis, we saw ten straight days of similar intraday selloffs. Let’s hope we don’t get to that point.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.