Why party like it’s 1999, when you can party like it’s 1995 instead? With futures indicated higher on the day, the S&P 500 is on pace to finish the first half with a gain of over 18%, while long-term US Treasuries are flirting with a gain of over 10% on the year. Heading into the last trading day of the half, the major focus is obviously on the weekend meeting between President Trump and President XI. Expectations are low heading into the meeting, but we should have a better idea of how things are going to play out as the day goes on and into tomorrow. To bad Xi doesn’t have a Twitter account too!

While China trade talks are a major issue, there is also a decent amount of economic data to contend with today and into next week. Then, after the July 4th weekend, we’ll start to kick off second-quarter earnings season.

Read today’s Morning Lineup to get caught up on everything you need to know ahead of the new trading day including a recap of overnight trading in Asia and Europe as well as a rundown of all economic data released.

Bespoke Morning Lineup – 6/28/19

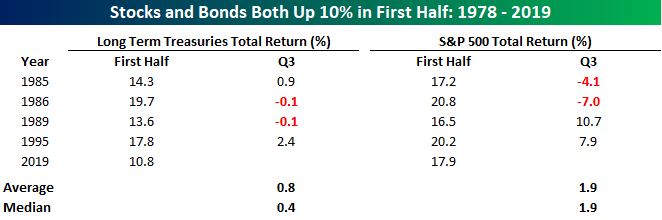

As mentioned above, 2019 is on pace to be the first year since 1995 where both long-term Treasuries (as measured by the Merrill Lynch Long-Term Treasuries Total Return Index) and the S&P 500 were up more than 10% in the first half of the year. Going back to 1978, this is also only the fifth year where both saw double-digit gains in the first half.

In the table below, we highlight each of those five years and show the performance of both asset classes in Q3. In the case of both asset classes, Q3 saw middling returns with periods of positive and negative returns evenly split.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.