Not a good start to the year. While futures are off earlier lows, the S&P 500 is poised to kick the year off with a decline of more than 1%. The culprit behind today’s weakness is poor economic data out of China and Europe. On the US front, things have been quiet…so far.

Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and commentary.

Bespoke Morning Lineup – 1/2/19

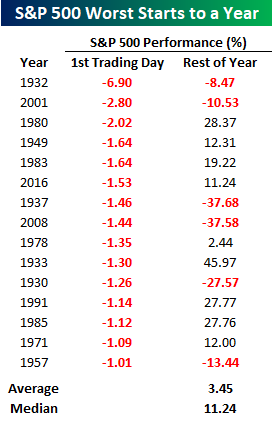

With futures indicating a decline of about 1.65% at the open, today’s start to 2019 could go down as the 16th time that the S&P 500 has kicked off a year with a first day decline of more than 1%. You may recall that the last such occurrence was in 2016 when stocks kicked off the year falling by 1.53% on the first trading day. The rest of that year wasn’t so bad as the S&P 500 went on to rally 11.24% from the first day’s close through year-end. That 11.24% advance also just happens to be the median rest of year gain that we have seen following prior years when the S&P 500 fell more than 1% on the first trading day of the year.

Besides 2016, the next two most recent occurrences where the S&P 500 fell more than 1% to kick off the year weren’t as friendly to the bulls. In 2008, the S&P 500 dropped 1.44% to kick off the year and proceeded to fall another 37.58% through year-end! Then, back in 2001, the S&P 500 kicked off the year with a decline of 2.8%. Following that sharp drop, the FOMC announced a surprise 50 bps rate cut from 6.5% down to 6.0% the very next day. Back then when rates were above 6%, the FOMC had plenty of more ‘ammo’ to ease further, but in the end, it didn’t seem to help as the S&P 500 fell another 10.5% through year-end, and the economy peaked and fell into recession in March.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.