It’s a relatively quiet morning for US equities ahead of this afternoon’s expected rate hike from the FOMC. US futures are slightly higher but have been fading. In trade news, there is some optimism out there on reports that China plans to cut tariffs on up to 1,600 items beginning on November 1st. Read all about today’s news and events in our Morning Lineup below.

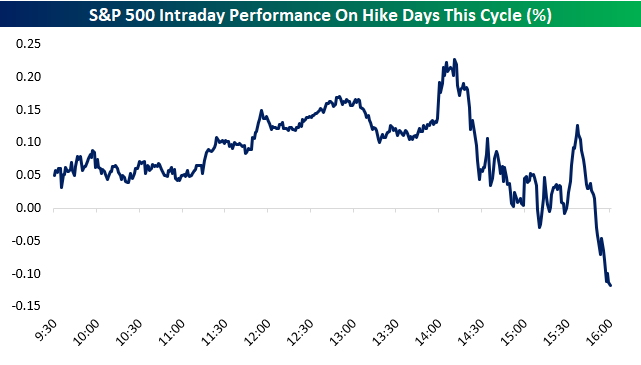

As mentioned above, today is also a Fed Day, and with that, we published our regular preview of the report in a B.I.G. Tips report yesterday. One chart we would like to highlight is a composite intraday chart of the S&P 500 on rate hike days over the last year. There have been 3 of them since last September, and the pattern that the S&P has taken on these days has been noteworthy.

As shown, the S&P has gotten off to a good start in the morning of these Fed Days, but afternoon trading has been a different story. After a drift lower from noon to 1:30 PM ET, we’ve seen the S&P catch a bid into the 2 PM rate announcement. From 2 PM to the close, however, we’ve seen the equity market sell-off pretty sharply to take the index into the red by 20+ basis points by the close of trading. It’s a small sample size, but something to keep in mind especially with futures already off their highs.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.