Futures are trading lower again this morning as rising interest rates and weakness in Europe are keeping a lid on any gains in the US. Worries over earnings are also a concern as we head into earnings season.

Earnings season hasn’t even started, but already we may have one company that will serve as a microcosm for all the concerns that investors have heading into the period. Last night, PPG Industries (PPG) lowered guidance for the quarter citing factors like rising input costs, weaker demand from the auto sector for its paints, softening demand from China due to trade tensions, the stronger dollar hurting foreign demand and weakness in emerging markets. If you were to sum up all of the concerns that investors have that could possibly have a negative impact on company results in Q3, PPG mentioned them!

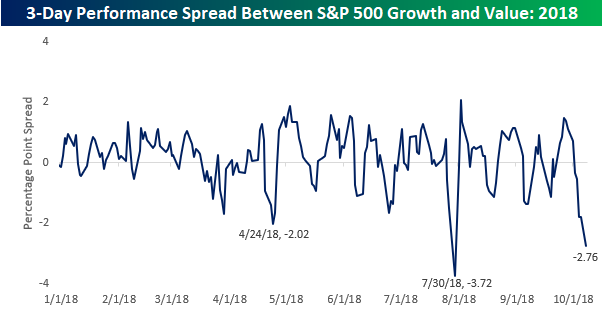

Growth stocks have been taking it on the chin over the last three days, and once again we find ourselves in a situation where they are sharply underperforming value stocks in the short term. Over the last three trading days, the S&P 500 Growth index is underperforming the S&P 500 Value index by over 2.5%. So far this year, this is only the third time that the S&P 500 Growth index has underperformed Value by more than two percentage points over a three trading day period. The last two occurrences were in late April and late July.

This is the third time this year that growth has underperformed value by over 2% in 3 days.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.