We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Equity investors around the world are breathing a global sigh of relief this morning as most equity markets have at least partially rebounded from Friday and Monday’s weakness. There’s a healthy dose of economic data coming up 8:30 with Housing Starts and Building Permits and then Consumer Confidence at 10 AM. Keep an eye on semis today as yesterday, they underperformed the broader market by a pretty wide margin, and then last night Samsung issued a profit warning. Semis have been the market’s leadership group for some time now, so bulls don’t want to see that group falter.

Please click the link below to read today’s Bespoke Morning Lineup.

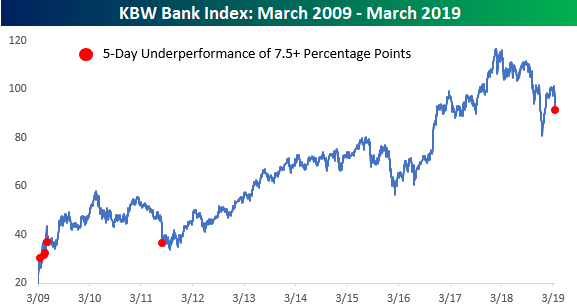

Things are looking up a bit today, but the last five trading days have been hell for bank stocks. After the KBW Bank Index briefly peaked above its 200-DMA last week for the first time since late September, it has been nothing but declines for the group ever since. During the last five trading days, the KBW Bank Index has seen daily declines of 1.32%, 3.02%, 1.53%, 3.92%, and 0.42%. In total, those declines work out to a five-day decline of just under 10% (9.83%) compared to a drop of just 1.22% for the S&P 500.

With bank stocks underperforming by more than 8 percentage points during this stretch, it goes down as the worst relative performance for the group since August 2011. Since the lows of the Financial Crisis, there have only been five other five day periods that saw similar underperformance, and all but the 2011 period occurred during the very early stages of the rally. You don’t see relative underperformance like this in the bank stocks very often.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.