See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Know your strengths and take advantage of them.” – Greg Norman

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Bulls checking the market before they went to sleep last night probably breathed a little sigh of relief that futures were higher following Friday’s rally. At least they slept OK. Waking up this morning, those dreams of gains turned into the reality of losses, and stocks are poised to open back up in the red for the quarter. Welcome back to 2022.

Recession fears are front and center again this morning, especially in Europe as concerns of natural gas shortages heading into the winter months put the likelihood of recession as near certain with the only question being how long and how deep.

On the calendar today, the only economic reports of note are Factory Orders and Durable Goods at 10 AM.

In today’s Morning Lineup, we discuss moves in Asian and European markets, a recap of the plunge in the euro, and more.

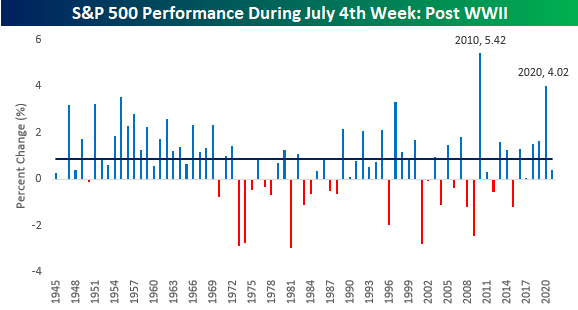

July 4th is usually a period when Americans are brimming with patriotism and that possibly helps to explain why equities have historically performed so well during the holiday week. In the post-WWII period, the S&P 500 has had a median gain of 0.88% during the July 4th holiday week with positive returns over 70% of the time (71.4%). The two best July 4th holiday weeks were in 2010 (5.42%) and 4.02% just two years ago in 2020. As shown in the chart, the S&P 500 heads into this year with a six-year run of positive returns during July 4th week, but that pales in comparison to the 19-year run from 1951 through 1969 when the S&P 500 averaged a 1.79% average weekly gain.

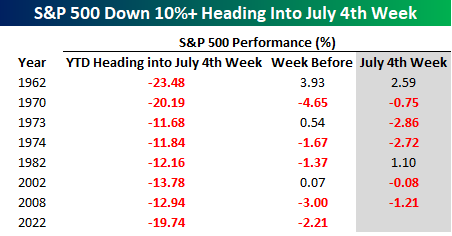

With the S&P 500 down just under 20% heading into this week and down 2.2% last week, will the patriotism of July 4th be enough to offset the pessimism regarding the market and economy? It’s going to be tough. The table below lists the seven prior years since WWII that the S&P 500 was down more than 10% heading into July 4th week. In those seven years, the S&P 500’s average performance during the July 4th week was a decline of 0.56% (median: -0.75%) with positive returns just two out of seven times.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.