See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Get ready for a busy week of economic, earnings, political, and Federal Reserve news. Futures are indicated higher to start to the week on little in the way of a concrete catalyst, but gold is surging as the dollar continues its decline.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, key earnings news in Europe and the US, global economic data, trends related to the COVID-19 outbreak, including some new charts tracking the outbreak, and much more.

OK. There’s a lot not to like about the world around us right now, whether it be from a societal, health, or economic perspective. While there are also plenty of silver linings, it’s not likely we’ll ever be looking back at this period as a ‘golden’ year. That doesn’t mean gold can’t shine, though. Prices are surging to kick off the week and appear locked and loaded on an eventual run to $2,000 per ounce as the precious metal is on pace for its 7th straight day of gains.

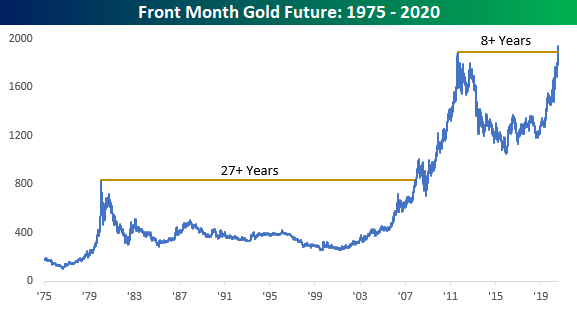

Longer-term, today’s rally has also pushed gold to new record highs eclipsing the prior record high of $1920.7 from September 2011. With a gap of nearly nine years since its last record high, it may seem like a long time since gold last made a new high, the prior gap was much longer. After topping $800 per ounce in early 1980, gold then went more than 25 years without making another new high. Talk about a drought!