See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

If there’s a time that bulls are hoping for a turnaround Tuesday, it’s today. After a strong rally yesterday that took the S&P 500 into positive territory for the year and the Nasdaq to another record high, sellers stepped in during the afternoon erasing all of the gains and then some. The S&P 500 finished down almost a percent and the Nasdaq was down over 2%. It’s pretty crazy to think that on the same day that the Nasdaq hit an all-time high, that it also finished the day down 4% from that record!

Today, sentiment is looking a little bit better than it did at the close yesterday. Futures are higher following some positive earnings news from Citi and JP Morgan, and NFIB Small Business Sentiment also came in better than expected.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, the latest earnings reports, global economic data, trends related to the COVID-19 outbreak, and much more.

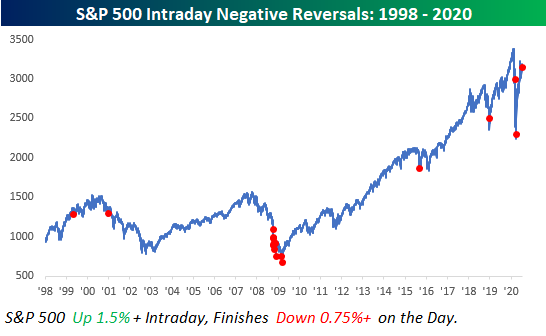

Yesterday’s reversal for the S&P 500 was the first time since March 20th that the index was up over 1.5% intraday but then finished the day down over 0.75% versus the prior day’s close. The chart below shows every similar occurrence going back to the late 1990s. The bulk of these prior occurrences all occurred during the late stages of the Financial crisis, but outside of that period, there were also a handful of occurrences leading up and after the dot-com peak.

More recently, occurrences in the last ten years have been more likely to occur in the later stages of a sell-off (August 2015 and December 2018) than near a peak. Overall, of the 17 prior occurrences since 1998, the S&P 500’s average next-day return was a gain of 1.24% (median: -1.13%) with positive returns just eight times. From a short-term perspective, the only takeaway is that volatility remains in place. On the day after all 17 prior occurrences, the S&P was up or down at least 1% each time. Buckle Up!