See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No technology has ever had the opportunity to address a larger part of the world’s GDP than AI.” – Jensen Huang

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To see yesterday’s CBNC interview, click on the image below.

The biggest report of the earnings season has come and gone, but as Nvidia CEO Jensen Huang said on last night’s call, “This is just the beginning.” At least that’s what NVDA bulls are hoping. Based on pre-market levels, shares of NVDA are looking at an upside gap of over 5%. That would be the stock’s biggest upside gap in reaction to earnings since last May, and as we highlighted in Tuesday’s Chart of the Day, would extend its streak of positive reactions to May reports to four.

NVDA’s current pre-market levels are at the high end of the range the stock has traded in since the DeepSeek news first hit markets in late January. If NVDA can build on these gains during the trading day, it would be notable for two reasons. First, it would indicate a breakout from the post-DeepSeek range (shaded area in the chart below). More importantly, it would help to reverse a trend where the stock has repeatedly capped rallies with intraday negative reversals (see arrows in the chart below).

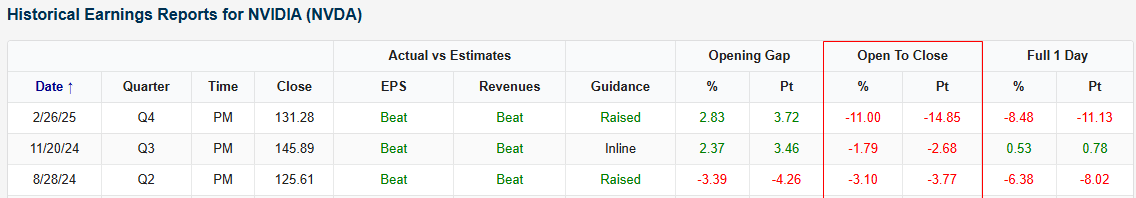

This trend has also been evident on the stock’s recent earnings reaction days. Following the last three earnings reports, the stock has sold off from the open to close, including in February when it sank 11% after initially gapping up nearly 3%.