See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The president wants lower rates… He and I are focused on the 10-year Treasury and what is the yield of that.” – Scott Bessent

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures have been weakening all morning as yields have risen. Oil prices are lower as OPEC+ mulls another production increase, and Bitcoin is above $111K. The House passed its tax bill, and we’re approaching a slew of economic data about to be released after what has to this point been a quiet week for data.

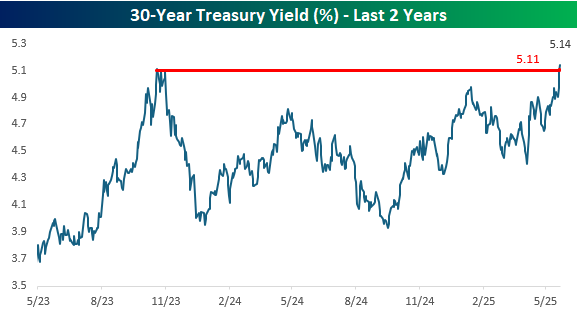

The President and Treasury Secretary may want and be focused on the level of yields, but that’s not what they’re getting. While the 10-year US Treasury yield still hasn’t reached a new high for the year, the 30-year yield broke out above resistance yesterday, trading as high as 5.11% and then adding to those gains this morning and reaching a yield of 5.14%. From a technical perspective, the move higher in yield looks like a textbook breakout, and if that pattern played out, it would suggest higher rates ahead.

From a longer-term perspective, 5.11% was an important level for the 30-year yield. Looking at a two-year chart, it represents the high from Q4 2023, and if current levels of 5.14% hold, we could be in for a new leg higher in yields, which would spell more headaches for equities.