See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“How you begin life is not nearly as important as how you end up.” – Emmitt Smith

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view last night’s segment on CNN’s OutFront with Erin Burnett, click on the image below.

After some positive days of market performance, the euphoria surrounding the US-China trade talks has faded a bit as investors focus again on rising rates, with the 10-year treasury yield back above 4.5%. Walmart (WMT) marked the unofficial end to earnings season with better-than-expected earnings on inline revenues, and the stock is up fractionally. The morning is much worse for UnitedHealth (UNH) as that company’s terrible year continues with reports that the company is under criminal investigation related to billing practices in its Medicare Advantage plans. Based on where the stock is trading in the pre-market, shares have lost more than half of their value since April 11th!

While the pace of earnings reports is slowing down, today is one of the busier days in recent memory for economic data with Empire and Philly Fed Manufacturing reports for May, Retail Sales for April, PPI for April, jobless claims, Industrial Production, Capacity Utilization, and Business Inventories. As if that’s not enough, Powell will also be speaking at 8:40 eastern.

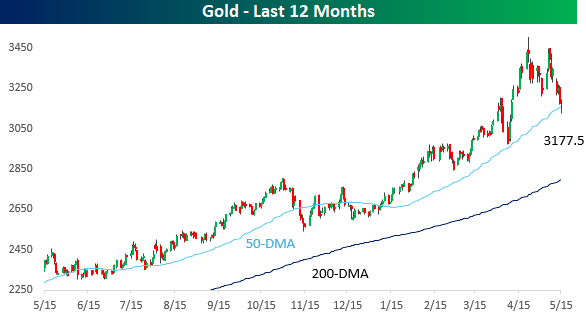

As tensions in global trade pushed economic uncertainty to levels rarely seen before, investors couldn’t get their hands on enough gold. At its high for the year on 4/22, front-month gold prices were up over 30% YTD, and Costco (COST) even had to place a one-ounce limit on the amount of gold that its customers could purchase as sales of the yellow metal on its website exceeded $200 million per month.

With the US and China dialing back on trade tensions, markets and investors have let out a giant exhale of relief, and while it has been good for risk assets, gold prices have taken a hit. Overnight, prices dropped as low $3,123 per ounce, representing a decline of 11% from the recent record high. While prices recovered a bit since the lows, gold briefly traded below its 50-day moving average for the first time since early January.

As gold corrects, its price has become increasingly volatile, and large daily moves have become increasingly common. While it traded more than 2% lower on an intraday basis yesterday, it finished the day down just 1.8%. Even though it didn’t have a daily move of 2%, 11 of the last 25 trading days have seen moves of more than 2%, and just recently, the rolling 25-day total was 12. As shown below, 2%+ daily moves haven’t been that clustered together since 2011, and before that, the Financial Crisis.