See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

Bespoke’s Quote of the Day: “Interest rates are like gravity on valuations. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that’s a huge gravitational pull on values.” – Warren Buffett

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

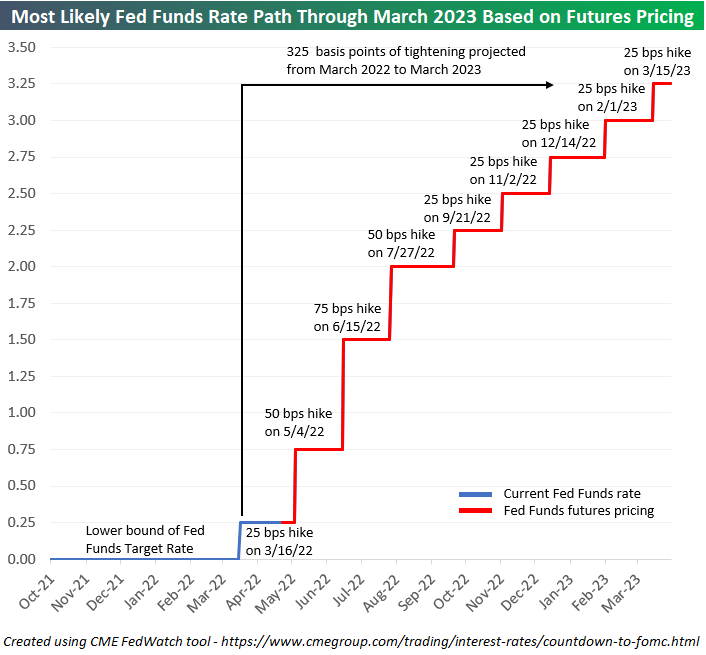

Yesterday’s market sell-off coincided with expectations for an even tighter Fed. As fed fund futures priced in a higher likelihood of tighter policy over the next year, equity prices fell. Below is a chart showing the expected path for the Fed Funds Rate (lower bound) through the March 2023 meeting. Pricing is now suggesting a 50 basis point hike at the May meeting, a 75 basis point hike at the June meeting, and another 50 basis point hike at the July meeting. That would take the Fed Funds Rate up to 2-2.25% (remember, it’s at just 0.25-0.50% now) by mid-July. Talk about a tight summer!

After the estimated 175 basis points of tightening through July, markets are pricing in five more consecutive 25 basis point hikes through March 2023, which would leave the lower bound of the Fed Funds Rate at 3.25%.

If we do see a Fed Funds Rate of 3.25-3.50% by next March, it will be tied for the steepest one-year of tightening since 1989:

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.