See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

Bespoke’s Quote of the Day: “When something is important enough, you do it even if the odds are not in your favor.” – Elon Musk

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

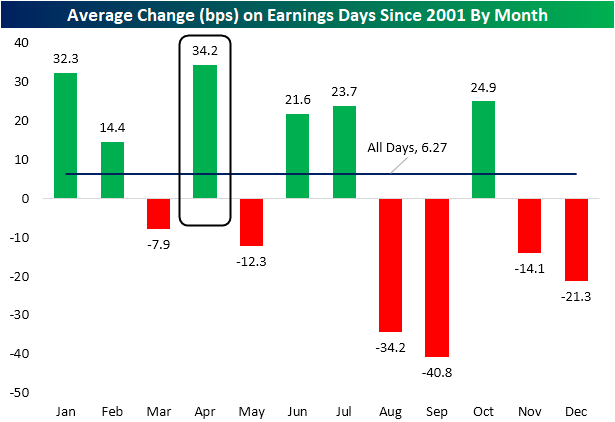

As earnings season ramps up, today we took look at how stocks have historically reacted to earnings reports from a seasonal perspective. The chart below shows the average one-day stock price reaction to earnings reports by month over the last 20 years. This data comes from our Earnings Explorer database that includes one-day share price reactions of more than 150,000 individual quarterly earnings reports dating back to 2001. As shown below, the average company that has reported quarterly earnings in the month of April has gained 34.2 basis points (+0.34%) on its earnings reaction day. That makes April the most bullish month for stocks reporting earnings. Conversely, August and September have been the two worst months to report earnings. Stocks that have historically reported quarterly numbers in August have averaged a one-day decline of 34.2 basis points (-0.34%) on their earnings reaction days. Stocks reporting in September have averaged an even bigger decline on their earnings reaction days (-0.41%). (For companies that report earnings in the morning before the open, its earnings reaction day is that same trading day. For companies that report earnings in the evening after the close, its earnings reaction day is the next trading day.)

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.