See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

PELLEY: Fair to say you simply flooded the system with money?

POWELL: Yes. We did.

Ten months ago, Fed Chair Jay Powell appeared on 60 Minutes to explain the Federal Reserve’s unprecedented response to the COVID pandemic and assure Americans that the Fed would be there at the ready to provide whatever financial support the economy needed. As the exchange between Pelley and Powell above indicates, Powell was pretty blunt in his explanation. Today, market participants eagerly await the Fed Chair’s explanation for how the Committee plans to proceed now that the US appears to be coming out from the other side of the pandemic. It’s much easier to throw money at a problem than it is to take that money back when the problem starts to go away, so it’s pretty safe to assume that the Fed Chair will be a lot more nuanced with his comments today than he was last May.

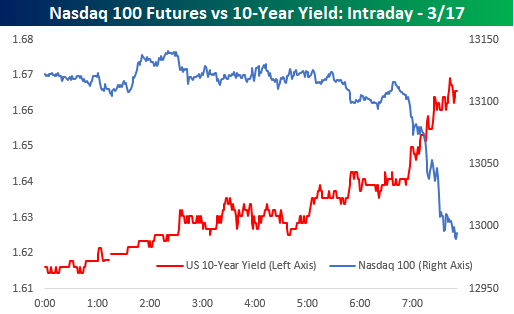

It may be St Patrick’s Day, but there’s not a lot of green on the screens today as US equity futures (especially the Nasdaq), commodities, Treasuries, and even bitcoin are all mostly flat to lower on the day. Housing Starts and Building Permits were just released, and following yesterday’s weaker than expected homebuilder sentiment report for March, these reports (based on February data) both came in significantly weaker than expected. Despite the miss, though, US Treasury yields haven’t pulled back, so there’s been no relief for the Nasdaq.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, an update on economic data out of Asia and Europe, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

To say the balancing act the FOMC finds itself in is delicate would be an understatement. An intraday chart of the 10-Year US Treasury Yield versus Nasdaq 100 futures provides an excellent example. Just after 6 AM eastern treasury yields spiked higher and the pavlovian response in the equity futures markets was to hit the bids sending futures sharply lower. Powell sure has his work cut out for him this afternoon!