See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you just set out to be liked, you would be prepared to compromise on anything at any time, and you would achieve nothing.” – Margaret Thatcher

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Ultimately, it all comes down to the fact that everyone just wants to be liked. After months of hawkish rhetoric even as inflation pressures started to ease, Powell has become as popular as the plague in financial circles, but yesterday he decided to tone it down a bit. It wasn’t a lot, but a comment like “We have no desire to overtighten”, was all the market needed. They took that centimeter and went miles with it. The Dow may have been flat on the day, but the S&P 500 finished up 1% and the Nasdaq tacked on a rally of 2%. We hear Powell even got a smile at the newsstand when he picked up the Post this morning (we’re not sure if it was the Washington or New York version). This morning futures are higher again as Meta’s stock surges close to 20%, but lower-than-expected Unit Labor Costs added another leg to the advance.

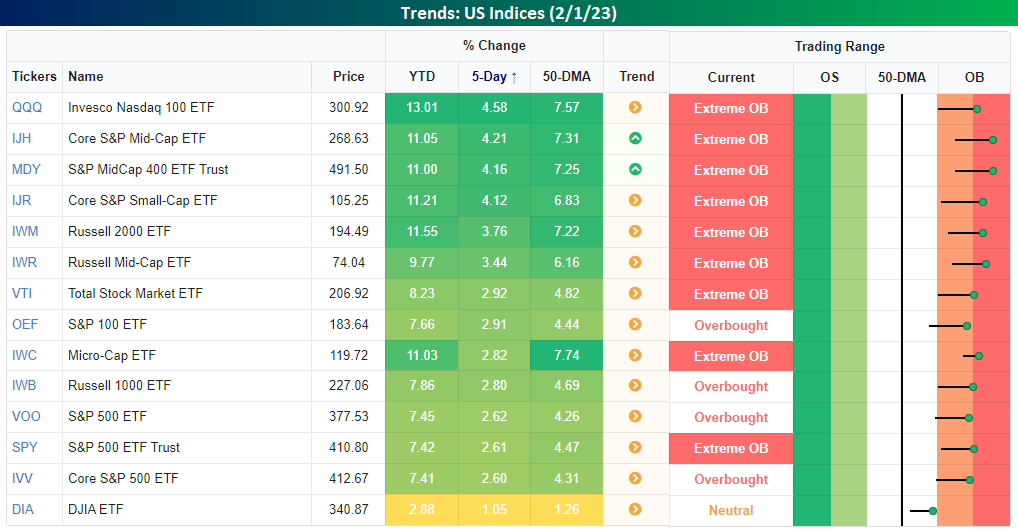

Except for the Dow, all of the major index ETFs in our Trend Analyzer finished the day at ‘overbought’ or ‘extreme overbought’ levels, and YTD they’re all (again excluding the Dow) up at least 7% YTD with many already up by double-digit percentages.

For the S&P 500, it finished the day 1.95 standard deviations above its 50-DMA. Since Powell became the Fed boss in February 2018, the only other time the S&P 500 was further above its 50-DMA on a Fed meeting day (scheduled or unscheduled) was on 11/3/21. That was the last meeting before Powell ditched the term ‘transitory’.

The S&P 500 has ‘passed’ a number of tests in recent weeks. First, it was the 200-DMA, and then it broke above its downtrend line from the highs in January 2022. Yesterday, the latest resistance to go by the wayside was the December peak which resulted in a higher high. Now, with the S&P 500 trading just under two standard deviations above its 50-DMA, it is at overbought levels where four prior rallies in the last 12 months have stalled out. Each milestone that the market crosses reinforces the sustainability of this rally, but on the way up, there are always ‘roadblocks’ ahead. They don’t call it a wall of worry for nothing!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.