Small Business Sentiment Wild Ride

This morning was light for economic data with the only release of note being the NFIB’s Small Business Optimism index. The headline number was expected to pull back following the post election surge, but the decline was larger than expected as it came in at 102.8 versus forecasts of 104.7. That being said, as shown in the chart below, small business sentiment is still up huge since last November’s election.

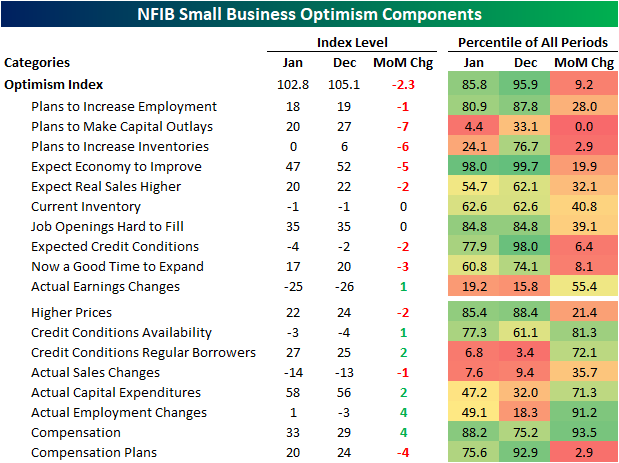

In the table below, we show the readings across the report’s sub-indices for January and December, the month over month change, and how those all rank as a percentile of all periods. As shown, the Optimism Index’s decline in January was actually quite large falling in the bottom decile of all months’ moves. Playing into that were bottom decile declines in a number of inputs like: inventory plans, expected credit conditions, viewing now as a good time to expand, and capital outlay plans. For that last category, the 7-point drop was actually a record single month decline. That is also only one indicator of a number that point to softening capex and labor market conditions which we discussed in today’s Morning Lineup.

As shown in the table above, breadth in January was weak on the whole. For all categories (both inputs and non-inputs for the headline index), there were ten indices that fell month over month versus six that rose while another two were unchanged. Looking at the decliners, most of the categories are expectation or plans based. Contrary to that weakness in soft data, hard data indices like actual earnings and employment changes were generally the ones that improved versus December.

In the charts below, we create indices tracking the strength of hard and soft data categories in the report. Following the election, the soft data index soared as expectations and optimism massively improved given small business sentiment has a tendency to favor Republicans. The historically strong readings in that index left more muted hard data in the dust. With that said, January saw the soft data index revert lower although it is still at solid levels in the 63rd percentile of readings. Meanwhile, hard data has continued to improve and is now at the highest level since September 2023.

Again, although the January report showed some moderation in small business optimism, reporting firms are still extremely optimistic. For example, the index of Outlook for General Business Conditions pulled back but remains in the top 2% of readings in the survey’s history. Likewise, the share of respondents reporting now as a good time to expand is around some of the highest levels of the past few years.

The NFIB offers a breakdown of reasons given for expansion outlooks. As shown in the second chart below, the strength in positive expansion outlooks has been largely driven by politics. Similarly, those giving uncertain outlooks have less frequently been pointing the finger at politics, however, there was an identical share in January that said costs of expansion was the reason for uncertainty. Unchanged at 7%, that was the highest reading since February 2020. Perhaps most notably, for those reporting an uncertain outlook, a record 22% share blamed economic conditions.

As much as a shifting political landscape has benefitted small business optimism, January did also see an interesting spike higher in the percentage of businesses reporting taxes and government red tape as their biggest issues as the threat of tariffs were quickly introduced. That reading rose to 27% of responses which was the highest since November 2021.

One other indication that Trump’s tariff plans have caused some trepidation among small businesses is the Economic Policy Uncertainty index. As shown below, during election years it is normal for this index to rise sharply. This most recent election was a prime example with the largest election year jump to date. While things moderated significantly in the wake of the election with a 24 point decline from the October report through December (also a record for all prior election years), the most recent reading for January showed a 14 point month over month rebound. Not only is that the largest jump of any inauguration month, but it is also the largest month over month increase in the index’s history.

Chart of the Day – Sentiment Takes a Hit

Bespoke’s Morning Lineup – 2/11/25 – Powell Heads to the Hill

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Common sense is the most widely shared commodity in the world, for every man is convinced that he is well supplied with it.” – René Descartes

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures are moderately lower this morning with technology leading the way to the downside as markets digest the latest round of tariffs from the President last night. Treasury yields and crude oil are higher, and the only economic report of the day – the NFIB Small Business Optimism survey showed a modest deterioration after the historic post-election surge.

As you probably know by now, this is an important week for interest rates. It starts with today’s Senate testimony by Fed Chair Powell. Then, we’ll get CPI and more Powell testimony at the House tomorrow. Thursday will cap things off with PPI, but there will also be plenty of other Fedspeak sprinkled in between. Maybe all this Fed/inflation news will allow the market to shift some of its attention from the White House!

Heading into today’s Powell testimony, Treasury yields are at an important juncture. The 10-year yield saw a sharp decline from its mid-January peak of 4.8% down below 4.4% but increased in the last few days moving back above 4.5% this morning. As shown in the chart, these levels put the 10-year yield back above its 50-day moving average (DMA) but still below the uptrend line that was broken to the downside last week. It’s common to see a test of a former trend line after it has been broken, and how that test turns out in the short term can often signal the intermediate-term direction going forward. An upside break would potentially signal higher rates going forward while a failed test could indicate a longer downtrend in rate from here.

Chart of the Day: The Biggest Losers

The Closer – Inflation Expectations, Mortgages, Auctions – 2/10/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a look at the latest inflation expectation data (page 1) followed by a review of the other data featured in the New York Fed’s Survey of Consumer Expectations (page 2). Afterward, we check in on mortgage rates and earnings (page 3) and then preview this week’s Treasury issuance (page 4). We then close with a weekly recap of positioning data (pages 5 -8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 2/10/25

Q4 2024 Earnings Conference Call Recaps: Illinois Tool Works (ITW)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Illinois Tool Works’ (ITW) Q4 2024 earnings call.

Illinois Tool Works (ITW) is an industrial manufacturer operating across seven business segments, producing specialized components, equipment, and consumables for automakers, construction firms, semiconductor manufacturers, food service providers, and others. The company’s performance offers insights into industrial demand, global manufacturing trends, and capital spending across key markets. ITW closed its year out with record margins and free cash flow despite macro uncertainty. Automotive OEM outperformed industry builds, especially in China, where ITW gained market share in EVs. Semiconductor and electronics markets showed early signs of recovery, while construction remained soft due to weak housing starts. Food equipment saw strong service demand (+5%). ITW remains cautious on 2025 demand, forecasting 1-3% organic growth, but expects another 100 bps of margin expansion. Tariffs remain a watch item, but ITW is confident in its pricing power. ITW shares were flat on 2/5 after posting mixed results…

Continue reading our Conference Call Recap for ITW by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Yum! Brands (YUM)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Yum! Brands’ (YUM) Q4 2024 earnings call.

Yum! Brands (YUM) is one of the world’s largest restaurant companies, owning iconic fast-food chains KFC, Taco Bell, Pizza Hut, and Habit Burger. With over 60,000 locations in 155 countries, the company operates a heavily franchised model. Digitally, YUM is a leader within the quick-service industry, with over 50% of system sales now coming through digital channels. In Q4, YUM delivered 5% system sales growth, despite headwinds in some international markets. Taco Bell US led the way, with 6% full-year system sales growth and strong consumer engagement, including the successful $7 Luxe Box and Decades platform. KFC International rebounded, with sales in the Middle East up 11% in Q4 after a tough year, while Africa and Latin America posted mid-to-high single-digit growth. Pizza Hut struggled in the US but improved internationally, with new digital-focused store concepts rolling out. YUM also introduced Bite by Yum!, a proprietary tech suite aimed at accelerating AI-driven personalization and digital sales, which grew 15% in 2024. After beating estimates, YUM shares climbed 9.7% on 2/6…

Continue reading our Conference Call Recap for YUM by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Walt Disney (DIS)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Walt Disney’s (DIS) Q1 2025 earnings call.

Walt Disney (DIS) is a global entertainment powerhouse spanning film, television, streaming, theme parks, and consumer products. Its content empire includes Disney, Pixar, Marvel, Star Wars, and ESPN, making it a dominant force in storytelling and media. DIS’s Q1 2025 results were indicative of streaming growth and solid momentum in its parks and experiences going forward. The company had the top three films of 2024 at the global box office and continued subscriber growth for Disney+ and Hulu, despite recent price hikes. ESPN’s transition to digital took center stage, with plans to launch its flagship streaming service in the fall, bundling it with Disney+ and Hulu. Parks and cruises performed well, with bookings up for the summer. Cost-cutting remains a priority, with content spending trimmed to $23 billion. DIS is betting on AI and personalization to improve its streaming experience, while ESPN’s 24/7 live content positions it strongly in an evolving sports media landscape. On mixed results, DIS shares fell 2.4% on 2/5…

Continue reading our Conference Call Recap for DIS by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Uber (UBER)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Uber’s (UBER) Q4 2024 earnings call.

Uber (UBER) is in the mobility and delivery services business, operating a platform that connects riders, drivers, and merchants in over 70 countries. The company provides ride-hailing, food delivery (Uber Eats), freight logistics, and expanding autonomous vehicle partnerships. In Q4, gross bookings rose 21% YoY, exceeding expectations, while Uber One membership grew 60% YoY to 30 million. Expansion into less dense markets and investments in driver incentives helped mobility gross bookings grow 24% YoY. Uber Eats saw merchant count rise 16%, strengthening its grocery ambitions. On autonomous vehicles, Uber reinforced its role as a go-to-market partner but said commercialization will take longer. Insurance costs remain a challenge, but price moderation is expected in 2025. Despite better-than-expected results, UBER fell 7.5% on 2/5…

Continue reading our Conference Call Recap for UBER by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below: