The Bespoke Report — And Just Like That

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Heading into this week, the consensus concern among investors was the “higher for longer” narrative that had been brewing for the past month and whether the Fed would decide to hike rates by either 25 or 50 basis points at its upcoming meeting on March 22nd. Inflation numbers that were cooling in the last quarter of 2022 perked up again in January, and US employment data (data that is being impacted by falling response rates) just won’t cooperate even though we’re seeing big increases in job cut announcements (as we’ll highlight later).

Earlier in the week, markets interpreted Fed Chair Powell’s testimony before Congress as hawkish, causing odds for a 50-basis point hike to spike well above the odds for a 25-basis point hike at the March meeting. On Wednesday, we also got a stronger than expected ADP Employment reading and a stronger than expected JOLTS reading. Both beats kept the 50-basis point hike narrative going ahead of Friday’s all-important nonfarm payrolls number for February.

On Thursday as investors were digesting the weekly jobless claims figures and listening to President Biden’s proposed tax hikes in his new budget, we saw a dramatic drop in the regional bank corner of the market when a West Coast bank known for funding a large portion of Tech and VC start-up businesses – SVB Financial (SIVB) – saw its share price fall more than 50% in early trading. By the end of yesterday, SIVB had lost 66% of its value in one day. By this morning when shares were halted after falling another 60% in pre-market trading, the entire investment world had taken notice, and when later in the day the state of California and the FDIC announced that SVB had gone belly-up, the stronger-than-expected nonfarm payrolls report was but an afterthought. The failure of SVB (formerly Silicon Valley Bank) is the 2nd largest bank failure in US history, and it happened just like that. For the week, the US equity market was down 4.5%, and Treasury bond yields that were hitting cycle highs earlier in the week ended up seeing some of their biggest 2-day declines ever.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Daily Sector Snapshot — 3/10/23

This Doesn’t Happen Often

After a surge earlier this week that took the yield on the two-year US Treasury up above 5% for the first time since 2007, concerns over the health of bank balance sheets have caused a sharp reversal lower. From a closing high of 5.07% on Wednesday, the yield on the two-year US Treasury has plummeted to 4.62% and is on pace for its largest two-day decline since September 2008. Remember that?

A 45 basis point (bps) two-day decline in the two-year yield has been extremely uncommon over the last 46 years. Of the 79 prior occurrences, two-thirds occurred during recessions, and the only times that a move of this magnitude did not occur either within six months before or after a recession were during the crash of 1987 (10/19 and 10/20) as well as 10/13/89 when the leveraged buyout of United Airlines fell through, resulting in a collapse of the junk bond market. As you can see from the New York Times headline the day after that 1989 plunge, just as investors are worrying today over whether we’re in for a repeat of the Financial Crisis, back then they were looking at ‘troubling similarities’ to the 1987 crash. The year that followed the October 1989 decline wasn’t a particularly positive period for equities, but a repeat of anything close to the 1987 crash never materialized. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 3/10/23 – Running into the Weekend

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I believe that banking institutions are more dangerous to our liberties than standing armies.” – Thomas Jefferson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are lower this morning heading into the 8:30 Non-Farm Payrolls report but given the action in SVB Financial (SIVB) which is trading down over 60% for the second straight day, the biggest surprise may be that futures aren’t even lower.

The February Non-Farm Payrolls report was just released and while it was mixed relative to expectations, it was generally positive for markets. Economists were expecting the headline reading to come in at 225K this morning, but the actual reading came in at 311K. Below the surface, though, the Unemployment rate was higher than expected, average hourly earnings were lower than expected, and average weekly hours were also lower than expected.

Yesterday was one of the worst days for bank stocks in years. In the 17 years that the S&P Regional Banking ETF (KRE) has been trading, Thursday’s 8.11% plunge was only the 22nd single-day decline of 7.5% or more, and it was the first since the COVID shock in early 2020. Before that, you have to go back to the debt limit and US credit rating downgrade of August 2011 to find the next occurrence when there was one day (8/8/11) when the ETF fell just under 10%. During the Financial Crisis, moves like yesterday’s almost seemed common. Whether yesterday was a one-day shock in the bank stocks or not remains to be seen, but based on the history of prior occurrences, like cockroaches, more often than not, when there’s one single-day large decline, others are usually lurking.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

50-DMAs Couldn’t Hold

Worries about banks today left major US index ETFs across the market cap spectrum back below their 50-day moving averages. The uptrend channels that have been formed over the last six months are also getting tested with this week’s move lower. You can see the current set-ups in the snapshot from our Chart Scanner tool below.

Looking at our Trend Analyzer, every sector ETF except for Technology has now moved back below its 50-day moving average. Six of eleven sectors are actually oversold (>1 standard deviation below 50-DMA), with Financials (XLF) and Health Care (XLV) at “extreme oversold” levels. XLF had been up more than 8% on the year about a month ago, but it’s now down 1.93% YTD.

Technology (XLK) and Utilities (XLU) are the only two sectors up over the last week. Interestingly, Utilities (XLU) has been one of the worst performing sectors so far this year, while Tech has been the best.

With Financials seeing such a sharp decline this week, below is a snapshot of various banks and brokers in the sector with the ones highlighted in red all now trading at least 5% below their 50-DMA. As shown, Charles Schwab (SCHW) is down the most over the last week with a decline of 12.6%, which has left it 16.4% below its 50-DMA and down nearly 20% on the year. Other names like Bank of America (BAC), JP Morgan (JPM), and Raymond James (RJF) are in extreme oversold territory as well. Of the major banks and brokers listed, Goldman Sachs (GS) has actually held up the best over the last week with a decline of just 2%. Click here to learn more about Bespoke’s premium stock market research service.

The Closer – The Great Balance Sheet Contraction – 3/9/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with commentary on Silicon Valley Bank (SIVB) and Silvergate (SI) and recap tonight’s earnings reports (page 1). We then turn over to a review of the Fed’s Z.1 Flow of Funds report (page 2 and 3) before closing out with a rundown of today’s 30 year bond reopening (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 3/9/23

The Bespoke 50 Growth Stocks — 3/9/23

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

B.I.G Tips – Most Correlated Periods to Last 12 Months

Bearish Sentiment Remains

The S&P 500’s swings higher and then lower over the past week have left sentiment little changed. For the American Association of Individual Investors’ (AAII) weekly survey, 24.8% of respondents reporting as bullish compared to 23.4% the previous week. That is the second higher reading in a row but still well below the recent high of 37.5% from one month ago.

Along with a modest bounce in bullishness, bearish sentiment has taken a modest decline falling from a recent high of 44.8% last week down to 41.7% today. That is the first decline in a month, leaving it in the middle of its range since the start of last year.

Given the moves in bullish and bearish sentiment, the bull-bear spread remains skewed in favor of bears for the third week in a row.

Following a sharp eight percentage point decline last week, neutral sentiment has bounced rising to 33.4%. Albeit higher, outside of last week, that reading would be the lowest since the end of 2022.

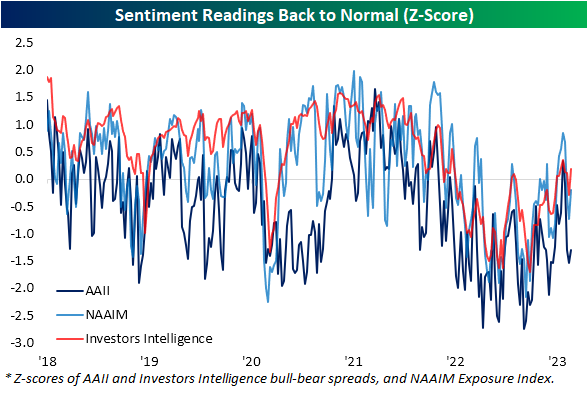

Although recent weeks have seen the AAII survey return to deeply bearish sentiment, other surveys are not nearly as pessimistic. While the AAII survey’s bull-bear spread sits well over a standard deviation below its historical average, the NAAIM Exposure index continues to show only modestly long positioning among active managers. Currently, that reading is 0.2 standard deviations below the historical norm. Meanwhile, the weekly Investors Intelligence survey is actually showing respondents are reporting as more bullish than has been historically normal. Click here to learn more about Bespoke’s premium stock market research service.