Daily Sector Snapshot — 3/14/23

Nothing SHY About This

shy /SHī/ – adjective 1. being reserved or having or showing nervousness or timidity in the company of other people.

When one thinks about short-term US Treasuries and their traditional day-to-day price action, shy is a pretty good description. Traditionally, short-term Treasuries have not been the place an investor who was looking for action would go to look. That’s what tech stocks are for! As the Fed has embarked on what has been the most rapid pace of rate hikes in at least 40 years, though, no type of financial asset, including short-term Treasuries, has been spared. The chart below shows the iShares 1-3 Year Treasury Bond ETF (with the aptly named ticker SHY) over the last year. A year ago, the ETF was trading just above $84, and last week it was down near $80 before rebounding over the past few days to a high of $82.02 yesterday. A one-year range of just under 5% is hardly volatile, but from the perspective of a short-term Treasury investor, it’s a gigantic move.

The last week has been a period of historic volatility for US Treasuries – at least relative to the last 20 years. The chart below shows the daily percentage changes in SHY since its inception in July 2002. Yesterday, the ETF had its largest-ever one-day gain at just under 1% (0.997%). You can also see from the chart that ever since the FOMC started hiking rates in early 2022, the magnitude of SHY’s average daily moves has rapidly expanded.

Monday’s (3/13) nearly 1% rally in SHY also marked a milestone for the ETF in that it experienced a one-day gain or loss of at least 0.25% for three consecutive trading days. That tied the longest-ever streak of 0.25% daily moves from back in September 2008 just after Lehman declared bankruptcy. With SHY down 0.34% on the day in late trading Tuesday, it is now on pace for its 4th straight day of 0.25% daily moves. Yup, you read that correctly; volatility in short-term Treasuries is greater now than it was during the Financial crisis! When Powell said last Summer that fighting inflation would ‘bring some pain’, he wasn’t kidding. As a result, SHY may want to consider changing its ticker to something more applicable. “BOLD” is available. Click here to learn more about Bespoke All Access, our premium membership offering.

Bespoke Stock Scores — 3/14/23

B.I.G. Tips – Banks Shatter

Some Good and Some Bad in Small Business Optimism

Early this morning, the NFIB released the results of its February survey of small business optimism. The headline index rose to 90.9 versus expectations of it remaining unchanged at 90.3. In spite of the bounce, small businesses continue to report some of the worst sentiment of the past decade with the February reading right back in line with the April 2020 low.

Diving deeper into the categories of the report, breadth was mixed. Of the ten inputs into the headline number, four were lower month over month, one was unchanged, and the other half were higher. For the most part, these indices also remain in the bottom decile of their historical readings.

In today’s Morning Lineup, we highlighted how the report’s labor metrics have been improving in each of the past four months on an aggregate basis. Plans to increase employment remain healthy in the 77th percentile while the percentage of respondents reporting job openings as hard to fill hit a new record high after rising by a near record 9 points month over month. Although openings were harder to fill, firms also took on more workers. With actual employment changes moving up to 4, it hit the highest level of the post-pandemic period. However, that did clash with hiring plans falling 2 points to match December for one of the lowest readings of the past few years. Likewise, plans to increase compensation are at the lower end of their recent range even while actual observed changes to compensation have improved in the past few months.

The same dynamic in which plans are headed in the opposite direction of actual changes can be observed with regards to capital expenditures. Capital expenditure plans were unchanged at 21 last month for the joint lowest reading since March 2021. Meanwhile, actual capital expenditures rose to 60, the highest since March 2020 and credit conditions have improved. Turning to inventories, satisfaction (meaning the net percent of firms reporting if inventories are too low versus too high) fell to the lowest since the spring of 2020. As a result, a net 7% of firms are reporting that they plan to decrease inventories in the coming months.

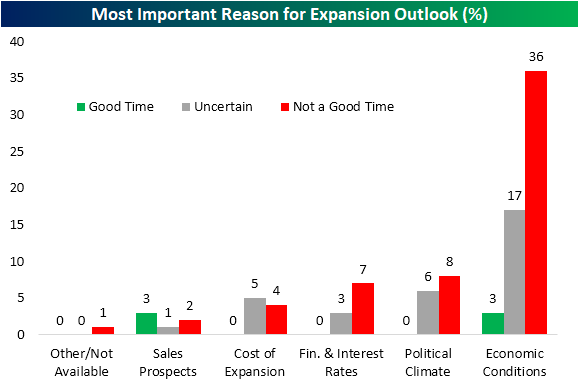

Finally, we would note that on net more firms are seeing lower rather than higher sales in spite of improvements to inflation metrics. The outlook for general business conditions has yet to see any improvement as few businesses report now is a good time to expand.

Most firms report now as a poor time to expand due to economic conditions at 36% of responses. The next most commonly credited reason is political climate followed by interest rates, which at 7% match the December reading for the highest since at least 2020. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Market Timing Model Turns Positive

Bespoke’s Morning Lineup – 3/14/23 – The Number You’ve All Been Waiting For

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“History is largely a history of inflation, usually inflations engineered by governments for the gain of governments.” – Friedrich August von Hayek

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures have been rallying this morning as bond yields move higher as investors breathe a sigh of relief due to the fact that there were no additional bank blowups overnight. Regional banks are seeing the most strength as a stock like First Republic (FRC) is up over 60% in the pre-market. That’s great if you bought the stock yesterday, but it’s still down sharply from where it closed last Friday, let alone where it was coming into the year.

The big number of the morning is obviously the February CPI and that reading came in right in line with forecasts at the headline level (0.4%). Ex Food and Energy, the reading was 0.5% which was slightly higher than expected (0.4%). On a y/y basis, both headline (6.0%) and core (5.5%) were right in line with forecasts. Markets were worried about another hot reading, so the immediate reaction has been a modest bounce in equity futures.

While the moves have been the most pronounced in the Treasury market and regional banks stocks, volatility and extreme reversals have been showing up all over global financial markets in the last several days. Take the equity market of Japan. Last week, the TOPIX finally broke above multi-month resistance to new 52-week highs on Thursday. From a technical standpoint, the action looked like a textbook breakout with well-defined support at former resistance near the 2,000 level. That was Thursday.

In the three days that followed, the TOPX has been down at least 1.5% every day for a total decline of 6%. And that support around the 2,000 level? It was more like Swiss cheese. In last night’s trading, the TOPIX also sliced right through its 50-day moving average (DMA) although it did find some support at the 200-DMA.

Going all the way back to the mid-1980s, the last four trading days for the TOPIX represent just the second time that the index hit a 52-week high and then followed that up with three straight declines of at least 1%. The other period was in October 2003 when the TOPIX hit a 52-week high on 10/20 and then followed that high up with daily declines of 1.1%, 1.8%, and 5.3%, respectively for a total decline of 8.8%. During that correction, the TOPIX’s total decline from that 52-week high pullback was 14.5% before the index went on to recover and resume its upward trend.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Where is the Buyer? – 3/13/23

Log-in here if you’re a member with access to the Closer.

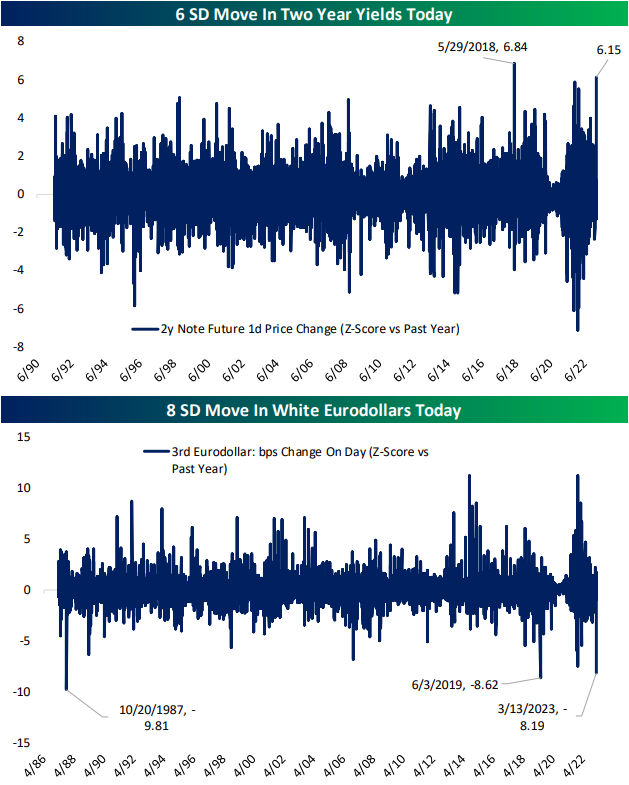

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a quick update on the banking situation (page 1) followed by a rundown of the historical superlatives for the moves in rates today (pages 2 and 3). Afterward, we dive into the NY Fed’s Consumer Expectations Survey (pages 4 and 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/13/23

A Look at the Financial Sector’s Weighting

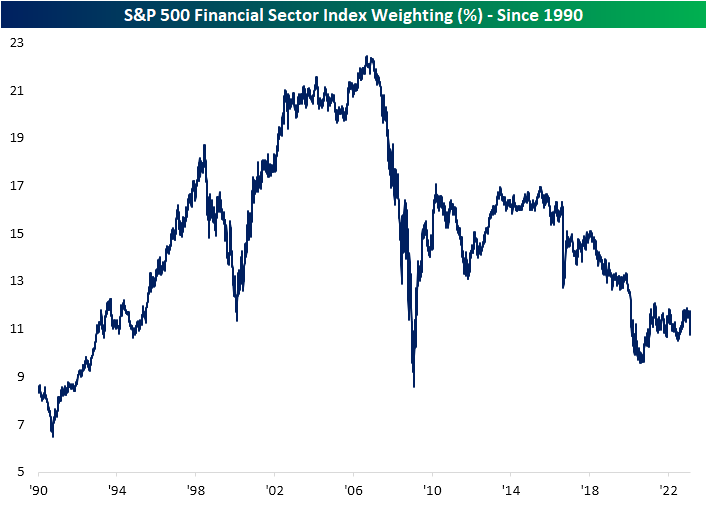

At its YTD high back on February 7th, the S&P Financial sector ETF (XLF) was up more than 8% on the year. Since that high, the sector has fallen more than 13% and is now down more than 6% YTD.

With systemic risk in the Financial system making front-page headlines again, we checked in on the sector’s weighting in the S&P 500 to see how it compares to where things stood back in the mid-2000s ahead of the Financial Crisis. Below is a look at the Financial sector’s weighting in the S&P going back to 1990. As of this writing, the Financial sector has a weighting of 10.73% in the S&P. That’s down a full percentage point from where it was at the end of February.

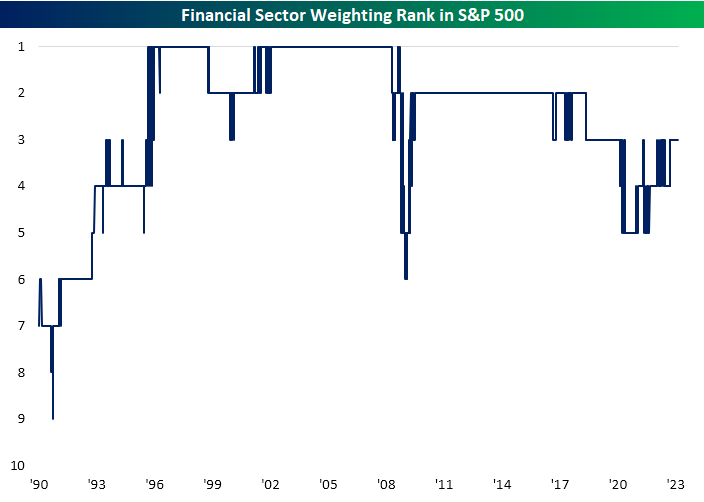

What’s interesting to note is how much smaller the sector is today compared to its weighting back in early 2006 when we were on the cusp of the Financial Crisis. At its peak in early 2006, the sector’s weight in the S&P had ballooned to 22.4%, which made it the largest sector of the S&P at the time. When the Financial sector, which is a sector meant to service the rest of the economy becomes the largest sector, something’s off! Of course, the Financial Crisis following the bursting of the housing bubble of the mid-2000s corrected this problem, as the Financial sector’s weighting fell from north of 22% down to south of 9% when the bottom was finally put in back in early 2009. During this latest bout of issues for Financials, the sector is still big enough to be the third largest sector in the S&P behind Tech and Health Care, but it’s not nearly as “weighty” as it was before the Financial Crisis, and its weighting has actually been trending lower for the last 7-8 years. Click here to learn more about Bespoke’s premium stock market research service.