Daily Sector Snapshot — 3/15/23

The Bespoke Triple Play Report — 3/15/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with above-expectations results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 18 stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Baskets Update — March 2023

Fixed Income Weekly: 3/15/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report, we review the historic collapse in interest rates over the past week.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – Fed and Market Diametrically Opposed

Fall of the Empire Fed

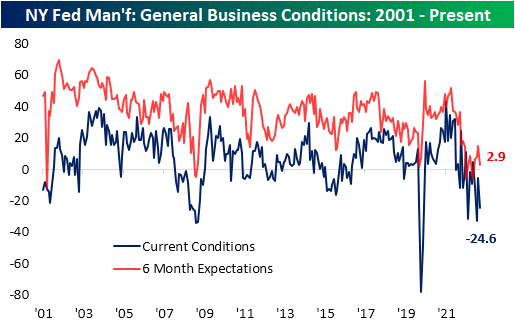

Among the bad news this morning was disappointing economic data in the form of the New York Fed’s Empire Manufacturing report. The report was expected to remain in contraction falling to -7.9 versus a reading of -5.8 last month. Instead, the index plummeted to a much weaker reading of -24.6. Although that is not a new low with even weaker readings as recently as January and last August, the report indicated a significant deterioration in the region’s manufacturing sector, and whereas weather in January was an easy scapegoat for the weakness, that’s not the case for the March report.

Given the large drop in the headline number, breath was equally bad with many other significant declines. Like the headline number’s 5th percentile reading and month-over-month decline, New Orders and Shipments both saw double-digit declines into bottom decile readings. In the case of Shipments, that low reading comes after an expansionary reading last month. Inventories was the only other current conditions index to move from expansion to contraction leaving Prices Paid and Prices Received as the last expansionary categories.

As mentioned above, demand appears weak as New Orders and Shipments are the two most depressed categories from a historical perspective with each index coming in the bottom 3% of all months since the start of the survey in the early 2000s. Six-month expectations are equally low. Unfilled Orders were one of two categories to see a higher reading month over month with the 2.5 point increase much smaller than the move in expectations. Unfilled Orders expectations surged by 12.1 points, ranking in the 95th percentile of all monthly moves on record. That would indicate the region’s firms expect unfilled orders to rise at a rapid pace in the months ahead, likely as a result of weakened sales. That does not mean the area’s firms are expecting inventory build-ups, though. Inventory expectations saw a modest 1.4-point increase month over month in March, but that remains one of the lower readings of the past decade.

The only other current conditions index to move higher month over month was delivery times. Even though it moved higher, the index continues to indicate lead times are rapidly improving and expectations are calling for those improvements to continue.

Next to the dampened demand picture, employment metrics were perhaps the next most jarringly negative. Hiring is falling precipitously with the Number of Employees index hitting a new cycle low of -10.1. Average Workweek also is reaching new lows. At -18.5 it has only been as low during the spring of 2020 and during 2008 and 2009. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 3/15/23 – Et tu, Credit Suisse

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Beware the Ides of March.” – Shakespeare, Julius Caesar

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are down sharply this morning, but surprisingly it has nothing directly to do with issues facing a US regional bank. Today’s weakness is due to a 30% plunge in Credit Suisse as its largest shareholder said it will no longer put additional capital into the bank. Dow futures are down over 600, the S&P 500 is indicated to open down 1.7% and the Nasdaq is holding up better with a drop of 1.4%. It’s been a busy morning for economic data as PPI missed expectations, Empire Manufacturing plunged, and Retail Sales were in line with forecasts. European stocks are down well over 2%, and Treasury yields are plunging. The only risk asset rallying on the day, at this point, is bitcoin.

As we type this, the two-year yield is down over 20 basis points (bps) and below 4% again in what can only be characterized as a turbulent move. If you were on an airplane, you’d be asking for another one of those white bags that they keep in the seat pocket in front of you. Today’s move is on pace to be the fifth straight day that the yield has moved more than 20 bps (up or down) in a single day. To put that move in perspective, the only other time that the two-year yield has had as many 20 bps moves in succession over the last 45 years was in December 1980. Outside of the early 1980s, there has never been another time when the yield on the two-year even moved 20 bps for three consecutive days. Two-year Treasuries have always been one of the most stable assets across the financial spectrum, but they’ve failed on that front lately.

The current moves in the two-year treasury stand out even more when you consider the actual level of yields. Sure, the last year or so has seen yields rise to the highest level since 2007, but in the early 1980s, which was the last time there was as much volatility in two-year yields as there is now, yields were more than double where they are now. Double. The Fed has gotten a lot wrong in their forecasts over the last few years, but one point where Powell was spot on was last August when he said that fighting inflation will “bring some pain”. He should have just come out and said, “Beware the Ides of March.”

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Inflation Surprise, But Eyes Are On Banks – 3/14/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with commentary on the geopolitical tensions arising from the Black Sea and domestic political speak from recent bank activity (page 1). We then pivot into a review of today’s CPI data (page 2) including the potential paths ahead inflation can take (page 3). We also take a look at CPI in Argentina (page 4). We finish with a look at a decile analysis showing just how rotational today’s price action was (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/14/23

Nothing SHY About This

shy /SHī/ – adjective 1. being reserved or having or showing nervousness or timidity in the company of other people.

When one thinks about short-term US Treasuries and their traditional day-to-day price action, shy is a pretty good description. Traditionally, short-term Treasuries have not been the place an investor who was looking for action would go to look. That’s what tech stocks are for! As the Fed has embarked on what has been the most rapid pace of rate hikes in at least 40 years, though, no type of financial asset, including short-term Treasuries, has been spared. The chart below shows the iShares 1-3 Year Treasury Bond ETF (with the aptly named ticker SHY) over the last year. A year ago, the ETF was trading just above $84, and last week it was down near $80 before rebounding over the past few days to a high of $82.02 yesterday. A one-year range of just under 5% is hardly volatile, but from the perspective of a short-term Treasury investor, it’s a gigantic move.

The last week has been a period of historic volatility for US Treasuries – at least relative to the last 20 years. The chart below shows the daily percentage changes in SHY since its inception in July 2002. Yesterday, the ETF had its largest-ever one-day gain at just under 1% (0.997%). You can also see from the chart that ever since the FOMC started hiking rates in early 2022, the magnitude of SHY’s average daily moves has rapidly expanded.

Monday’s (3/13) nearly 1% rally in SHY also marked a milestone for the ETF in that it experienced a one-day gain or loss of at least 0.25% for three consecutive trading days. That tied the longest-ever streak of 0.25% daily moves from back in September 2008 just after Lehman declared bankruptcy. With SHY down 0.34% on the day in late trading Tuesday, it is now on pace for its 4th straight day of 0.25% daily moves. Yup, you read that correctly; volatility in short-term Treasuries is greater now than it was during the Financial crisis! When Powell said last Summer that fighting inflation would ‘bring some pain’, he wasn’t kidding. As a result, SHY may want to consider changing its ticker to something more applicable. “BOLD” is available. Click here to learn more about Bespoke All Access, our premium membership offering.