B.I.G. Tips – Fed Day Briefing

Chart of the Day: Fickle Fed Fund Futures

Bespoke’s Morning Lineup – 3/21/23 – All Quiet (For Now) on the Banking Front

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Bank failures are caused by depositors who don’t deposit enough money to cover losses due to mismanagement.” – Dan Quayle

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

There’s been no new news on the banking front this morning, and investors are taking the lack of news as an excuse to rally. US futures are up about 0.80% as treasury yields spike higher. Ahead of tomorrow’s fateful Fed decision, the only economic report on the calendar is Existing Home Sales at 10 AM today.

With an increase of ‘just’ 14 basis points (bps), yesterday broke a streak of seven straight days that the yield in the yield of the 2-year US Treasury had a daily move of more than 20 bps. Another record streak that continued, though, was the fact that the 2-year yield traded with an intraday range of at least 30 bps. Going back to 2000, which is as far back as we have intraday data for the 2-year yield, the current six-trading day streak of 30+ bps intraday moves is now longer than the five-trading day streak in September 2008 after the Lehman bankruptcy.

Not only is the current streak of wide daily ranges a record, but it also included what was a record single-day intraday range. Last Wednesday, the 2-year yield’s intraday range spanned a low of 3.71% to a high of 4.41%. That 70-bps range was a full 10 bps more than the prior record of 60 bps back on 9/19/08. Is that enough action for you?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke Triple Play Report — 3/21/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with above-expectations results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 14 stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

The Closer – A Tier 1 Mess – 3/20/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with further commentary regarding the Credit Suisse situation and its fallout (page 1 and 2). We then dive into an update of commercial mortgage backed security credit performance (page 3) before finishing with a preview of this week’s Treasury reopenings (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/20/23

Nasdaq Leaves the S&P in the Dust

Looking at the major US index ETF screen of our Trend Analyzer shows just how disconnected the Nasdaq 100 (QQQ) has become from other major index ETFs recently. As shown below, as of Friday’s close, QQQ actually finished in overbought territory (over 1 standard above its 50-DMA) whereas many other major index ETFs were oversold, some of those to an extreme degree. On a year to date basis, the Nasdaq 100 (QQQ) has rallied more than 14% compared to low single digit gains or losses for the rest of the pack.

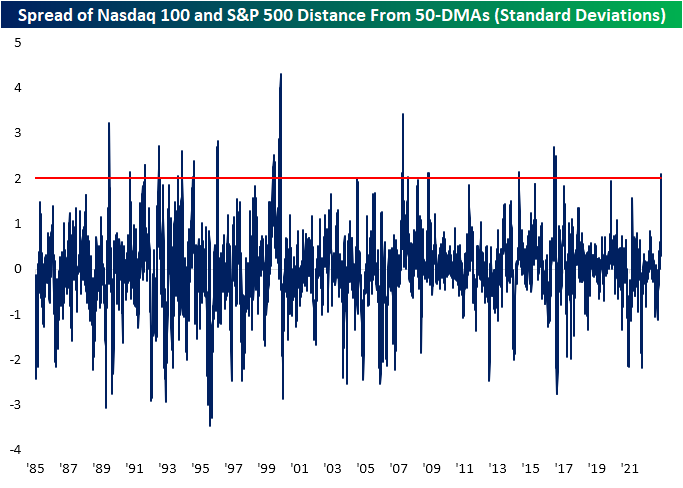

Historically, the major indices, namely the S&P 500 and Nasdaq, tend to trade at similar overbought and oversold levels. In the chart below we show the Nasdaq 100 and S&P 500’s distance from their 50-DMAs (expressed in standard deviations) over the past five years. As shown, typically the two large cap indices have seen similar albeit not identical readings. That is until the past few weeks in which the two have diverged more significantly.

On Friday there was more than 2 standard deviations between the Nasdaq’s overbought 50-DMA spread and the S&P 500’s oversold spread. As shown in the chart below, that surpassed recent highs in the spread like the spring of 2020 to set the highest reading since October 2016.

Going back to 1985, the spread between the Nasdaq and S&P 500 50-DMA spreads diverging to such a degree is not without precedent, but it is also not exactly common. Friday marked the 16th time that spread eclipsed 2 standard deviations for the first time in at least 3 months. Relative to those prior instances, the current overbought and oversold readings in both the S&P 500 and Nasdaq are relatively middling. However, only the instance in early 2000 similarly saw the Nasdaq technically overbought (trading at least a standard deviation above its 50-DMA) while the S&P 500 was simultaneously oversold (at least one standard deviation below its 50-DMA). Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Semis Leading

Bespoke’s Morning Lineup – 3/20/23 – “Merger” Sunday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You’re finished…When you’re down by half, people figure you can go down all the way. They’re going to push the market against you.” Vinny Mattone, When Genius Failed: The Rise and Fall of Long-Term Capital Management

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

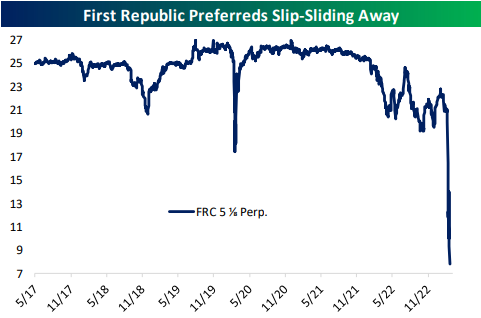

After opening higher last night, futures gave up all of their initial gains and sold off sharply as Asia opened for trading. Shortly after the European open, though, buyers stepped back in and futures have rebounded back to the flat line. Outside of the Credit Suisse/UBS arranged marriage by Swiss Bank regulators that was announced on Sunday afternoon, there really hasn’t been much in the way of market-moving news, and there are no economic reports on the US calendar. Regional banks have been rallying, but First Republic (FRC) is down sharply again after it had its second ratings downgrade in a week.

In the press conference on Sunday discussing the shotgun ‘merger’ between Credit Suisse and UBS, regulators and officials of the banks cited the turmoil in the US banking sector as the reason for Credit Suisse’s demise. There’s always a need for a scapegoat, but to blame regional US banks for Credit Suisse’s downfall is a stretch. For now, let’s put aside the fact that just last week Credit Suisse announced an $8 billion loss in its delayed annual report. The bank noted that “the group’s internal control over financial reporting was not effective,” and its auditor PriceWaterhouse Coopers gave the bank an ‘adverse opinion’ with respect to the accuracy of its financial statements. Well before the SVB failure, Credit Suisse was already a dirty shirt.

Just look at the stock price. From its peak of over $77 per ADR in 2007, Credit Suisse (CS) has been in a long downtrend. After bottoming at just under $19 in early 209, the share price quickly tripled over the last six to seven months, but the bounce was short-lived. By 2012, the share price was back below its Financial Crisis lows and in the ensuing years, any rally attempt quickly ended with a lower high followed by a lower low. The collapse of SVB and stresses on other US banks may very well have been the straw that broke Credit Suisse’s back, but if the bank had proper internal controls in the first place maybe it would have noticed the pile of hay on its back in the first place.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke Report — Something Broke

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Back in September of 2022, we published a Bespoke Report entitled “Hike It ‘Til You Break It” (link). In that report we characterized the Powell Fed as seeming “committed to breaking either the financial system or economy…whichever it can mangle first”. Stocks made their major bear market low about three weeks later, on October 12th. The Fed Funds rate has been raised another 225 bps since that point, while the 2 year yield (a proxy for the Fed Funds rate a year ahead) went up another 90 bps to a peak of 5.07% on March 8th. The result? The Powell Fed absolutely broke something.

During the pandemic, enormous fiscal transfers and Federal Reserve QE of government bonds meant an enormous buildup of deposits in the banking system. Those deposits were created by either issuance of government bonds or by purchases of those bonds, financed by bank reserves which match with deposits. Banks faced with those massive inflows of deposits generally bought government bonds. Unable to invest in riskier securities or grow loans rapidly thanks to macroprudential regulation, banks were forced to buy low credit-risk government bonds.

While those bonds don’t have a credit risk, they do have duration risk. As long as banks aren’t forced to sell them thanks to ample deposits, they do not have to recognize a mark-to-market loss on those holdings. But for banks that are under deposit pressure, things can get out of hand quickly. Concentrated crypto deposits (like at Silvergate or Synchrony) or exposure to specific demographics (like at Silicon Valley Bank or to a lesser extent First Republic) that fled quickly led to stress and ultimately a need to wipe out equity, though for now the total losses remain unclear.

It remains to be seen whether this effort to break the financial system will have a large macro-economic feedback, but the Federal Reserve has certainly at least managed to create collateral damage via interest rate markets that has dominated headlines this week.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.