Bespoke’s Morning Lineup – 3/23/23 – Always Keep ‘Em Guessing

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“These contradictions are not accidental, nor do they result from ordinary hypocrisy: they are deliberate exercises in doublethink” – George Orwell

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In foreign relations, a policy of strategic ambiguity can often be effective. Conflicting messages regarding responses to a potential action leave all actions on the table and keep the parties involved guessing regarding any reaction you might have. The US has been employing this strategy with respect to China and Taiwan. Over the years, various officials have repeatedly given conflicting messages regarding how we would respond to a Chinese invasion or if Taiwan sought to declare independence. By doing this, it keeps China from invading under the threat of a US military intervention, but by also supporting the one-China principle, Taiwan has refrained from declaring independence from China. It may not be a long-term answer, but in the short term, it maintains the status quo.

One area where a policy of strategic ambiguity may not be as effective is in the handling of a banking crisis. Within the span of under 30 minutes yesterday, we saw the heads of the Federal Reserve and US Treasury give somewhat conflicting signals regarding the US banking sector. At 3 PM Eastern, Treasury Secretary Janet Yellen told a Senate Committee that she is not considering a broad increase in deposit insurance at US banks. Besides the fact that she made somewhat contradictory remarks just a day earlier, her statement seemed to be the complete opposite of FOMC Chair Powell who said just a few minutes later in his post-meeting press conference that the Fed has the tools to protect depositors and is prepared to use them in order to safeguard deposits. Given the conflicting signals, most rational investors would not stay put thinking that there is a good chance their deposits are safe, they would step on the gas and get out of dodge!

The conflicting signals given by Powell and Yellen yesterday certainly didn’t instill a whole lot of confidence on the part of investors, and that helped spark a sharp late-day sell-off in equities towards the close. From the end of Powell’s press conference through the closing bell, the S&P 500 sold off more than a full percent to finish right near the lows of the day.

Powell made another subtle shift in his messaging yesterday. While he has tended to kick off prior speeches lately with an adamant anti-inflation message (remember Jackson Hole), that wasn’t in yesterday’s speech. Instead, he used the opportunity to highlight the ‘decisive’ actions taken by the Federal Reserve and Treasury to address and contain the crisis and keep the banking system ‘sound and resilient’. If you thought the omission of the anti-inflation message was a sign of a more dovish Powell, though, he tried to dispel any notions of that when he closed out his press conference with the statement “I mentioned with rate cuts, rate cuts are not in our base case. And you know, so that’s all I have to say, so.” Always keep them guessing!

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Fed Stays Hawkish, Rates Don’t Care – 3/22/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with commentary regarding the results of today’s Fed decision and the update of the Summary of Economic Projections (SEP) (page 1 and 2). We also dive into the market reactions across assets (page 3). We close out tonight’s report with a look at this week’s EIA release (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 3/22/23

FANG+ Flying

As we noted in today’s Morning Lineup, sector performance has heavily favored areas like Tech, Consumer Discretionary, and Communication Services in recent weeks. Playing into that sector level performance has been the strength of the mega-caps. The NYSE FANG+ index tracks ten of the largest and most highly traded Tech and Tech-adjacent names. In the past several days, that cohort of stocks is breaking out to the highest level since last April whereas the S&P 500 still needs to rally 4% to reach its February high.

Although FANG+ stocks have been strong recently, that follows more than a full year of underperformance. As shown below, relative to the S&P 500, mega-cap Tech consistently underperformed from February 2021 through this past fall. In the past few days, the massive outperformance has resulted in a breakout of the downtrend for the ratio of FANG+ to the S&P 500.

More impressive is how rapid of a move it has been for that ratio to break out. Below, we show the 2-month percent change in the ratio above. As of the high at yesterday’s close, the ratio had risen 22.5% over the prior two months. That comes up just short of the record (22.6%) leading up to the pre-COVID high in February 2020. In other words, mega-cap Tech has experienced near-record outperformance relative to the broader market. However, we would note that this is in the wake of last year when the group had seen some of its worst two-month underperformance on record with the worst readings being in March, May, and November.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Fixed Income Weekly: 3/22/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

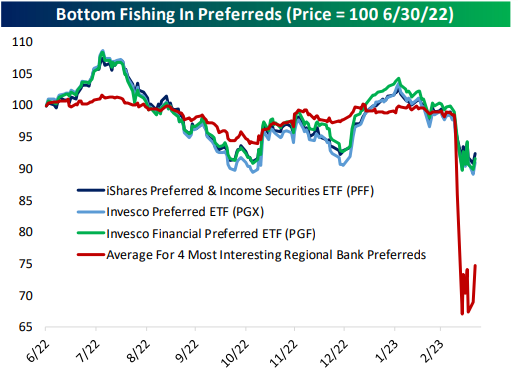

In this week’s report, we try and find attractive preferred securities in the wake of the recent banking stress.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Chart of the Day – Financials Underperformance: Canary or Nothing Scary?

Bespoke’s Morning Lineup – 3/22/23 – Now Batting

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Those who have the task of making such policy don’t expect you to applaud.” – William McChesney Martin

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

There’s no economic data on the calendar and there’s little in the way of earnings news to focus on this morning, so for the next six hours, we’ll only have the Fed to worry about. Markets are still overwhelmingly pricing in a 25 bps hike with the current odds at close to 90%. It’s hard to imagine a rate hike given the weakening macro backdrop and the crisis in the banking sector, but those are the numbers, and at this point, there have been little signs of the problems spreading.

The fact that UK CPI just printed its sixth straight month of double-digit y/y increases and ECB President Christine Lagarde was out saying she doesn’t see clear evidence that inflation is trending down doesn’t help the cause of those calling for a pause. Those are trends literally an ocean away, though, and over on this side of the Atlantic, just about every inflation indicator we track has been trending lower. Whatever decision the FOMC makes, it’s safe to assume that there will be no shortage of critics after the fact, and we don’t envy the position that Powell is in.

Heading into today’s rate decision, most sectors have traded down over the last week with Real Estate and Energy leading the way lower. Surprisingly, in the middle of a banking ‘crisis’ Financials isn’t even the worst performing sector as it is down less than 1% over the last five trading days and isn’t even the worst performing sector on a YTD basis. Sure, it’s down over 6.5%, but Utilities and Energy are also both down more than the Financials.

While Financials, Utilities, and Energy have been a drag on the market, Communication Services, Technology, and Consumer Discretionary have been the main drivers of gains this year. Not only are they the only sectors up more than 1% on the year, but they’re also all up over 10%, so these three sectors are basically in a league of their own versus the rest of the field.

Lately, Technology has been the clear leader. It’s only the second-best performing sector YTD, but its further above its 50-DMA than any other sector, and it’s on the verge of breaking out of the sideways range it has been in for the last two months.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Schatz Collapse, Existing Sales Surge, Construction Cost – 3/21/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick things off by looking at Nike (NKE) and GameStop (GME) earnings (page 1) followed by a review the latest home sales figures including a look at construction costs (page 2 and 3). Afterward, we update the latest service sector surveys from regional Feds (page 4) and finish with a rundown of today’s disappointing 20 year bond reopening (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!