Bespoke’s Matrix of Economic Indicators – 3/31/23

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke’s Morning Lineup – 3/31/23 – That’s a Wrap

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Good publicity is preferable to bad, but from a bottom-line perspective, bad publicity is sometimes better than no publicity at all. Controversy, in short, sells.” – Donald Trump

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

A bunch of economic data just hit the tape and it was generally better than expected. Personal Income was slightly better than expected (0.3% vs 0.2%) while Personal Spending was a little weaker (0.3% vs 0.2%). On the inflation front, Core PCE came in lower than expected on both a month-over-month and year-over-year basis. The m/m reading came in at 0.3% versus forecasts for an increase of 0.4% while the y/y reading was also a tenth lower than expected at 4.6%. In response, futures, which were already higher, added a little bit to their gains.

What an interesting quarter it’s been for the stock market. While the S&P 500 is up 5.5%, the Russell 2000 is barely hanging on to gains, and the Dow is actually slightly lower. These all pale in comparison to the Nasdaq which is up 14.8% and the Nasdaq 100 which is up an unbelievable 18.5%. If these gains hold through the end of today, Q1 will go down as the best quarter for the Nasdaq 100 since Q2 2020, and it will mark the 21st quarter in the Nasdaq 100’s history (since 1985) that the index was up at least 15%.

Of the 20 prior quarters where the Nasdaq 100 was up 15%+, its median performance in the following quarter was a gain of 6.1% with positive returns 65% of the time. That compares to an average gain of 4.0% with positive returns 68.4% of the time in all quarters since 1985. When the 15%+ gain occurred in Q1, however, forward returns weren’t as positive. In those six quarters, the median performance in Q2 was a decline of 1.2% with gains just half of the time while the median rest of year gain was 7.5% also with positive returns half of the time. Before reading too much into these numbers, though, we would caution that returns were all over the map. In terms of the rest of year performance, 97 percentage points separate the best (50.4% in 1998) and worst performances (-46.8% in 2000).

Looking at the Nasdaq 100 ETF’s (QQQ) price chart shows an interesting picture depending on your perspective. In the short run, QQQ broke above resistance this week and traded to its highest level since Powell’s Jackson Hole speech in late August. It has also carved out what technicians would describe as a bullish cup and handle formation.

Longer-term, QQQ’s rally has taken it to levels that once acted as support back in the first half of 2021 and Q1 2022. Since that Q1 2022 period there have only been a handful of days that QQQ traded above these levels, and two other times it attempted to make a break of that level it immediately pulled back.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Broken Silence – 3/30/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with the broken silence out of FOMC members (page 1) followed by a look through the latest GDP update (pages 2 – 4). We then look at the latest update of the Fed’s balance sheet (page 5) before closing with a look at quarterly sector performance (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 3/30/23

The Bespoke 50 Growth Stocks — 3/30/23

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Sentiment Still Bearish…Or Is It?

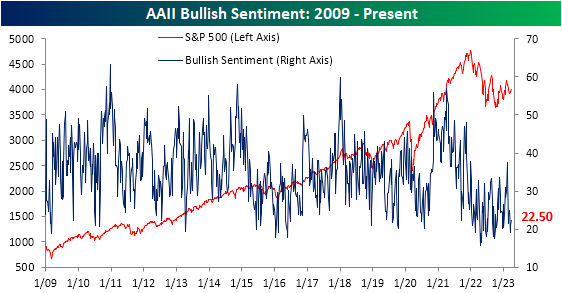

The S&P 500 has made a press back up towards the high end of the past month’s range this week, but sentiment has yet to reflect the moves higher in price. The past several weeks have seen the AAII sentiment survey come in a relatively tight range between the high of 24.8% on March 9th and a low of 19.2% the following week. That is in spite of the recent updates to monetary policy and turbulence in the banking industry. Today’s reading was smack dab in the middle of that recent range at 22.5%.

Given there have not been any major developments with regard to sentiment, the record streak of below-average (37.55%) bullish sentiment readings has grown to 71 weeks.

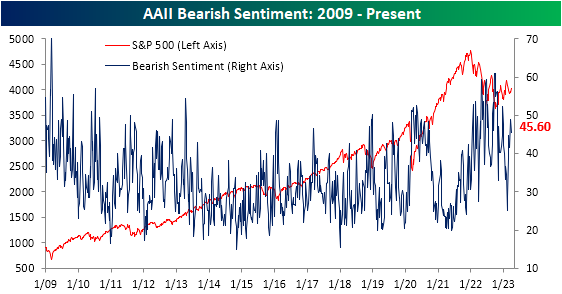

While bullish sentiment was modestly higher this week rising 1.6 percentage points, bearish sentiment shed 3.3 percentage points to fall to 45.6%. That is only the lowest reading in three weeks as bearish sentiment has sat above 40% for all of March.

The predominant sentiment reading continues to be bearish. The bull-bear spread has been negative for six weeks in a row following the end of the record streak of negative readings in the bull-bear spread in February.

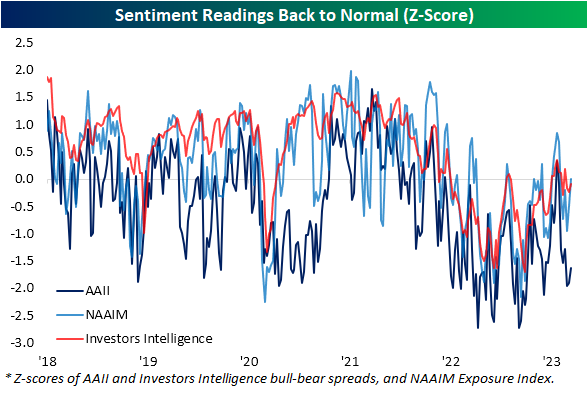

Taking into account other sentiment surveys, the AAII reading stands out as far more pessimistic at the moment. In the chart below, we show the readings of the AAII bull-bear spread paired with the same spread in the Investors Intelligence survey and the NAAIM Exposure index. Whereas the latter two surveys have basically seen readings return back to their historical averages, the AAII survey sits 1.6 standard deviations below its historical average. In other words, overall sentiment might not be as pessimistic as the AAII survey would imply.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Claims Spend Another Week Below 200K

Initial jobless claims took a step higher this week rising by 7K to 198K. With last week’s number also going unrevised, claims have now been below 200K for 10 of the last 11 weeks. That being said, this week’s reading was the highest since the 212K print in the first week of March.

Before seasonal adjustment, claims were once again higher rising by over 10K week over week to 223K. Although that is not a concerningly high reading nor is it a large jump, the increase was peculiar in that it went against expected seasonal patterns. Prior to this year, jobless claims have only risen week over week in the current week of the year 16% of the time; the most recent instance prior to 2020 (right as claims surged at the onset of the pandemic) was in 2017.

Although initial jobless claims modestly deteriorated, it has not exactly been a worrying increase as claims remain at historically healthy levels. The same goes for continuing claims. This week saw continuing claims rise by a modest 4K to 1.689 million. That is only the highest level since the end of February when claims totaled over 1.7 million.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day: 60-40 In Comeback Mode

Bespoke’s Morning Lineup – 3/30/23 – Play Ball

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Russia has sold us a sucked orange… has therefore done wisely in selling the territory and islands which to her had become useless.” – New York World, 4/1/1867

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After the Nasdaq 100 closed at the highest levels since Powell’s Jackson Hole speech last August, investors are looking to close out the quarter on a positive note. A bunch of economic data just hit the tape, and there weren’t a lot of big surprises. Initial Jobless Claims came in slightly higher than expected (198K vs 196K) while Continuing Claims came in modestly below forecasts. The final read of Q4 GDP was revised lower by a tenth of a percent to 2.6% from 2.7%. One piece of bad news was Core PCE which was revised up to 4.4% versus forecasts for a reading of 4.3%. The market reaction to the news has been muted with only a slight ding to the positive tone in futures and a slight upward move in interest rates.

When news surfaced that Secretary of State William Seward had negotiated to purchase Alaska from Russia on this day in 1867, “Seward’s Folly” was widely ridiculed in the press and the public as a waste of money for land that was nothing but ice and frozen dirt. By the late 1800s, Alaska’s main trade of fur had been largely depleted due to overhunting that resulted in the near extinction of sea otters. Also, other minerals couldn’t be mined because of the climate conditions in the area.

Little did anyone know at the time how rich the Alaskan territory was in terms of oil and gold and that advances in mining would make these resources more accessible. In terms of oil alone, according to the Department of Energy, Alaska produced an average of 437K barrels of oil per day last year which works out to roughly $35 million! Seward’s $7.2 million purchase of Alaska translates to $146 million in today’s dollars, so even after adjusting for inflation, the amount of oil that comes out of the ground in Alaska every five days is more than enough to cover what the US paid for the entire state!

There are two important investment lessons that investors can take from “Seward’s Treasure”. First, the largest returns don’t usually come when you’re following the crowd (think tech’s performance so far this year and sentiment towards the sector heading into 2023). Second, no matter how bad an investment may look in the short term, the more time you are willing to give it, the better it will likely look down the road.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – What’s In The Price? – 3/29/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at various monetary policy scenarios based on market pricing (page 1). We then dive into today’s pending home sales numbers (page 2) followed by a look at the latest quarterly CFO data (page 3). Next, we recap this week’s EIA data (page 4) and the 7 year note auction (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!