Small Business Outlook Cratering

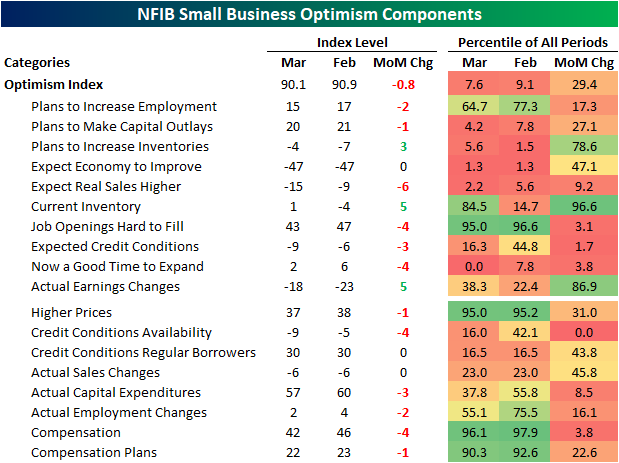

Small business optimism continued to decline in March with the headline index from the NFIB falling from 90.9 down to 90.1. That headline reading was actually better than the consensus forecast of 89.3, but it was still in the bottom decile of the indicator’s historical range dating back to 1986.

Looking across individual categories, breadth was weak in the report with only three indices moving higher month over month, three going unchanged, and all the others falling. As with the headline number, many categories are historically depressed in the bottom decile of readings, including some record lows.

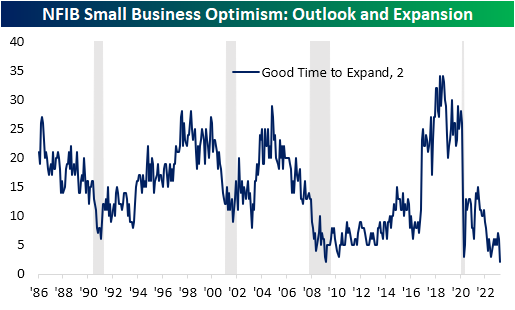

That record low was in the percentage of respondents reporting now as a good time to expand. Only 2% reported now as a good time to expand, down 4 points month over month. While the reading has been at the low end of its historical range for much of the past year, March’s reading matched the historical low from March 2009.

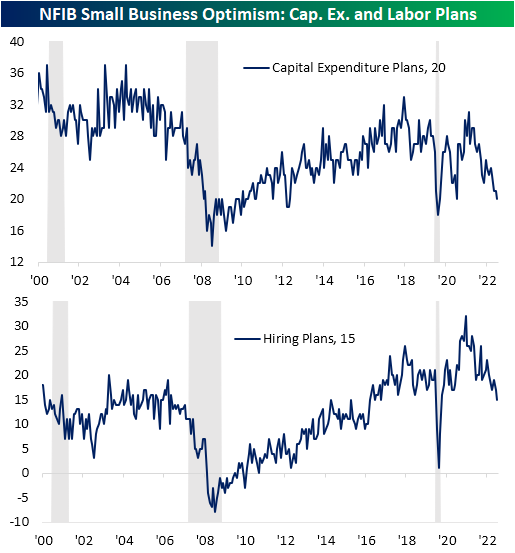

Given the small business outlook for the economy has soured, fewer firms are reporting plans to increase hiring or capital expenditures. In fact, the index for capex plans fell to 20, which alongside March 2021, is the lowest reading since the spring of 2020. Similarly, hiring plans are at new lows for the post-pandemic period.

One factor likely impacting business plans has been financial conditions. The most pronounced decline of any category last month was a record 4-point decline in the availability of loans. While the reading has been rolling over for some time, that drop leaves the index at the lowest level since December 2012.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 4/11/23 – Small Businesses Glum

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“What are the odds that people will make smart decisions about money if they don’t need to make smart decisions—if they can get rich making dumb decisions?” – Michael Lewis

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

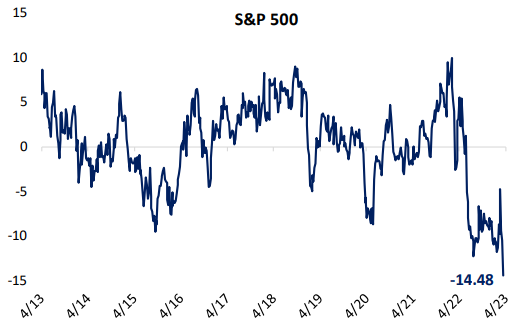

It’s looking like another quiet start to the trading day here in the US as equity futures are little changed and the yields on two and ten-year US Treasuries have moved less than a basis point. The only economic report on the calendar today was the NFIB’s index of small business sentiment, and while it was slightly better than expected, the headline index declined and remains below where it was at the depths of the COVID shutdowns. Within that report, the percentage of small businesses saying now is a good time to expand dropped to levels only seen at the depths of the Financial Crisis in March 2009 while the index for hiring plans dropped to its lowest level since May 2020. In other words, small business sentiment is not particularly optimistic. We’d also note that within the latest Commitment of Traders report, net short positions on the S&P 500 reached their highest level since 2007, so it’s not as though investors are positioned bullishly against the weaker macro backdrop.

In Europe, Retail Sales for February fell 0.8% on a m/m basis, but that was actually in line with expectations. Stocks on the continent are modestly higher after yesterday’s holiday

As recession concerns have grown in the wake of the SVB Financial and Signature Bank failures and the run of deposits from other smaller banks, investors have become increasingly convinced that the indicators which have been flashing recession warning signs for months now may in fact turn out to be accurate. If the economy was slipping into recession, one would expect to see those concerns manifesting in the performance of cyclical sectors. Specifically, Industrials would be one sector expected to underperform while defensive sectors like Utilities would outperform. Looking at the relative strength of the two sectors, however, the market’s message hasn’t exactly confirmed the headlines.

The chart below shows the ratio in closing prices between the S&P 500 Industrials sector ETF (XLI) versus the Utilities sector (XLU). When the line is rising, the Industrials sector is outperforming Utilities and vice versa. Over the last five years, there have been two distinct troughs in the chart. The first was in March 2020 while the next was last September. Back in late February, it looked as though the ratio was on the verge of hitting new five-year highs, but the bank failures and run on deposits stopped the relative outperformance of Industrials right in its tracks. It’s still too early to tell whether this will be a temporary pause or a new leg lower in the ratio, but with banks kicking off earnings season later this week, the tone of companies giving their results will shed a lot of light on that answer. At this point, if the market really was convinced of an impending recession, this ratio would likely be falling much faster.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Rotating Fed, Rotating Factors – 4/10/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at May FOMC pricing and an update of our Fedspeak Monitor index (page 1). We then dive into factor performance today (page 2). Afterward, we recap the latest consumer expectation survey (pages 3 and 4), Treasury auctions (page 5), and positioning data (pages 6 – 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/10/23

B.I.G. Tips – Earnings Season: Will Banks Spoil the Party?

Chart of the Day: Retail Investor Sentiment Stagnant

Full-Time Septuagenarian Workers Put in the Most Hours

We track US employment trends in our monthly Bespoke Consumer Pulse survey along with dozens of other interesting consumer and personal finance topics. Each month since 2014, we’ve asked our 1,500 survey participants (with balanced demographics according to the US census) whether they’re employed or not along with how many hours they typically work each week.

When it comes to the average hourly work week, we get the results below when we break down our survey response data by age. The two age bands of employed workers that work the least are the youngest (18 to 24) and oldest (75 or older). Those aged 45 to 54 work the most each week at 38.5 hours, while the 35 to 44 group works the second most at 37.6 hours.

Of course, the youngest workers and oldest workers could be working part-time, which would bring down the average work week for these two age bands. We get some interesting results when we look at average weekly hours for full-time employees only. As shown below, the oldest full-time employees average by far the most weekly hours at 43.0, while the three age bands between ages 45 and 74 all average right around 41 hours. The youngest full-time workers average the fewest weekly hours of any age band at 37.7.

Why would 75+ year-olds be working the longest hours of any age cohort when they’re supposed to be enjoying retirement? Is it work satisfaction? Work ethic? Economic reasons? This may be something we attempt to find out in future surveys!

If you would like to check out our full Bespoke Consumer Pulse report, here’s a link that tells you how to do that.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 4/10/23 – Cold Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I don’t think one should ever be satisfied with any objective that you’re trying to accomplish because perfection is never attained.” – Fred Ridley

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

With European markets closed for Easter and many Asian markets also still on holiday, it’s been a quiet pre-market session. Chinese stocks were open for trading, though, and they traded modestly lower. S&P 500 futures have been weakening into the open with the Nasdaq leading the way lower, as some of the tech sector’s outperformance this year gets unwound. Friday’s employment report has also raised the odds of a 25-bps hike at the May meeting to better than a two-in-three chance.

Enjoy the quiet while it lasts because earnings season kicks off at the end of this week when the major banks start to report on Friday with Blackrock (BLK), Citi (C), JPMorgan Chase (JPM), PNC (PNC), and Wells Fargo (WFC) all on the calendar. Outside of these banks, the only other notable reports this week will be Delta (DAL) on Thursday and UnitedHealth (UNH) on Friday.

It may be a dull start to the week for stocks, and from a bull’s perspective, dull is good. Historically, the week following Easter has been better than normal. Since 1945, the S&P 500’s median performance during Easter week has been a gain of 0.54% with positive returns just under 60% of the time. For all weeks in the post-WWII period, the S&P 500’s median weekly performance has been just over half of that at a gain of 0.29% with positive returns 56.6% of the time.

Breaking out performance further by how the market was performing YTD heading into the holiday when the S&P 500 was up on the year heading into Easter the median performance during Easter week was a gain of 0.67% with gains 61.7% of the time. That compares to a gain of just 0.20% in years when it was down YTD. Recall that last year, the S&P 500 was down 7.8% heading into Easter and declined 2.8% during Easter week.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 4/9/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Renewables

Contingent Supply: Why Spodumene Reserves May Be the Key to a More Secure Lithium Supply Chain by Arnab Datta & Alex Turnbull (Employ America)

One possible approach to insuring price volatility in key EV inputs doesn’t get carried away is establishing strategic reserves of an important input. [Link]

A Football Field-Sized Boat Will Service US Offshore Wind Farms by Josh Saul (BNN Bloomberg)

In Louisiana, a shipyard is busy turning out the first wind farm service vessel designed to operate in US waters, part of a fledgling offshore industry in this country. [Link]

EVs

2025 Ram REV Just a Regular 1500 Truck With Electric Underpants by Alexander Stoklosa (MotorTrend)

Stellantis’ entry into the EV pickup market offers a massive 168kWh battery pack in its base model with a gigantic 229kWh pack in the longer-range version. That larger pack is a full 100 kWh larger than the F-150 Lightning, for a total size more than 4x that of a sedan like a Tesla Model 3. [Link]

Special Report: Tesla workers shared sensitive images recorded by customer cars by Steve Stecklow, Waylon Cunningham and Hyunjoo Jin (Reuters)

Tesla employees reportedly had access to and shared details from recordings from the company’s internal car cameras. [Link]

Taxes

Internal Revenue Service Inflation Reduction Act Strategic Operating Plan (IRS)

Last year the Inflation Reduction Act granted significant new resources to the IRS, with this report serving to update the Treasury Secretary on what it’s doing with those resources. [Link; 150 page PDF]

Sports

‘It’s about the damn money’ by Kent Babb (MSN/WaPo)

North Carolinian golfer and LIV Tour participant Harold William Varner III on why he’s joining the upstart Saudi golf tour; one part discussion of the golf business and one part biography for one of the most interesting characters in the game. [Link]

Babe Ruth bat sells for record $1.85M after ‘photographic corroboration’ by Dan Hajducky (ESPN)

A bat used by the Babe in 1921 has been photographically corroborated to establish he actually did swing the stick personally. [Link]

Interest Rates

Latest Fed Increase Came Down to the Wire. ‘That Was a Rough Weekend.’ by Nick Timiraos (WSJ)

FOMC voters only decided on their rate plans in the days immediately preceding the March meeting, a highly unusual outcome driven by the bank collapses of March. [Link; paywall]

The pain and SOFRing are almost over by Alexandra Scaggs (FTAlphaville)

After much sturm und drang, regulators have required that even though it will continue to be published, LIBOR will become synonymous with the reference rate that it’s being replaced by. [Link; soft paywall]

Real Estate

Moody’s: Multifamily Demand “Softened notably over the past few quarters” by Bill McBride (Calculated Risk)

Apartment landlords are reporting an uptick in vacancy rates and declining rents in just the latest sign that national rent tightness is over. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Closer – Big Revisions To Claims Data – 4/6/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look into the stock performance of auto OEMs and aircraft manufacturers (page 1) followed by an update of the latest Canadian employment report (page 2). Afterward, we review some details of the revisions to claims data (pages 3 and 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!