Industry Performance and CPI

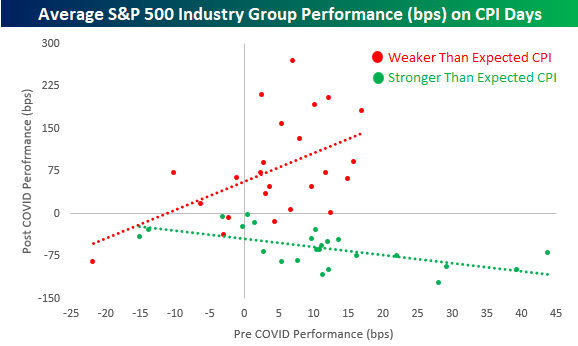

Tomorrow’s release of March CPI is expected to show headline inflation cooling to 5.1% on a y/y basis from 6.0% in February. In the table below, we break down the average performance (in basis points) of each of the 24 industry groups in the S&P 500 on days of CPI releases since 2000 based on how the headline reading came in relative to expectations. There have been some notable shifts in reactions among groups to CPI reports in the pre and post-COVID (February 2020) periods. For example, in the pre-COVID period, the three best-performing industry groups on days when CPI was stronger than expected were Real Estate, Banks, and Semis. In the post-COVID period, though, these three industry groups have been among the market’s worst performers on CPI beats with all three averaging one-day declines of at least 69 bps compared to the S&P 500’s average decline of 62 bps. Interestingly, the disparity is a lot less apparent when we compare pre and post-COVID performance on days when CPI is weaker than expected.

To further illustrate this shift and how it has been much more notable on days when the CPI is stronger than expected, the scatter chart below compares industry group performance on CPI days in the pre and post-COVID periods when the headline reading comes in better and worse than expected. Starting with weaker-than-expected CPI days (red dots and red trendline), the trendline is positively sloped as groups that tended to perform best on weaker-than-expected CPI days are generally still performing the best while the industry groups that lagged on weaker-than-expected CPI days still tend to lag in the post-COVID period. The performance dynamic on stronger-than-expected CPI days (green dots and trendline), however, is the complete opposite as the trendline is negatively sloped indicating that the best-performing groups pre-COVID have tended to be the weakest in the post-COVID period and vice versa.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day – Analysts Have Been Increasingly Pessimistic On These Three Sectors

Bespoke Stock Scores — 4/11/23

Inflation Concerns Continue to Ease

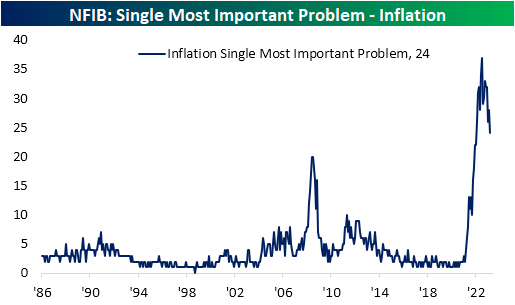

In an earlier post, we mentioned the record-low reading in the percentage of small businesses perceiving now as a good time to expand. As for what these firms perceive to be their most pressing issues, inflation continues to be the single most prevalent answer at 24%, albeit the gap has narrowed dramatically. Quality of labor is now only a single percentage point behind inflation at 23%, and when combined with cost of labor, the two issues account for over a third of small businesses’ biggest problems. From a historical standpoint, inflation, quality of labor, and cost of labor all remain elevated and account for a massive share (58%) of the most pressing issues facing small businesses.

The four percentage point drop month over month in the percentage of respondents reporting inflation as their biggest issue is the largest decline since January when it fell six percentage points. As a result, the category is only down to the lowest level since January 2022 which remains well outside the range of pre-pandemic readings. In other words, inflation has improved compared to last July when it was top of mind for 37% of small businesses, but it is still nowhere near a non-issue.

Picking up some of those losses has been government-related concerns. This series has historically held a political bias in which under Republican administrations, small businesses are less concerned with red tape and taxes and vice versa during Democratic administrations. With the surge in inflation concerns during President Biden’s tenure, this index has remained historically low but has begun to rise more recently as inflation has improved.

Another area to see a rise in firms reporting it as their biggest problem has been poor sales. While the reading is far from flying, it has begun trending higher now accounting for 5% of responses in March. That pairs with the index for actual reported sales changes which have remained firmly negative for nearly a year now. When poor sales turn into the biggest problem for a small business, you know times are really tough, which is why we’ll be watching this reading closely in the months ahead. For now, the reading is still extremely low, which is a good thing.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Small Business Outlook Cratering

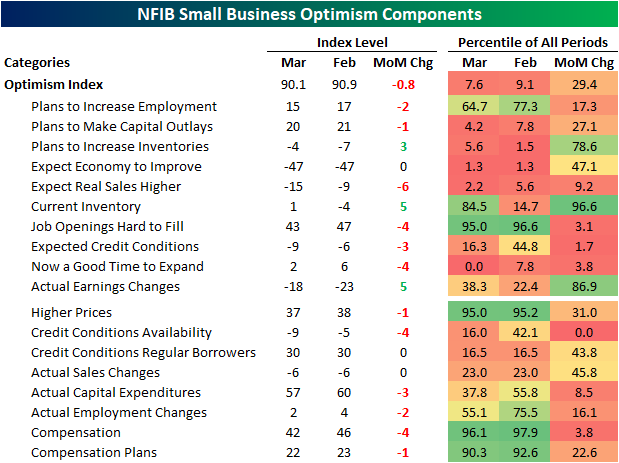

Small business optimism continued to decline in March with the headline index from the NFIB falling from 90.9 down to 90.1. That headline reading was actually better than the consensus forecast of 89.3, but it was still in the bottom decile of the indicator’s historical range dating back to 1986.

Looking across individual categories, breadth was weak in the report with only three indices moving higher month over month, three going unchanged, and all the others falling. As with the headline number, many categories are historically depressed in the bottom decile of readings, including some record lows.

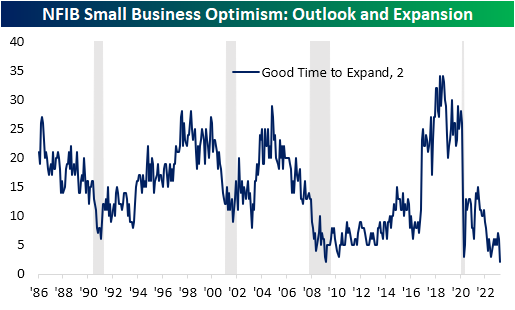

That record low was in the percentage of respondents reporting now as a good time to expand. Only 2% reported now as a good time to expand, down 4 points month over month. While the reading has been at the low end of its historical range for much of the past year, March’s reading matched the historical low from March 2009.

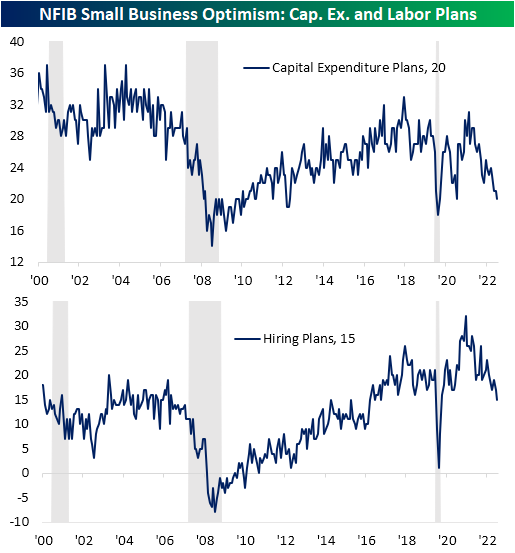

Given the small business outlook for the economy has soured, fewer firms are reporting plans to increase hiring or capital expenditures. In fact, the index for capex plans fell to 20, which alongside March 2021, is the lowest reading since the spring of 2020. Similarly, hiring plans are at new lows for the post-pandemic period.

One factor likely impacting business plans has been financial conditions. The most pronounced decline of any category last month was a record 4-point decline in the availability of loans. While the reading has been rolling over for some time, that drop leaves the index at the lowest level since December 2012.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 4/11/23 – Small Businesses Glum

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“What are the odds that people will make smart decisions about money if they don’t need to make smart decisions—if they can get rich making dumb decisions?” – Michael Lewis

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

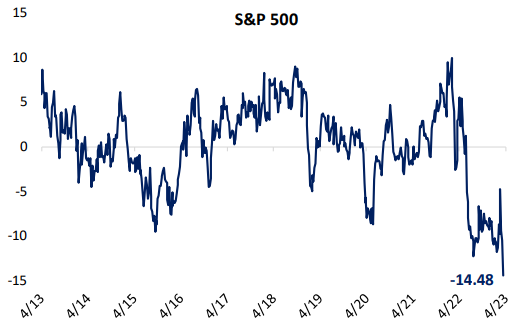

It’s looking like another quiet start to the trading day here in the US as equity futures are little changed and the yields on two and ten-year US Treasuries have moved less than a basis point. The only economic report on the calendar today was the NFIB’s index of small business sentiment, and while it was slightly better than expected, the headline index declined and remains below where it was at the depths of the COVID shutdowns. Within that report, the percentage of small businesses saying now is a good time to expand dropped to levels only seen at the depths of the Financial Crisis in March 2009 while the index for hiring plans dropped to its lowest level since May 2020. In other words, small business sentiment is not particularly optimistic. We’d also note that within the latest Commitment of Traders report, net short positions on the S&P 500 reached their highest level since 2007, so it’s not as though investors are positioned bullishly against the weaker macro backdrop.

In Europe, Retail Sales for February fell 0.8% on a m/m basis, but that was actually in line with expectations. Stocks on the continent are modestly higher after yesterday’s holiday

As recession concerns have grown in the wake of the SVB Financial and Signature Bank failures and the run of deposits from other smaller banks, investors have become increasingly convinced that the indicators which have been flashing recession warning signs for months now may in fact turn out to be accurate. If the economy was slipping into recession, one would expect to see those concerns manifesting in the performance of cyclical sectors. Specifically, Industrials would be one sector expected to underperform while defensive sectors like Utilities would outperform. Looking at the relative strength of the two sectors, however, the market’s message hasn’t exactly confirmed the headlines.

The chart below shows the ratio in closing prices between the S&P 500 Industrials sector ETF (XLI) versus the Utilities sector (XLU). When the line is rising, the Industrials sector is outperforming Utilities and vice versa. Over the last five years, there have been two distinct troughs in the chart. The first was in March 2020 while the next was last September. Back in late February, it looked as though the ratio was on the verge of hitting new five-year highs, but the bank failures and run on deposits stopped the relative outperformance of Industrials right in its tracks. It’s still too early to tell whether this will be a temporary pause or a new leg lower in the ratio, but with banks kicking off earnings season later this week, the tone of companies giving their results will shed a lot of light on that answer. At this point, if the market really was convinced of an impending recession, this ratio would likely be falling much faster.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Rotating Fed, Rotating Factors – 4/10/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at May FOMC pricing and an update of our Fedspeak Monitor index (page 1). We then dive into factor performance today (page 2). Afterward, we recap the latest consumer expectation survey (pages 3 and 4), Treasury auctions (page 5), and positioning data (pages 6 – 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!