Europe Treasure

For an area of the world that couldn’t have been considered less attractive last summer, European equities have been on a tear since the October lows. The Euro Stoxx 50 Europe ETF has now rallied more than 50% off its October lows and broke out to 52-week highs last week.

The S&P 500, meanwhile, hasn’t fared nearly as well. While it has formed a gradual uptrend from its October lows, SPY currently has three prior highs (February 2023, August 2022, and April 2022) standing between it and 52-week highs.

Other parts of the global equity market spectrum haven’t been able to keep up with Europe either. Emerging markets, as tracked by the iShares MSCI Emerging Markets ETF (EEM), rallied sharply off its lows in October, but that rally ran out of gas in early February and hasn’t been able to recover. Like the S&P 500, EEM remains well below 52-week highs from last April.

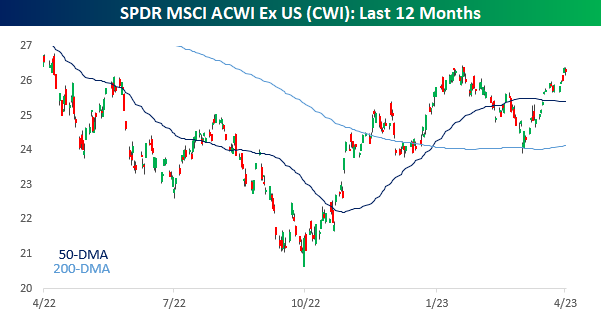

Since Europe accounts for a major share of international equity market cap, the MSCI All Country World Ex US ETF (CWI) is much closer to 52-week highs than EEM, but it still has a number of resistance points to clear.

The chart below compares the relative strength of all three ETFs (FEZ, EEM, CWI) to the S&P 500 (SPY) over the last three years and provides a clear look at how Europe has led the global rally. From April 2020 through April 2021, all three ETFs outperformed the S&P 500, but then they really started to underperform as the US economy reopened and the FOMC later started to hike rates. Last October was the major turning point for global stocks, though, as the relative strength for all three ETFs made multi-year lows. While they’ve all started to reverse, only Europe has managed to erase all of its underperformance from the post-COVID period and move into the black versus the S&P.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

March 2023 Headlines

Bespoke’s Morning Lineup – 4/17/23 – Big Beat in the Big Apple

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Either write something worth reading or do something worth writing.” – Ben Franklin

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were flat up until a few minutes ago, but have moved modestly into positive territory this morning following a better-than-expected Empire Manufacturing report. Just as important as the headline beat was the fact that Prices Paid fell back down to what is basically post-pandemic lows. Despite the bounce in futures, treasury yields have moved higher following the release of the report.

While it didn’t end on a positive note, stocks finished the week higher last week with the S&P 500 up by about 0.8%. Small and mid-caps led the way higher with gains of about 1.5% while mega-caps in the Nasdaq 100 barely finished the week higher. In many respects, last week was mostly about a reversion to the mean where the most overbought sectors underperformed while sectors that were either oversold or neutral heading led the way higher. As shown in the image below from our Trend Analyzer, Financials, Energy, and Industrials were all oversold or neutral heading into the week, and they rallied more than 2%. Meanwhile, all five sectors that were overbought were all either down or up less than 1%. The only exception to the trend was Real Estate. Even though it was one of five sectors below its 50-day moving average coming out of the Easter weekend, it was still the worst-performing sector in the week.

After a strong one-month rally off the October lows, the last five months or so have been a lot like watching paint dry as the S&P 500 is barely higher now than it was at the end of November. Six months removed from the low last October, in order for the S&P 500 to keep its uptrend intact, it’s going to need to clear resistance above its early February high just below 4,200 or roughly $418 in SPY.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 4/16/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Labor

‘Zero Interest in Doing Business’: TSMC Snubs Phoenix Construction Workers by Lee Harris (The American Prospect)

Unionized construction workers in Arizona are getting little interest from Taiwan Semi’s massive fab investment, as the chip giant prefers importing contractors from out of state. [Link]

Next Wave of Remote Work Is About Outsourcing Jobs Overseas by Konrad Putzier (WSJ)

With tight labor markets and strong wage growth, some traditionally localized, skilled service workers are being outsourced to emerging markets economies. [Link; paywall]

Tech Dystopia

They’re Selling Nudes of Imaginary Women on Reddit — and It’s Working by EJ Dickson (Yahoo!/Rolling Stone)

A pair of computer scientists are selling nude pictures of women that don’t exist, proving that machine learning algorithms like Stable Diffusion have leaped forward towards full realism. [Link]

The U.S. Cracked a $3.4 Billion Crypto Heist—and Bitcoin’s Anonymity by Robert McMillian (WSJ)

Since blockchain transactions are immutable, with enough hard work forensic efforts to track bitcoins and other crypto currencies have yielded an impressive list of criminals. [Link; paywall]

Discord Member Details How Documents Leaked From Closed Chat Group by Shane Harris and Samuel Oakford (WaPo)

A small group chat on the platform Discord turned into the source of one of the most damaging national security leaks in recent history, with hundreds upon hundreds of documents transcribed and later photographed and sent to the small group of gamers and gun enthusiasts. [Link; soft paywall]

People Are Sick and Tired of All Their Subscriptions by Rachel Wolfe and Imani Moise (WSJ)

Attrition among subscription models is rising, with streaming cancellations up 49% and a range of other services repeatedly getting the axe from cost-conscious consumers. [Link; paywall]

Corporate Culture

JPMorgan Calls Managing Directors to Office Five Days a Week by Hannah Levitt & Daniel Taub (Bloomberg)

Leadership will be pushed to show their face in person at the nation’s largest bank, setting a tone for JPM after years of remote work jump-started by the pandemic. [Link; soft paywall]

Your Email Does Not Constitute My Emergency by Adam Grant (NYT)

The ever-present nature of email creates pressure for rapid responses which in turn raise the stress of workers receiving what they perceive as high priority communiques. [Link; soft paywall]

Cars & Drivers

After a Boom, an Auto Profit Bust Looms by Stephen Wilmot (WSJ)

In the wake of three years with tight inventories, under-producing factories, and key component shortages, the American auto industry is eying rate hikes and financial stress nervously. [Link; paywall]

General Motors will stop offering Apple CarPlay and Android Auto connectivity by Car Dow (Top Gear)

In an effort to keep Apple and Alphabet out of their data and customer relationships, GM won’t be including popular phone-mirroring apps in future EVs (even as they continue to offer them in their ICE fleet). [Link]

E.P.A. Lays Out Rules to Turbocharge Sales of Electric Cars and Trucks by Coral Davenport (NYT)

Under new emissions standards, automakers would be obliged to convert roughly two-thirds of their new sales to EVs in less than a decade, with heavy trucks targeted at a perhaps more ambitious quarter. [Link; soft paywall]

Real Estate

Downtown San Francisco Whole Foods Closing a Year After Opening by Josh Koehn (The San Francisco Standard)

Whole Foods is shuttering a downtown San Francisco location, citing deteriorating street conditions including drug use and crime near the store, including high theft and hostile visitors. [Link]

What’s the Real Situation with CRE and Banks: Doom Loop or Headline Hype? By Kevin Fagan, Matt Reidy, Thomas Lasalvia, Blake Coules, and Victor Calanog (Moody’s)

Moody’s analysts think that while banks are heavily exposed to commercial real estate and CRE is dependent on banks, mitigating factors can keep the two from spiraling together into a major credit crunch. [Link]

Sports

Quinnipiac Shocked the College Hockey Universe in 10 Seconds by Jason Gay (WSJ)

A historic come-from-behind victory to earn a national championship may have looked like a lucky break, but to win its first NCAA title Quinnipiac bet on itself rather than relying on luck. [Link; paywall]

Michael Jordan’s signed trainers sell for record $2.2mn at Sotheby’s auction by Alexandra White (FT)

A pair of signed Michael Jordan sneakers worn during Game 2 of the 1998 NBA Finals were sold for $2.2mm in a record for a shoe transaction; an MJ jersey went for $10mm back in September. [Link; paywall]

Climate Change

Policies, Projections, and the Social Cost of Carbon: Results from the DICE-2023 Model by Lint Barrage & William D. Nordhaus (NBER)

An update to the giant cost-benefit model which was most recently updated in 2016 shows a significantly higher social cost of carbon and therefore more urgency for action on climate change. [Link; soft paywall]

The American West

Biden Administration Proposes Evenly Cutting Water Allotments From Colorado River by Christopher Flavelle (NYT)

Overuse and drought have left the mighty Colorado near dry, leading the federal government to propose pro-rata cuts to water distributions out of the river system. But that would flout legal precedent, which gives California first dibs on water and could almost eliminate drinking water supplies in Phoenix. [Link; soft paywall]

Peak Real Estate: This Tiny Wyoming Community Has Some of the Country’s Priciest Mountain Homes by Jessica Flint (WSJ)

A tiny town of 1600 people in the neighborhood of Jackson Hole is the second-most expensive mountain town real estate in the country, trailing only Aspen. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 4/14/23 — Terra Firma

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

A month ago, financial markets were focused on how badly the Federal Reserve had broken the banking system. This week, the initial earnings from a few very large banks suggest that the quick work of the FDIC and Federal Reserve in the wake of Silicon Valley Bank’s failure have prevented broader damage. Lenders including PNC Financial (PNC), JPMorgan (JPM), Wells Fargo (WFC), and Citi (C) reported Friday,, and the sigh of relief from markets was palpable. JPM delivered beats on strong investment and commercial banking performance and raised guidance for net interest income this year by some 11%. That drove the stock to its biggest gains since 2020 and its second best earnings reaction day in at least 20 years. It’s hard to view the US banking system as faulty when its largest lender is finding such firm ground beneath its feet. Other lenders delivered less spectacular results, but reassured investors that among big banks there isn’t much reason to be concerned. In the charts at right, we show the aggregate results from banks reported Friday in the form of loan loss reserves as a percentage of the total loan book and loan book-weighted average interest margin. Credit quality didn’t deteriorate much on the quarter, and there are plenty of reserves relative to recent history. At the same time, the core bank business of borrowing short and lending long appears to be doing just fine with net interest margins nearing 3%.Terra firma beneath the feet for financials may be just the platform this market needs to push higher.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Daily Sector Snapshot — 4/14/23

First Republic and Other Banks See Large Jumps in Short Interest

Short interest figures get published every two weeks, and movements in short interest are a helpful way to gauge bull/bear positioning on individual names as well as groups and sectors. When a stock has a high percentage of shares sold short, it means that a lot of investors are betting against it. If a highly-shorted company manages to produce better-than-expected results, however, shares will often see outsized gains as many of the ‘shorts’ rush to cover.

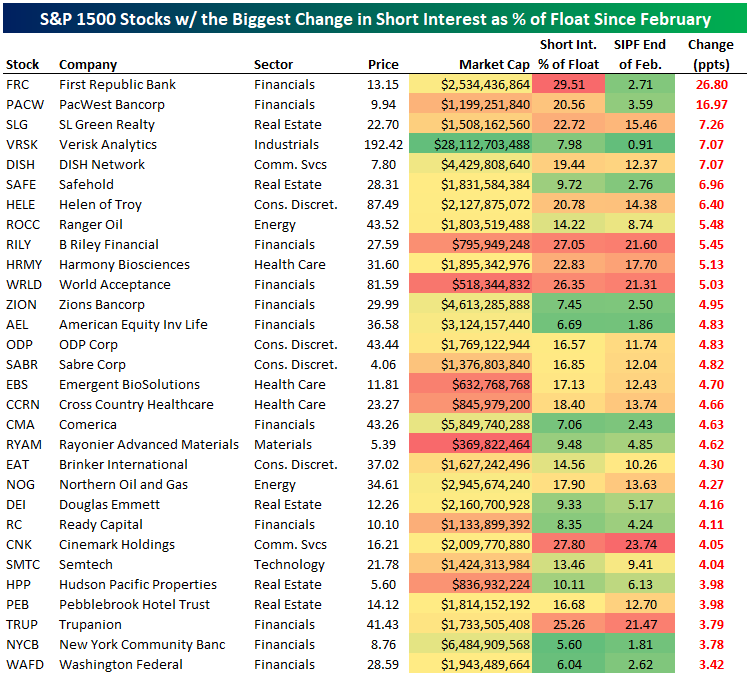

With bank failures and deposit flight emerging in March, causing two S&P 500 bank stocks to fail and many other regional bank stocks to fall precipitously, we were interested to see how short interest levels changed during the month. End-of-month short-interest figures for March were just recently published, and below is a table showing stocks in the S&P 1500 that saw the biggest increases in short-interest as a percentage of float (SIPF) during the month.

The two stocks that saw the biggest increases in short interest were First Republic Bank (FRC) and PacWest Bancorp (PACW). At the end of February, FRC only had 2.71% of its float sold short, but by the end of March, that figure had spiked to 29.51%. PACW’s jump in short interest was slightly less extreme, but extreme nonetheless, rising from 3.59% up to 20.56%. Another nine Financials sector stocks are on the list of the 30 S&P 1500 stocks that saw the biggest jumps in SIPF in March, while another five REITs made the list as well. That’s half the list!

Below is a better look at just how much short interest spiked in First Republic (FRC) during March. While the bank did see a mini-spike in late 2018 when the broader market was struggling with another batch of Fed tightening, FRC’s short interest normally sits between 0-5% of its float. Now it’s up to nearly 30%. For a stock that’s down 94% from its highs, where do you think the risk/reward lies at this point?

In terms of the most heavily shorted stocks, only Big Lots (BIG) currently has a higher percentage of its float sold short than FRC in the S&P 1500.

Below is a chart showing the average change in SIPF for stocks in the S&P 1500 by industry group in the month of March. Banks saw the biggest average jump at 0.78 ppts, followed by Telecom Services, Media & Entertainment, and REITs. Stocks in the Consumer Durables & Apparel group saw the largest decline in SIPF at -0.23 ppts.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

B.I.G. Tips – Retail Sales – Yikes

Bespoke’s Morning Lineup – 4/14/23 – Earnings Starts With a Bang

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When you put your hand in a flowing stream, you touch the last that has gone before and the first of what is still to come.” – Leonardo da Vinci

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

We’ll get to earnings in a sec, but just wanted to note that Retail Sales came in significantly weaker than expected falling 1.0% m/m versus forecasts for a decline of 0.5%. It was a similar size miss after stripping out Autos, but Ex Autos and Gas the decline wasn’t quite as small as expected (-0.3% vs -0.6%). Import Prices also fell 0.6% m/m versus forecasts for a decline of -0.1%. Futures have been little changed on the news. Do you think the Fed will take any of this into account?

Well, it looks like earnings season has kicked off on a positive note. Of the six companies reporting this morning, all of them topped EPS forecasts, and PNC was the only one that had weaker-than-expected revenues. Even here, though, the miss was extremely narrow. All six stocks that have reported are also trading higher in the pre-market, but the star of the show so far has been JPMorgan Chase (JPM), which is trading up 6% as we write this. That’s an impressive gain! Looking through our Earnings Database, there has never been a time since 2000 when JPM gapped up 6% or more in reaction to earnings. Heading into today, the record for the largest opening gap in JPM in reaction to earnings was on 7/17/08.

Back after that July 2008 report, JPM’s CFO Michael Cavanaugh reported that losses in its home equity business were less than expected, and while he noted that, “It’s too early to declare victory”, he added that “The trend of deterioration may be slowing a bit here.” That type of positive tone helped investors breathe a sigh of relief, but you don’t need the chart below to remind you that the trend of deterioration was only about to get worse. In other words, back then, like now, it was important to stay on top of trends and developments in the market and not become dogmatic based on a single metric or point in time. Like a river, the market is always moving, and especially in the rapids, if you don’t move with it, you’re guaranteed to go overboard.

Speaking of the chart below, the red dots indicate each time since 2000 that JPM rallied 5% on its earnings reaction day, and if today’s gain holds, it will be the first time in more than a decade that the stock has rallied that much on an earnings reaction day. The period since 2000 for JPM can be divided into two distinct periods. First, from 2000 through 2012, the stock was essentially range bound with the upper bound capped in the mid-30s. In 2013, the stock broke out of that range and rose nearly four-fold over the next nine years. What’s interesting, though, is that not a single one of the stock’s prior 5%+ rallies in reaction to earnings occurred during that nine-year leg higher, but there were six occurrences in the 12-year period where the stock did nothing.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Emergency Programs Unwind, EUR At The Highs, PPI – 4/13/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with an update on the Fed’s balance sheet and money market flows (page 1) before diving into rate differentials (page 2). We then take a look at today’s PPI data (page 3) before closing out with a recap of the long bond reopening (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!