Bespoke’s Morning Lineup – 5/4/23 – Inequality in Commodities

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When you blow away the foam, you get down to the real stuff.” – T. Boone Pickens

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After a relatively hawkish tone from Fed Chair Powell where he reiterated his view that the regional banking system is doing fine, reports surfaced that PacWest (PACW) is mulling strategic options for its business. Shares of PACW and other regional banks immediately plunged on the idea that things really aren’t fine, and that pulled futures for the broader market lower as well. In earnings news, shares of Qualcomm (QCOM) are down over 7% after the company reported weaker-than-expected EPS and lowered guidance. QCOM’s weak earnings report suggests that sales of handsets have been weak, and on that news, Apple (AAPL) is also trading lower heading into its earnings report after the close.

On the economic calendar today, jobless claims are the primary focus, but we also got updates on Non-Farm Productivity and Unit Labor Costs. Initial claims were slightly higher than expected (242K vs 240K) while Continuing Claims were significantly lower than expected (1.805 million vs 1.865 million). Non-Farm Productivity fell 2.7% versus forecasts for a decline of 2.0%, and Unit Labor Costs rose 6.3% compared to estimates of 5.6%.

All the headlines surrounding the troubles in the banking sector have weighed on sentiment in the last week as the AAII sentiment survey showed that bulls were unchanged at 24.1%, but bullish sentiment jumped from 38.5% up to 44.9%.

When it comes to trends within individual asset classes, the typical pattern is one of a tide lifting or sinking all boats. While it hasn’t necessarily been the case over the last two years, when the stock market rallies, most individual stocks rally and vice versa. Similarly, when bonds rally rates usually fall, even if the move lower is to varying degrees. One area of financial markets where we have been seeing a wide degree of disparity within the asset class is commodities.

The snapshot from our Trend Analyzer below shows where various commodity-related ETS currently stand relative to their trading ranges. At the top of the list and all trading in overbought territory are ETFs related to precious metals like gold and silver. Most of them are also up by double-digit percentages YTD. While these ETFs have performed well both recently and on a YTD basis, most other ETFs in the sector are down sharply YTD and trading at oversold levels. Crude oil ETFs like USO and DBO are down 7% over the last week while Natural Gas is sitting on a 55% YTD decline after falling an ominous 6.66% over the last five trading days. Is it getting hot in here?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – A Fed Pause…If We Can Stomach It – 5/3/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a rundown of the latest earnings (page 1) followed by commentary on today’s FOMC meeting and the market’s reaction to the decision (page 2). Switching over to macro data, we provide a look at the latest PMIs (page 3), homeownership rates (page 4), mortgage delinquencies (page 5), and petroleum inventories (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Chart of the Day – The “Powell Fade” Comes Right on Cue

Daily Sector Snapshot — 5/3/23

The Triple Play Report — 5/3/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with above-expectations results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features seven stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Fixed Income Weekly: 5/3/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

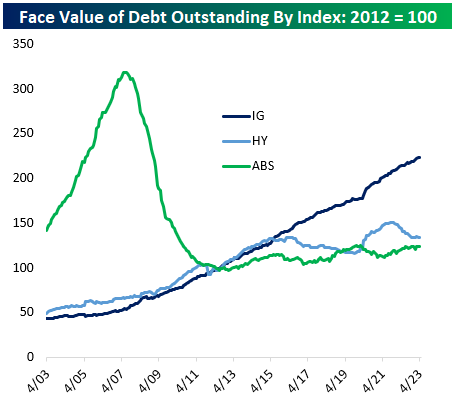

In this week’s report, we track investment grade corporate bond issuance.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Morning Lineup – 5/3/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Men in general judge more from appearances than from reality. All men have eyes, but few have the gift of penetration.” ― Niccolo Machiavelli

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If you were to apply the quote above to the markets, it would be that you should never invest based on the headlines.

It was nice while it lasted, but the Fed blackout will come to an end this afternoon when the FOMC announces its latest decision on interest rates and Powell holds a 2:30 PM Eastern press conference. There’s a bit of a positive tone in the markets ahead of the announcement, but that will all change later on. The ADP Employment report crushed estimates surpassing forecasts by more than 100K, and while it hasn’t been particularly reliable in forecasting the Non-Farm Payrolls report, the strong reading suggests that the labor market is holding up even after yesterday’s weaker JOLTS report. We’ll have to wait and see jobless claims and Non-Farm Payrolls later this week to get a better read on that sector. As far as the rest of the day is concerned, we still have ISM Services at 10 AM.

As large caps have carried the lion’s share of the weight in market performance this year, the performance gap between the Nasdaq 100 and the Russell 2000 has really widened. Year to date, the Nasdaq 100 has rallied by 19.9% while the Russell 2000 has declined nearly 2%, and over the last six months, the gap has been similar at 19.8%. The chart below shows the rolling six-month performance spread between the two indices, and while the spread has spiked in the last few months, it’s still lower than it was at post-COVID extremes in the fall of 2021 and the middle of 2020. At the other extreme, the peak period of outperformance for the Russell 2000 was in Mach 2021 when US consumers were flush with stimulus cash. Over the last 13 years, though, the performance gap has been in the Nasdaq 100’s favor as the spread has been positive 65% of the time since 2010.

With the gap in performance favoring the Nasdaq 100 nearly two-thirds of the time over the last 13 years, its relative strength versus the Russell 2000 has, up until recent years, been in a consistent uptrend. After going parabolic in the early COVID days, relative strength has been in a sideways range for three years now. Tighter credit conditions from the regional banking crisis this year have recently helped buoy the performance of large caps. Now, with the Fed on tap this afternoon, will Powell continue the hawkish tone and keep a tight grip on the credit spigot for smaller companies, or will he take a softer tone and help grease the skids?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Recession Pricing On Recessionary Data, JOLTS, LMI – 5/2/23

Log-in here if you’re a member with access to the Closer.

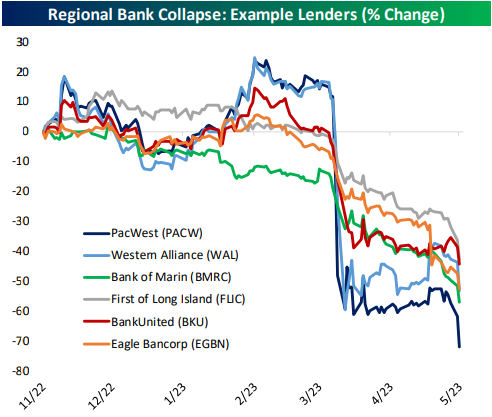

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, after earnings recaps (page 1), we check on the collapse in regional banks, the rise in credit spreads, and drop in yields and energy prices (page 2). Turning to macro data, we recap today’s JOLTS figures (pages 3 and 4) and finish with a look at the latest logistics data (pages 5 – 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!