The Closer – Dow Down for Five, Fedspeak, Household Debt & Credit, Positioning – 5/15/23

Log-in here if you’re a member with access to the Closer.

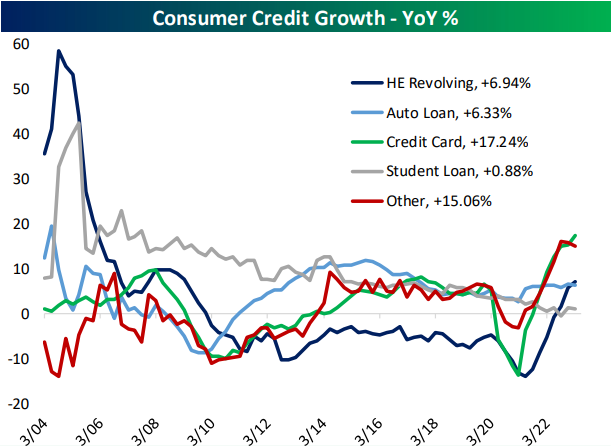

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the Dow snapping its losing streak (page 1) followed by an update on today’s Fedspeak (page 2). We then dive into today’s consumer credit numbers (pages 3 -5) before finishing with updates of this week’s Treasury auctions (page 6) and the latest positioning data (pages 7-9).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 5/15/23

NY Fed Plummets

The economic calendar was light this morning with the Empire Fed Manufacturing survey the only release of note. Whereas last month saw a solid reading of 10.8 implying expansionary activity in the NY Fed’s region, expectations were set low as the index was forecasted to fall down to a contractionary reading of -3.9. Instead, the index plummeted all the way down to -31.8, the lowest since January when the index reached a slightly worse -32.9. Additionally, the monthly decline in the headline number ranks as the second largest drop on record behind April 2020. Overall, the index has been quite volatile in recent months bouncing from historically contractionary readings to modest contraction or even growth.

As shown below, the month-over-month declines across many categories were nothing short of historic in May. For example, New Orders saw an astounding 53.1 point decline (just short of a record decline similar to the headline index). Shipments wasn’t much better with a 40-point decline. However, expectations for both of those categories rebounded with New Orders being a particularly big uptick, ranking in the upper decile of all month-over-month increases. That being said, the indices remain in the bottom deciles of their historical ranges while all other categories (like unfilled orders and inventories) saw declines in expectations alongside declines in current condition indices. Again, while recent months have seen some volatility in these survey results, the findings would imply responding firms have observed a significant slowdown in their businesses.

One silver lining relative to post-pandemic trends is that the report has shown a complete reversal in readings on prices and delivery times. As shown in the first chart below, the average of the two current conditions indices has been rolling over and is now basically right in line with the historical median. Balancing out the more normalized level in supply chain readings, firms also appear to be reporting massive pullbacks in hiring capital expenditures, and plans for tech spending. During the past two recessions, this average has turned negative, and at the moment, it is only barely positive at 3.43.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day – Narrow Ranges

Bespoke’s Morning Lineup – 5/15/23 – Positive Vibrations

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If any of my competitors were drowning, I’d stick a hose in their mouth.” – Ray Kroc

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After five straight days of losses and declines in nine of the last ten trading sessions, bears are making way for the positive day in the Dow, as futures are firmly in positive territory. Whether the bears stay out of the way for the entire session, though, is another question. Not helping matters for the bulls this morning is the just released Empire Manufacturing report which came in at -31.8 compared to forecasts for a reading of -1.8 and last month’s reading of 10.8. Going back 20 years, today’s report was the third weakest relative to expectations on record trailing the reports from April 2020 and August 2022. This weakness comes against the backdrop of Atlanta Fed President Bostic saying that inflation is not coming down very quickly and that rate cuts do not factor into his near-term plan.

If the maritime analogy were to be applied to markets, it has been a bit of a slack tide in the last week as there wasn’t much in the way of a major current in the market’s direction. While the S&P 500 was down fractionally, and most sectors were lower, there is a lot of disparity. Heading into the new week, seven sectors are neither overbought or oversold, three sectors are overbought, and just one sector (Energy) is oversold. In general, sectors that had been performing the worst YTD, did the worst last week and vice versa. Take the Energy and Communication Services sectors, for example. Energy has been the worst-performing sector YTD; it was the worst performer last week and it is further below its 50-day moving average (DMA) than any other sector. Conversely, Communication Services is the top-performing sector YTD, was the best-performing sector last week and it is further above its 50-DMA than any other sector.

Looking in more detail at the Energy sector, it has been stuck in a downtrend since last October, and after a steep sell-off to kick off the month, the sector looks to be trying to stabilize. Whether this attempt proves successful remains to be seen, but it is worth noting that this most recent low has taken place on lower levels of volume compared to the one in March.

Communication Services has been in a steady uptrend since its Q4 lows. While it has consistently been making higher lows, the ETF that tracks the sector (XLC) has stalled out at resistance multiple times this year. If it can break above $60, there’s no short-term resistance above.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads – 5/14/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Retail

Tipping at Self-Checkout Has Customers Crying ‘Emotional Blackmail’ (WSJ)

Since when did paying for a cup of coffee warrant a 20% tip? Consumers are being inundated with gratuity requests, so their employers don’t have to pay them as much. [link]

Wendy’s, Google Train Next-Generation Order Taker: an AI Chatbot (WSJ)

The next time you go to the drive-through to order French Fries it may be a bot that takes your order. This is one way to solve the labor shortage. Will we have to tip the bots too? [link]

Investing

Robinhood to Launch 24-Hour Trading on Weekdays in Stocks and ETFs (WSJ)

Just what we need more to time to trade illiquid markets. Robinhood announced last week that it will offer “round-the-clock trading between 8 p.m. ET Sunday and 8 p.m. ET Friday in 43 securities, including some popular stocks such as Amazon.com, Apple and Tesla.” [link]

Investment App Commonwealth Hits Big With Mage’s Kentucky Derby Win (Front Office Sports)

Shareholders of Commonwealth made a $170,000 investment in Kentucky Derby winner Mage. That stake is now worth over $5 million, a 30x return for shareholders. [link]

EVs

The Executive Who Keeps Tesla Rolling Isn’t Elon Musk (WSJ)

A profile of Tesla’s CFO, Zach Kirkhorn, who many have credited with shoring up the company’s financial strength. Unlike Musk, who has over 100 million Twitter followers, Kirkhorn has 63. “He doesn’t take the limelight from Elon”. Many analysts who cover the stock have never even had a one-on-one conversation with him. [link]

Lithium is becoming more crucial in a warming world, but Maine’s huge deposits may never be mined because of environmental concerns. (Boston Globe)

Lithium deposits near Newry, Maine may be the largest in the country which would provide a strong boost to the state’s economy, but environmental regulations have prevented any development of the deposits. Too bad. Guess it’s back to burning coal and gasoline. [link]

End of a love affair: AM radio is being removed from many cars (Washington Post)

Due to interference from electric batteries, many EVs are being made without AM radios. But now where will we go for our political talk radio? [link]

Science and Nature

The Untold Story of the Boldest Supply-Chain Hack Ever (Wired)

The backstory behind the 2020 SolarWinds hack, which is considered the boldest supply chain hack ever. [link]

Before Smartphones and the National Weather Service, There Was Grandma’s Knee (New York Times)

Borrowing from ‘old school’ methods, researchers have developed a new weather forecasting model that mimics the flexibility of animal joints and the movement of clouds, potentially improving prediction accuracy. [link]

Hammerhead sharks are first fish found to ‘hold their breath’ (Nature)

It’s not just people that hold their breath underwater. This article on hammerhead sharks describes why as well as other traits of the unique shark. [link]

Sports

NFL schedule 2023 winners, losers: Jordan Love takes center stage; Colts shut out of prime time (The Athletic)

Only the NFL can manage to drum up so much excitement for the release of the next season’s schedule. Teams with the easiest expected schedules include the Dallas Cowboys and Los Angeles Chargers, while the Philadelphia Eagles and New Orleans Saints appear to have the toughest road to the playoffs. [link]

Economy

How soon and at what height will China’s economy peak? (economist)

Estimates vary, but at some point between 2025 and 2040, the Chinese economy is expected to peak and an aging population and rising levels of debt pose long-term challenges to country. [link]

Moving Out of a Flood Zone? That May Be Risky! (NY Fed)

Just because you move out of a ‘flood zone’ doesn’t necessarily mean your house won’t flood. This article discusses the potential risks of relocating out of flood-prone areas and explores potential policy solutions to help homeowners make informed decisions about relocation and mitigate the risks of flooding. [link]

The Monetary-Fiscal Policy Mix and Central Bank Strategy (St. Louis Fed)

Hawkish Federal Reserve member James Bullard describes why the Fed needs to counter easy fiscal policy, and that while continued disinflation is likely, it is not guaranteed. [link]

Mother’s Day

How Mother’s Day became its founder’s worst nightmare (National Geographic)

Ever wonder about the history behind Mother’s Day and how it ultimately became commercialized? [link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Daily Sector Snapshot — 5/12/23

The Bespoke Report – 5/12/23 – Not Feeling It

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

Legally speaking, 18 is the age when you are considered an ‘adult’ in the United States. That’s when you are old enough as an American to serve your country, vote, and be tried as an adult for any crimes you may commit. Eighteen may be the age when you are given extra responsibilities, but it doesn’t make you feel like an adult. You won’t be able to legally buy a beer for another three years, and in most states, you can’t even buy a pack of cigarettes without a fake ID. Most 18-year-old Americans still have several years left of school, and they can legally stay on their parent’s health insurance for another eight years. In other words, being 18 makes you an adult in name only.

From a technical perspective, we’re still in a bear market, but like an 18-year-old kid, it doesn’t necessarily feel that way. In fact, there isn’t much ‘feeling’ on the part of bulls or bears these days. As discussed in this week’s report, with seven months having passed since the October low, it doesn’t feel like a bear market, but with the S&P 500 up less than 20% from those lows, it hardly has the feeling of a bull market either. The S&P 500 is essentially right around the same levels it was at 12 months ago, nine months ago, six months ago, or three months ago!

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Bespoke’s Morning Lineup – 5/12/23 – So Good, It’s Bad

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s tough to make predictions, especially about the future.” – Yogi Berra

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

What you think of the stock market these days will depend a lot on which index you’re looking at. While futures are up across the board today, the Dow has been down every day this week and eight of the last nine trading days. The Nasdaq, on the other hand, has been up in four of the last five trading days and is near its highs of the year. There’s little in the way of news driving the positive tone this morning, although the delay of the meeting between political leaders in DC over the debt ceiling until next week has been taken as a positive sign that the two sides are making progress. Along with the positive tone in futures, treasury yields are higher, but the two-year yield is still only at 3.92%. Crude oil prices are up modestly, and Energy Secretary Granholm has reportedly said that purchases for the SPR could resume in June.

On the economic calendar this morning, Import and Export prices will be released at 8:30 while Michigan Sentiment will be the least report of the week at 10 AM.

The performance disparity between major US equity indices has been well documented, but over the last several days, the gap has widened even more. Through yesterday’s close, the S&P 500 was up 7.6% on the year while the Dow was up only 0.5%. At 7.1%, the performance gap between the two indices on a YTD basis through 5/11 has never been wider, and the only time in the post-WWII period that it ever even exceeded five percentage points was in 1985 and 2020.

Given the differences in the way each index is constructed (market cap weighting of 500 stocks for the S&P 500 compared to a price-weighted index of 30 stocks for the Dow), performance disparities this large may not be too surprising, but since 1945, the correlation of daily returns for the two indices has been +0.95 meaning they’re almost perfectly correlated.

At the other end of the spectrum, there have been more years (seven) where the Dow outperformed the S&P 500 by over five percentage points YTD through this point in the year, but the most extreme was in 1999 when at this point in the year, the S&P 500 was up 10.3% while the Dow was already up over 20%! Comparisons between now and the late 1990s/early 2000s have been common, but in the case of performance disparities, the two periods couldn’t have been further apart.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Triple Plays Back to Normal, PPI, Large Metro Labor Markets – 5/11/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the normalization in the rate of triple plays and their reaction to earnings (page 1) followed by a look at regional banks’ return below pre-financial crisis highs (page 2). We then switch over to macro data to view the latest PPI readings (page 3), claims counts versus layoffs mentions in news headlines (page 4), and job postings data (pages 5 and 6). We finish with a recap of the strong 30 year bond auction (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!