Bespoke Baskets Update — May 2023

Chart of the Day: Up Days Returning

Bespoke’s Morning Lineup – 5/17/23 – Optimism Over Debt Ceiling

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Success is making ourselves useful in the world” – George Dayton, Founder of Target

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Politicians on both sides of the aisle are still talking tough regarding the debt ceiling, but there are signs of progress being made as President Biden has announced that he will cut short his trip to Asia. In response, futures were rallying ahead of the April release of Housing Starts and Building Permits. Starts were right in line with forecasts (1.401 million vs 1.400 million) and Building Permits were shy of forecasts (1.416 million vs 1.430 million). Regarding starts, though, the March reading was revised significantly lower from 1.420 million down to 1.371 million. Building Permits, however, experienced a modest upward revision. Futures are still in positive territory on the news, but off slightly from their pre-release level.

On the earnings front, retailers continue to take center stage, and after yesterday’s report from Home Depot (HD) where the company noted softer sales trends post the SVB collapse, Target (TGT) management had similar comments.

We still have another day left until Walmart (WMT) marks the unofficial end to earnings season, but this morning we wanted to take a quick look at how stocks have recently performed during the earnings ‘on’ and ‘off-seasons. The red lines in the chart below show the performance of the S&P 500 from the time of JP Morgan’s (JPM) report to WMT. While the first two earnings seasons of 2020 were not friendly for stocks, the next three were very positive periods for the market. Unlike the last three earnings seasons, performance during the current period has been remarkably sideways. On the surface, the lack of much upside during the current earnings season may be considered a negative signal. Then again, when you consider the fact that the market started to sell off after each of the last three earnings rallies, maybe the lack of an earnings rally means the odds of a post-earnings hangover are less likely.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

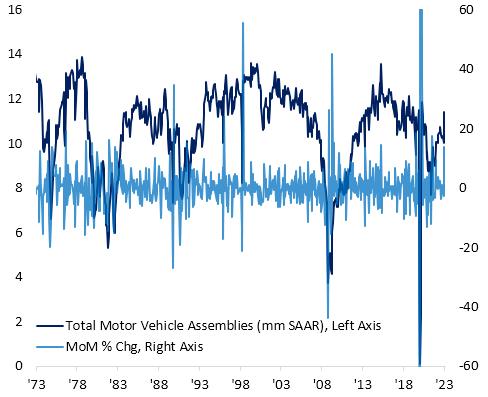

The Closer – Another Dose of Fedspeak, Auto Assemblies Surge, Services Slump – 5/16/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look at another busy day of Fedspeak (page 1) followed by a recap of industrial production numbers (page 2). We then dive into service sector (page 3) and credit availability data (page 4) from the New York Fed.

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 5/16/23

Bespoke Stock Scores — 5/16/23

Homebuilders Sentiment and Stocks Still On the Rise

As we noted last week on the release of the latest mortgage purchase data, housing activity appears to have finally stabilized after plummeting earlier in the tightening cycle. That improvement in housing markets is flowing through to builders as this morning’s release of homebuilder sentiment from the NAHB rose to 50 versus the expectation of it remaining unchanged at 45. While the index still has a long way to go to get back to pre-pandemic levels, let alone the record highs from the first two years of the pandemic, in May it hit the highest level since last July.

The higher reading in the headline index was a result of improvements across the board, including increases in present and future sales and traffic. As for regional sentiment, homebuilders have gotten more optimistic across most of the country. Everywhere save for the Northeast have seen steady improvements to homebuilder sentiment over the past several months. As for the Northeast, that is not to say sentiment has not improved. The reading has rebounded off of the worst levels but remains below the recent highs of 46 from February and March.

Homebuilder stocks continue to be even more impressive. Proxied by the iShares Home Construction ETF (ITB), homebuilders have been trading in a steady and uninterrupted uptrend. In fact, the ETF has been overbought every day for a month now.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day: No Love for Dividend Stocks

Fixed Income Weekly: 5/16/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report, we break down the differences in short-term pricing of interest rates in the Fed Funds and US Treasury markets.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!