The Closer – FAANG Valuations Fly, Logistics Industry Slumps – 6/6/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look into mega cap stock valuations running hot (page 1) followed by a look at the big drop in building permits in Canada (page 2). We then shift over to review trends in recent housing inventory data (pages 3 and 4). Next, we look at the latest supply chain data (pages 5-7) before closing out with an overview of sentiment on equities (page 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 6/6/23

B.I.G. Tips – Earnings Triple Play Recap

Today we published our newest Earnings Triple Plays report. This season there were a total of 127 earnings triple plays out of just under 2,000 individual quarterly earnings reports from US-listed stocks.

What is a triple play? When a stock reports quarterly earnings, it registers a “triple play” when it beats analyst EPS estimates, beats analyst revenue estimates, and raises forward guidance. We coined the term back in the mid-2000s, and you can read more about it at Investopedia.com. We consider triple plays to be the cream of the crop of earnings season, and we’re constantly finding new long-term opportunities from this basket of names each quarter. You can track the newest earnings triple plays on a daily basis at our Triple Plays page if you’re a Bespoke Premium or Bespoke Institutional member. To read our newest report and see some of the triple plays with intriguing charts at the moment, start a two-week trial to Bespoke Premium!

Bespoke Stock Scores — 6/6/23

Chart of the Day – Stocks Nearing New Highs

Bespoke’s Morning Lineup – 6/6/23 – No News is Good News

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I’m not in this world to live up to your expectations and you’re not in this world to live up to mine.” – Bruce Lee

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures have had a quiet session overnight on little news flow. The only major news of note was a surprise 25 bps rate hike in Australia. Investors are still digesting the virtual headset that Apple unveiled at WWDC yesterday, and while a charitable description is that it is a work in progress, hopes are that future versions will show improvement in form, function, and price. After trading lower after the headset was unveiled, shares of AAPL are trading down over 2.5% this morning. In case you missed it yesterday, we published a BIG Tips report on how AAPL stock historically performs before, during, and after the annual WWDC conference.

There’s no economic data to speak of in the US, but in Europe this morning, Retail Sales for the EU were unchanged, which was weaker than 0.2% m/m growth that was expected. Factory Orders in Germany declined 0.4% which was much worse than expectations for 2.8% growth. In Spain, Industrial Production also declined by 0.9% compared to consensus forecasts of 1.7%, so a weak showing overall. Maybe the lack of economic news in the US today is a good thing!

We discussed oil’s lack of ability to rally on what should be considered good news for prices last Wednesday, but considering the commodity’s action in reaction to the weekend news that Saudi Arabia would cut supply, it’s worth updating again. First, OPEC+ announced a surprise production cut in early April which caused prices to immediately spike by over 8% and a total ultimate gain of just over 10%. The gains didn’t last long, though. The rally stalled out just shy of the 200-day moving average, and by the end of the month, the gains had all been erased.

In late May, a Saudi minister warned speculators who were short oil to ‘watch out’. Those comments were good for a rally of less than 4% lasting less than two days, and after stalling out at the 50-day moving average (DMA) the gains were erased within a day. That brings us to the past weekend when Saudi Arabia announced it would cut production by 1 million barrels per day in July. That production cut was good for a 4%+ rally in crude oil when futures markets opened for trading Sunday evening, but by the end of the trading day Monday, crude oil was already below its Friday close, and this morning crude oil is down another 2%.

A key factor behind all three rallies and their ultimate bearish reversals is that they all ended abruptly at a key moving average. During bull markets, moving averages tend to act as support in any pullback, during bear markets, they act to squash any rally right in its tracks.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Just Missed A Bull Market, Calendar Effected Delinquencies, CoT – 6/5/23

Log-in here if you’re a member with access to the Closer.

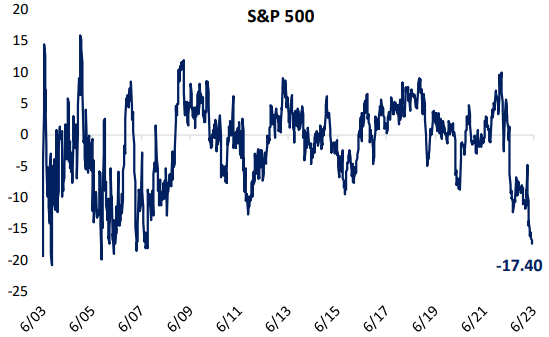

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the S&P 500’s near miss of ending its bear market, and what the start of past bull markets have looked like (page 1). We then dive into the latest economic data including service PMIs, durable goods (page 2), and mortgage delinquencies (page 3). We finish with a look at the still weak positioning readings for US equities (pages 4 -6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 6/5/23

Bespoke’s Consumer Pulse – June 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.