Bespoke’s Weekly Sector Snapshot — 6/8/23

B.I.G. Tips – Is the Pause Finally Here?

The Bespoke 50 Growth Stocks — 6/8/23

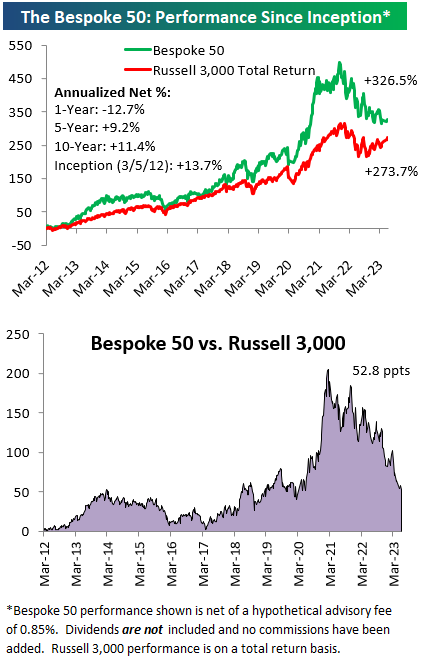

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. With Bespoke Premium, you’ll receive a number of daily market updates from us along with our weekly newsletter and a portion of our investor tools. With Bespoke Institutional, you’ll receive everything that’s included with Premium plus additional daily macro analysis and more stock-specific research.

To see all 50 stocks that currently make up the Bespoke 50, simply start a two-week trial to Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Sentiment Surge

Bespoke’s Morning Lineup – 6/8/23 – Wake Me When Something Happens

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It wasn’t the money, it was just that we had them on the run and gave in. They knew it, and that’s why they wanted to come to terms.” – Al Davis

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In a week that has been quiet on the market, economy, and policy fronts, one of the biggest stories has been the merger between the PGA and LIV Golf, and it came 57 years and just two days after what was the most important merger in US sports history when the NFL merged with the AFL forming what has gone on to become the most formidable league in all of professional sports. This week’s merger in golf hasn’t been without controversy, but with time, will we look back on this merger as anything nearly as significant?

As we said, it has been a quiet week, and this morning is no exception. The only economic reports of note today are Jobless Claims and Wholesale Inventories, and they’ll also be the last reports of the week. Jobless claims were mixed as initial claims came in at an 18-month high of 261K while continuing claims were lower than expected (1.757 mln vs 1.802 mln) falling to their lowest level since February. Equity futures are slightly higher but basically unchanged. Likewise, crude oil is up fractionally, and treasury yields are higher across the curve.

Market rotation has been a common theme this year, and throughout the first week of June, we’ve seen it again where the winners YTD have underperformed as the laggards lead. Look at the chart below which compares the YTD performance of major equity index ETFs (x-axis) to their performance in the first week of June. With its 31.2% YTD gain, no index ETF has performed better than the Nasdaq 100 (QQQ), but in the first week of June, it is the only index ETF up less than 1%. Conversely, the Russell Microcap ETF (IWC) was the second worst-performing index ETF YTD, but it’s the best performed during the first week of June (+8.25%).

At the sector level, the inverse relationship hasn’t been quite as notable, but it has still been a factor. Technology (XLK) and Communication Services (XLC) are the two best-performing sector ETFs YTD with gains of over 30% each, but in the first week of June, they’ve been two of the three worst performers. Meanwhile, Energy (XLE), the worst-performing ETF this year (-6.11%), has rallied more than 7%, leading all other sectors. There have also been some exceptions, though. Consumer Discretionary (XLY) is the third best-performing sector YTD and it remained near the top in the first week of June as the fifth best-performing sector. Meanwhile, Utilities (XLU), Health Care (XLV), and Consumer Staples (XLP) were among the weakest sectors YTD, and they continued to lag in the first week of June.

Whatever side of the trade you are on, the question of whether this rotation is a trend shift or not is important, but the fact that it has coincided with the start of a new month would suggest that it has been more a function of rebalancing than a real trend shift.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – No Hold Up North, Commodities Tested, Consumer Credit Crumples – 6/7/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look at the implications of Canada’s rate hikes for pricing of the FOMC (page 1) followed by a dive into commodity prices (page 2) and term structure (page 3). We then look at the latest EIA data (page 4). We finish with reviews of the trade balance (page 5) and consumer credit (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Fixed Income Weekly: 6/7/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed-income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation, and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1-year return profiles for a cross-section of the fixed income world.

In this week’s report, we discuss the relevance of short-term interest rates for other financial markets.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Daily Sector Snapshot — 6/7/23

Chart of the Day – Russell Turns the Tables

Bespoke’s Morning Lineup – 6/7/23 – Slow Drift Higher in Stocks and Rates

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The Edge… There is no honest way to explain it because the only people who really know where it is are the ones who have gone over.” – Hunter Thompson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s another quiet morning in the markets today as futures are little changed with a positive bias. Crude oil and yields are also higher, although overnight economic data out of China and Europe generally came up short of expectations, and mortgage applications in the US declined 1.4% versus the prior week. Bitcoin is also modestly lower on the morning, but given the SEC’s actions towards the industry this week, one might have thought the sector would be under even more pressure.

With every advancement, the negative side effects tend to get a disproportionate amount of attention even when the societal benefits of the breakthrough dwarf the costs. The bank runs this spring were a perfect example. How many times did we hear that a consumer’s ability to transfer large sums of capital with nothing more than a couple of taps on their smartphone was a threat to the banking system?

The list of benefits these same commentators fail to mention is long and includes the ability to effortlessly move funds around the world with just a couple of taps and how it has radically improved economic efficiency. Besides the benefits, if banks simply offered even something resembling a competitive deposit rate and didn’t load up on long-duration assets when interest rates were near zero, they never would have run into these problems in the first place. And anyway, is a business model built on a foundation of making it difficult for customers to take their business elsewhere really one we all want to get behind? If that’s the case, why wasn’t anyone defending America Online back in the early 2000s when the company made it nearly impossible for customers to cancel their accounts?

The only reason for bringing this up now is that back on this day in 1962 Switzerland opened its first drive-through bank. After seeing that, we wondered if, even with the added convenience, there were similar cries from the Luddite community railing against the fact that customers could now just drive up to the bank and withdraw funds…all while the car was still running. Talk about a bank run!

Regarding banks, we noticed yesterday that the S&P Regional Banking ETF (KRE) closed above its 50-day moving average for the third day in a row which hasn’t happened since late February/early March, before the onset of the regional banking crisis. Who knows if the worst is over, but if it is, it would have been one hell of a quick ‘crisis’.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.