The Closer – Inflation Falling, Deficit Widens, Bond Buyers Missing- 8/10/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at Banxico’s rate decision and other Fedspeak here in the US. We also discuss real wages’ impacts on consumer confidence (page 1) before pivoting over to an in depth rundown of today’s CPI data (pages 2 and 3). Next, we review the latest budget deficit data (page 4 and 5) before closing out with a recap of the weak demand for long bonds at auction (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 8/10/23

Bulls and Bears Beat the Average for Ten

The S&P 500’s selloff over the last week heading into today’s CPI print caused bullish sentiment to dip a little. Compared to last week when 49% of respondents to the weekly AAII survey reported as bullish, this week only 44.7% reported as such. That is the weakest reading on optimism in a month, but remains well above the range of readings of most of the past year and a half.

The drop in bullishness was met with an increase in bearishness. Bearish sentiment rose back above 25% for the first time since the week of July 14th.

In turn, the bull-bear spread moved lower this week, crossing back below 20 to 19.2. That is the lowest reading in four weeks as the spread continues to point toward an overall bullish tilt to investor sentiment.

In fact, this week marked the tenth in a row that bullish sentiment sat above its historical average while simultaneously bearish sentiment was below its historical average. Looking across the past twenty years, there are not many examples of this sort of extended bullish sentiment streaks. In fact, only three other periods saw streaks of similar length. The most recent ended in May 2021 at 13 weeks. Before that, there was an identically long streak in the first quarter of 2012 and prior to that, you’d have to go all the way back to 2004 to find an example. In the 1990s through late 2000, such streaks were much more common.

Claims Seasonal Tailwinds Waver

Initial Jobless Claims have been back on the rise for the last two weeks with this week’s reading coming in at 248k versus estimates for 230k. That is the most elevated reading since the first week of July and marks the largest week-over-week rise since the first week of June.

Before seasonal adjustment, claims totaled 225.6K, up roughly 20K from the previous week. At those levels, claims are above those of the comparable week of last year and multiple pre-pandemic years. The past couple of weeks have seen particularly pronounced seasonal tailwinds which have historically ebbed this week and will again likely happen next week. However, those tailwinds are set to continue later this month into September when claims have typically reached an annual low point.

Lagged one week to initial claims, continuing claims came in lower than expected, dropping to 1.684 million from 1.7 million. That is slightly above the low from two weeks ago but does not yet disrupt the trend downward in continuing claims.

As for a state level breakdown of claims, in the heatmap below we show where continuing claims are most and least elevated as a share of the each state’s respective labor force. As shown, the West Coast and Northeast are the two weakest regions of the country with the highest percentage of continuing claims. Some states in the Southwest like Texas and New Mexico and the Midwest like Illinois and Minnesota also have pockets of weakness. Given various states have different unemployment insurance program eligibility requirements, benefit amounts, and program lengths, that is not necessarily to say these are the areas with the highest unemployment rates, but rather these are the places contributing the most to national claims counts.

Chart of the Day – Rent Disinflation’s Long Runway

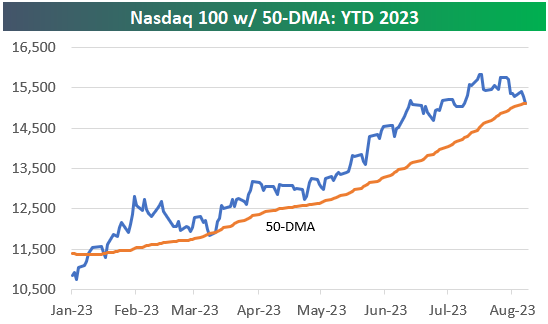

Bespoke’s Morning Lineup — Nasdaq 100 Breaks 50-DMA — 8/10/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everything looks nicer when you win.” – Billy Martin

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

US equity index futures are pointing to a higher open as of 8:10 AM ET as the world awaits US CPI for July due out at 8:30. Weekly Jobless Claims are also due out at the same time. As highlighted yesterday, YoY CPI is set to end a streak of twelve monthly declines in a row.

Yesterday, the Nasdaq 100 closed below its 50-day moving average for the first time in 103 trading days. Going back to 1985 when this index began, there have only been ten other streaks of 100+ trading days of closes above the 50-DMA, with the last occurring in mid-2020.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Consumer Credit Quality In Focus, 10y Sale, EIA – 8/9/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start with a review of the latest earnings (page 1) followed by the drop in consumer credit growth (pages 2 – 6). We then dive into the latest 10 year auction (page 7) and big surge in domestic oil production (page 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 8/9/23

Fixed Income Weekly — 8/9/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed-income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation, and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1-year return profiles for a cross-section of the fixed income world.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!