Bespoke’s Morning Lineup – 9/7/23 – More September Weakness

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no law. It’s just the best lawyers always win.” – Ron Baron

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

Trade disputes and the potential for moving towards more closed borders on commerce has weighed on futures this morning. Futures are down across the board, but the Nasdaq is taking it hardest as additional restrictions on Apple iPhone usage for Chinese government employees could be coming. In the other direction, both the US and Europe are considering adding additional tariffs on Chinese steel imports.

On the economic side of things, Non-Farm Productivity and Unit Labor Costs were both higher than expected, and jobless claims came in lower than expected on both an initial and continuing basis. That kind of data won’t do much to weigh down interest rates, but it will certainly pressure stock prices.

Given its reputation, September has started just how you would expect it to. While the S&P 500 barely avoided finishing the first three trading days of the month down 1%, the Nasdaq finished down 1.16% month to date yesterday. The chart below shows the index’s performance during the first three trading days of the month for all years since 1971, and the red bars indicate years that the index was down 1%+. As shown, 1%+ declines in the first three trading days haven’t been particularly uncommon, especially in the last six years.

So, does a bad start to September for the Nasdaq mean anything with respect to the rest of the month? The table below lists each year that the Nasdaq was down 1%+ in the first three trading days of the month. For each year, we also show the index’s YTD performance heading into the month along with its performance for the remainder of the month. Of the sixteen prior years shown, the Nasdaq’s average change for the rest of the month was a decline of 2.85% (median: -3.70%) with gains less than a third of the time. That’s considerably worse than the 0.85% average decline for all years since 1971.

While it appears that months which start out poorly for the Nasdaq lead to further declines over the course of the rest of September, there is a caveat. If you look at the years when the Nasdaq was up over 10% heading into September but then traded down over 1% in the first three trading days, performance wasn’t nearly as bad. In fact, the S&P 500’s average rest of month performance was a gain of 0.61% (median: 1.56%) with positive returns four out of seven times.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The 20 Most Loved Stocks by Wall Street Analysts

In the large-cap Russell 1,000, there are more than 18,800 individual analyst ratings, meaning the average stock in the roughly 1,000 member index has more than 18 analyst recommendations. It’s widely known that there are way more “buy” ratings than “sell” or “hold” ratings, but to put a number to it, right now 54.5% of all analyst ratings in the Russell 1,000 are “buy” ratings. (A “buy” rating includes terms like “outperform” or “overweight” that some firms prefer to use.)

Today we wanted to provide you with a list of the current stocks in the Russell 1,000 that have the highest percentage of “buy” ratings. These could be considered the most loved stocks by Wall Street analysts. (To be included on the list below, the stock needed to have at least five analyst ratings.)

Starting at the top, there are nine stocks that have 100% buy ratings, and the name with the most number of buys is Alexandria Real Estate (ARE) at eleven. WillScot Mobile (WSC), Royalty Pharma (RPRX), Liberty Media Sirius XM (LSXMA), Kirby (KEX), Curtiss-Wright (CW), Churchill Downs (CHDN), Service Corp (SCI), and Howard Hughes (HHH) are the eight other stocks with 100% buy ratings. The remaining eleven stocks shown have at least 93% buy ratings, and the most notable are two mega-caps with $1+ trillion market caps: Amazon (AMZN) and NVIDIA (NVDA). At the moment, 61 of 64 analyst ratings for Amazon (AMZN) are buys, while 59 of 63 ratings for NVIDIA (NVDA) are buys.

NVIDIA (NVDA) has already surged 232% in 2023, so it’s pretty remarkable that analysts are still this bullish on the name. It may be hard to believe, but the average analyst price target for NVDA has moved up to $638/share. NVDA’s current share price is 26.6% below that price target. The average stock in the Russell is only 14% below its consensus price target, so analysts expect more gains for NVDA than they do for the average name in the index.

Remember, from a contrarian’s perspective, a stock with an extremely high percentage of buy ratings may be a name to avoid. After all, once you get to 100%, there’s no more room for analysts to get more bullish!

The Closer – Credit Spreads, WTI Surge, Beige Book, PMIs, Housing Data – 9/6/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look into credit spreads and the steep backwardation of crude (page 1). We follow up with a quantified look at the Beige Book (page 2), trade balance (page 3), and ISM data (page 4). We then take a look into the latest housing delinquency data from Black Knight (page 5) in addition to housing inventories from Realtor.com (pages 6 – 7). We finish with an update on the latest investor sentiment data from TD Ameritrade (page 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 9/6/23

Fixed Income Weekly — 9/6/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit each week. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed-income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation, and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1-year return profiles for a cross-section of the fixed income world.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

2% Moves Are Back

As we noted in a tweet this morning, price action of US equities has been flipped from Tuesday with large caps suffering larger losses than small caps. Looking at yesterday, the decline in the Russell 2,000 (-2.1%) dwarfed the S&P 500’s (-0.4%). For the small cap Russell 2,000, that marked the first daily move of at least 2% (positive or negative) since June 5th when the index rallied 2.4%. As shown below, that three month stretch without a daily move of 2% is far from the longest on record, but it does stand out as one of the largest in some time. Running for 61 trading days, it was the longest since the 133 day streak ending on 10/9/18.

As previously mentioned, today’s price action is a bit of the reverse of Tuesday, however, the S&P 500 is far from a 2% drop of its own. In fact, the S&P 500 has been on an even longer streak without a 2% daily move. At 136 trading days, the current streak ranks as the longest since February 2018 (310 days). As with the Russell, the current streak would have a long way to go to reach records that lasted for years like from 2003 to 2006. Regardless, the fact of the matter is that day to day volatility by this measure has been extremely muted of late.

Chart of the Day: Defensives Dumped

Bespoke’s Morning Lineup – 9/6/23 – Living at the Woodshed

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s not what you look at that matters, it’s what you see.” – Henry David Thoreau

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

It’s another weak morning for US equity futures as the backdrop of higher rates and oil prices weigh on sentiment. Futures are lower across the board, but not by a large amount. The key report of the day will be ISM Services at 10 AM. Plus, there are a number of conferences today, so be on the look out for individual company news throughout the day.

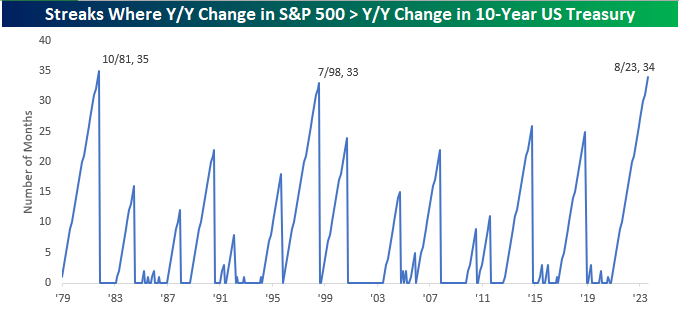

176 years ago today, Henry David Thoreau moved in with Ralph Waldo Emerson and his family after living in a woodshed on Walden Pond for two years. Two years in a shack is a long time, but bonds have been out behind, or maybe more accurately, in front of the woodshed for even longer. As measured by the Bank of America 10+ Year US Treasury Index, August was the 31st straight month that the year/year total return for US Treasuries was negative, easily surpassing the 15th month streak than ended in December 1980. Not only has the y/y change in long-term Treasuries been negative for more than two and a half years, but the y/y change has also lagged the y/y total return of the S&P 500 for 34 straight months.

Since 1979, there have only been two other periods where the 10-year underperformed the S&P 500 on a y/y basis for more months. The most recent ended in July 1998 at 33 months while there was a 35-month streak ending in October 1981. Given the way the numbers work out, unless treasuries stage a monster rally and/or stocks take a sharp leg lower this month, it’s almost a guarantee that the current streak will at least tie, if not exceed, the 35-month streak from 1981. In at least the last forty years, there hasn’t been a worse time to be creditor of Uncle Sam.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day – Smart Money Stays on Vacation

The Closer – Dovish Fedspeak, Factory Sales, LMI, CoT – 9/5/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a look at the dovish pivot in Fed commentary and the subsequent rise in the dollar (page 1). We then pivot over to the latest factory orders data (page 2) and Logistics Managers Index (pages 3 -5). We then review the latest positioning data (pages 6 – 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!