The Closer – Doves Fly At The ECB, Retail Sales, PPI, NowCasting, Shutdowns – 9/14/23

Log-in here if you’re a member with access to the Closer.

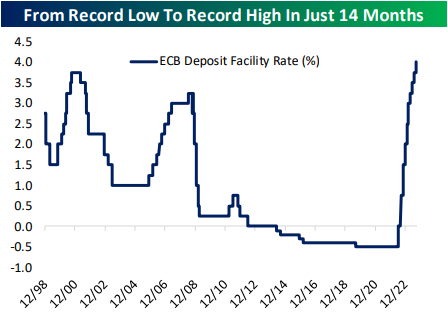

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with commentary regarding the ECB’s dovish hike (page 1) followed by a dive into the latest retail sales report (page 2). We then review today’s PPI data (page 3) and GDP tracking (page 4). We also discuss the impacts of government shutdowns (page 5) and the drop in the correlation between the Nasdaq and Russell 2,000 (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Continuing Claims Flatten Out

As was expected this week, jobless claims data deteriorated with seasonally adjusted claims rising to 220K from 216K. However, that was better than expectations which were calling for claims to rise by another 5K up to 225K. As shown below, claims continue to sit at the low end of the past several months range, indicating a still healthy labor market.

At the moment, claims prior to seasonal adjustment are at an interesting point of the year. Unadjusted claims totaled 174.5K this week. That is only a couple thousand claims higher than last year and near the slightly lower readings from 2018 and 2019. Overall, those remain some of the strongest readings on record when comparing the like weeks of the year. Additionally, we would note that claims are likely at or near their seasonal low. Historically, the current week of the year has been the annual low a quarter of the time (that being the case in 2018 and 2019) whereas the following week has marked the low another 35.7% of the time. In other words, as we have frequently mentioned in recent weeks, seasonal tailwinds will begin to shift to headwinds in the coming weeks.

Seasonally adjusted continuing claims likewise came in below expectations this week, rising to 1.688 million compared to forecasts of 1.69 million. Again like initial claims, continuing claims are far from worrisome as they sit at historically strong levels, however, the past few months downtrend in claims has begun to bottom out as it has been eight weeks since the last near term low.

Bulls Slump While The Put/Call Ratio Surges

The S&P 500 has managed to rise 1.15% in the past week, but sentiment has barely reflected the positive tone. After climbing to 42.2% last week, AAII bullish sentiment dropped right back down to 34.4% this week. That is the largest one week drop in a month although it doesn’t leave bullish sentiment at any sort of new low.

The bulls didn’t move to the bearish camp, however. In fact, bearish sentiment fell to 29.2%, which is the lowest reading since the week of August 10.

Because the declines in bullish sentiment outpaced the drop in bears, the spread between the two dropped to +5.2.

Given both bulls and bears dropped, neutral sentiment picked up the difference. As shown below, neutral sentiment rose to 36.4% this week, which was the highest reading since the week of May 18th when it was slightly higher at 37.4%.

While the AAII sentiment survey did not see any sort of particularly noteworthy moves this week, the equity put/call ratio did notch a new high yesterday. As shown below, over the past couple of months, the ratio has begun to turn higher with yesterday seeing the highest reading since March 10th. At 1.35, that ratio also measures in the top 1% of all readings since 1995. Remember, a reading above 1 means there are more put buyers (negative bets) than call buyers (positive bets).

Bespoke’s Weekly Sector Snapshot — 9/14/23

Chart of the Day – Presidential Approval: An Inflation Referendum

Bespoke’s Morning Lineup – 9/14/23

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Smart people focus on the right things.” – Jensen Huang

Start a two-week trial to Bespoke Premium now to get full access the Morning Lineup.

US equity futures are up slightly this morning as investors digest a surprise rate hike from the ECB and await a slug of economic data at 8:30 AM ET, including August Retail Sales, August PPI, and weekly Jobless Claims.

Markets continue to trade heavy and small-caps continue to underperform as we work our way through what has historically been the worst month of the year for stocks. As shown below, the Russell 2,000 closed below its 200-day moving average yesterday for the first time in months as a short-term head and shoulders pattern has formed.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

CPI Gains Come and Go

The S&P 500 managed to rise 0.12% on Wednesday in the wake of the CPI release. That is the fifth month in a row in which the S&P 500 rose in response to a CPI print, and only two months over the past year (February and April) have seen negative reactions. Although the S&P has consistently risen on CPI days, the size of the moves have been less substantial than they were previously. As shown below, taking a rolling 10-day average of the S&P 500’s daily change on days that CPI is published shows the average performance remains positive but has turned lower versus a couple months ago when the average move was above 1.2%, which was some of the strongest reactions in a decade and a half.

Although S&P 500 performance has been positive on the day of CPI releases over the last year, looking one week out, the results have been less positive. As shown below, the S&P has consistently fallen in the week after CPI releases. Again taking a rolling 10-day average, one week performance has been negative for 20 months in a row, or every month since the start of 2022.

The Triple Play Report — 9/14/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with better-than-expected results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 15 new stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Zscaler (ZS) is an example of a company that reported an earnings triple play recently back on the evening of September 5th. As shown below, ZS’s stock struggled in 2022 but since its low in May, ZS has gained about 80%. Despite a negative reaction to the triple play news, ZS is now trading above both its 50-day and 200-day moving averages.

As shown in the snapshot from our Earnings Explorer below, ZScaler (ZS) has now posted 22 straight EPS and revenue beats since its IPO in 2018! This quarter’s triple play adds to the list, and is now its sixth trip in a row. Although the stock didn’t move in a favorable direction following the earnings report after the close on September 5th, ZS had lots to celebrate in a strong quarter that featured rapid growth of its data protection offerings. You can read more about ZS and the 14 other triple plays in our newest report by starting a Bespoke Institutional trial today.

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

The Closer – CPI Accelerates, Record Surplus, EIA, Long Bonds – 9/13/23

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, after starting out with some commentary on bank lending appetite and passenger airline stocks (page 1). We then dive into the latest inflation data (page 2 and 3) followed by a look into Argentine rates and politics (page 4). Turning back to US macro data, we review the latest fiscal data (page 5), long bond reopening (page 6), and petroleum stockpile release (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!