Bespoke’s Morning Lineup – 2/2/24 – The $170,000,000,000 Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Nobody goes there anymore. It’s too crowded.” – Yogi Berra

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

If Yogi Berra were alive today, we could only imagine how he would describe Meta Platforms (META). While the company owns the apps that everybody loves to hate, not only are most people on it, but thanks to AI-enhanced algorithms, they’re spending more time on them than ever. The result is a record high in META’s stock price and an overnight increase in its market cap of $170 billion. According to Bloomberg, that would rank as the fifth largest one-day gain in market cap for a single company on record. Can you imagine where META would be if people “liked” the product?

Turning to the rest of the market, futures were sharply higher on the back of earnings from META and Amazon.com (AMZN) overnight, while a 2.5% decline in Apple (AAPL) keeps the gains in check. All in, the S&P 500 was indicated to open up by about 0.7% while the Nasdaq was up over 1% as each index erased its declines from the mid-week “Fed-induced” decline.

Almost lost in the shuffle of all the earnings news after the close yesterday and this morning is this morning’s employment report for January. If you thought the results relative to expectations of AMZN and META knocked the cover off the ball, you may want to sit down for this one. Non-farm payrolls showed a monster increase of 353K relative to forecasts for a gain of just 185K, and the last two months were also revised higher. Average hourly earnings doubled expectations (0.6% vs 0.3%), and the Unemployment Rate came in at 3.7% versus 3.8%. The only negative in the report was average hourly earnings which dropped to 34.1 hours from 34.3 last month. This was a very strong report and will put the idea of good news being good news for the market to the test. The immediate reaction in equity futures was a decline as the Dow dipped into the red, while the gains in the S&P 500 and the Nasdaq were more than cut in half.

META’s 15%+ pre-market rally has the stock on pace to have its fifth-best day in reaction to earnings since the IPO in 2012. It will also be the ninth time that the stock rallied at least 10% on an earnings reaction day. A big question for traders is whether the stock tends to build on these gains after gapping up so much or does it give back some of the gains.

The chart below compares the relationship between META’s performance on its earnings reaction day versus its performance from that day up until its next earnings report. When the stock was down on its earnings reaction day or up less than 10% (non-shaded area in chart), its median performance up until its next earnings report was a gain of 5.8% compared to the 10.2% forward performance following the eight days when the stock rallied more than 10% on its earnings reaction day. History is never guaranteed to repeat itself, but when META rallied by double-digit percentages in reaction to earnings it tended to keep the rally going moving forward.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

The Closer – Mega Cap Earnings, PMIs, Construction Spending – 2/1/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a review of the latest mega cap earnings (page 1) followed by a review of today’s manufacturing PMIs (page 2). We then dive into today’s productivity and cost data (page 3) as well as the surge in construction spending (page 4). We finish with a look at the latest housing inventory data (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Weekly Sector Snapshot — 2/1/24

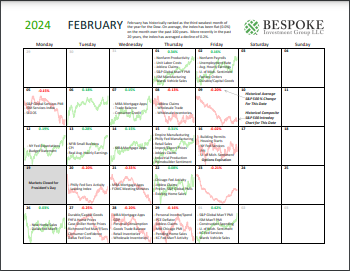

Bespoke Market Calendar — February 2024

Please click the image below to view our February 2024 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

The Bespoke 50 Growth Stocks — 2/1/24

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. There were 21 changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. With Bespoke Premium, you’ll receive a number of daily market updates from us along with our weekly newsletter and a portion of our investor tools. With Bespoke Institutional, you’ll receive everything that’s included with Premium plus additional daily macro analysis and more stock-specific research.

To see all 50 stocks that currently make up the Bespoke 50, simply start a two-week trial to Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day – Sahm Rule for Stocks

High Share Prices vs. Low Share Prices

It shouldn’t matter, but we saw a huge disparity in the performance of stocks with high versus low share prices in January. Here are the numbers:

As shown below, in the large-cap Russell 1,000, the 100 stocks that began 2024 with the lowest share prices fell an average of 7.4% in January, while the 100 stocks that began the year with the highest share prices rose an average of 2%.

There are 25 stocks in the Russell 1,000 that began 2024 with a sub-$10 share price, and these stocks fell an average of 11% in January. Conversely, the 41 stocks in the Russell 1,000 that began the year with a share price of more than $500 rose an average of 3.2% during the month.

What gives?

Bespoke’s Morning Lineup – 2/1/24 – Getting Back on the Horse

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Alexander Hamilton started the U.S. Treasury with nothing, and that was the closest our country has ever been to being even.” – Will Rogers

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Futures are higher this morning as investors look to regroup following yesterday’s FOMC meeting and Powell’s press conference which pooh-poohed the possibility of a March cut. The S&P 500 finished the day down over 1.5% in what was the worst day in four months. Powell gets much of the blame for the decline, but equities were already firmly in the red leading up to the announcement, and the market was also trading at overbought levels. Powell didn’t help, but what he said wasn’t exactly a major surprise. Just the fact that the chair was openly talking about rate cuts being a matter of when rather than if is a stark difference from the last two years.

The tone right now is positive, but if you think Tuesday was a seminal moment in the earnings season, today promises to be even bigger with Apple (AAPL), Amazon (AMZN), and Meta (META) being just three of the dozens of companies reporting after the close.

On the economic calendar, Jobless Claims, Unit Labor Costs, and Non-Farm Productivity were all just released, and later we’ll get Construction Spending as well as the S&P and ISM Manufacturing PMIs. Non-Farm Productivity came in stronger than expected (3.2% vs 2.5%) while Unit Labor Costs were weaker than forecasts (0.5% vs 1.2%). Jobless claims weren’t particularly good as both initial and continuing claims came in higher than expected and at their highest levels since November. Expectations for the PMIs aren’t particularly positive, and based on the regional Fed Manufacturing reports we got throughout the month, we’ll be lucky to even get an inline reading.

What had been a very strong first month of the year turned into a more modest one as Fed Chair Powell successfully let some of the air out of the market balloon in his press conference yesterday. When the dust settled, the S&P 500 finished January up 1.7% on a total return basis after being up well over 3% heading into yesterday’s session.

On a y/y basis, the S&P 500 is still up over 20% on a total return basis which is nine full percentage points above the long-term historical average of 11.8% ranking the last year in the 69th percentile relative to all one-year periods. While one-year returns have been very strong, two-year returns have been the complete opposite. At 5.3% annualized, the S&P 500’s two-year performance ranks in just the 28th percentile relative to all other two-year periods. Looking further out, both five and ten-year annualized returns have been above the historical norm while 20-year returns are still below their long-term average.

Long-term US Treasuries are a completely different story. Based on returns of the BofA/Merrill 10+ Year US Treasury Index, long-term treasuries were down 1.65%. You may recall that in December treasuries ended a 34-month streak of negative 12-month returns, but January’s weakness moved the one-year returns back below zero. As shown in the chart below, annualized returns over the last one, two, and five years are all negative. On a 10 and 20-year basis, returns are positive, but they are still well below their historical long-term average, and for all periods except the last year, current returns rank in the 3rd percentile or below relative to all other periods. Calling the last decade a dark age for bonds wouldn’t be an understatement.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

January 2024 Key ETF Performance

The first month of 2024 is already complete, and below is a look at the performance of various asset classes during January using key ETFs that we track closely. The S&P 500 (SPY) finished the month up 1.59% even though the average stock in the index was down 0.84%. While large-cap ETFs like SPY and QQQ finished the month higher, the small-cap Russell 2,000 (IWM) was down 3.9%.

At the sector level, Real Estate (XLRE) and Consumer Discretionary (XLY) both fell 4%+, while Communication Services (XLC) saw the biggest move to the upside at 4.4%. International equity ETFs were all over the place in January with India (PIN) and Japan (EWJ) solidly higher and China (ASHR) and Hong Kong (EWH) sharply lower. Oil (USO) was actually the best performing area of the entire matrix in January with a gain of 6.4%. On the flip side, natural gas (UNG) and silver (SLV) both fell 3%+.

Start a complimentary 30-day trial to Bespoke Premium today!

The Closer – Fed Confidence, Net New Highs Go For Three, EIA – 1/31/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with commentary regarding the FOMC decision and market reaction (page 1) followed by a look at the streak of positive readings in S&P 500 net new highs (page 2). We then review the latest earnings reports (page 3) before shifting over to Latin American central banking (page 4). We finish with looks into a bunch of EIA data (pages 5 and 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!