Q1 2025 Earnings Conference Call Recaps: Mondelez International (MDLZ)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Mondelez International’s (MDLZ) Q1 2025 earnings call.

Mondelez International (MDLZ) is one of the world’s largest snack food companies, known for iconic brands like Oreo, Chips Ahoy, Ritz, Cadbury, and Toblerone. Operating across more than 150 countries, the company focuses primarily on biscuits and chocolate, with growing portfolios in gum, candy, and baked snacks. MDLZ delivered 3.1% organic revenue growth despite headwinds from record-high cocoa costs and soft consumer demand in North America. Chocolate pricing drove growth, but volume mix declined 3.5% due to elasticity, Easter timing, and US retailer destocking. The company gained market share in chocolate globally and defended biscuits through innovation and value packs. In Europe, pricing passed with minimal disruption, while emerging markets like China and Brazil remained bright spots despite broader consumer softness. US confidence remains low, pressuring discretionary snack sales. Tariff impacts were manageable, and MDLZ reaffirmed its full-year guidance, emphasizing reinvestment if cocoa prices ease. MDLZ shares rose 4.5% on 4/30 after posting mixed results…

Continue reading our Conference Call Recap for MDLZ by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: Booking (BKNG)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Booking’s (BKNG) Q1 2025 earnings call.

Booking (BKNG) is one of the world’s largest online travel platforms, operating well-known brands like Booking.com, Priceline, Agoda, and OpenTable. It connects millions of travelers with accommodations, flights, rental cars, attractions, and dining reservations across the globe. With over 31 million accommodation listings (including 8.1 million in alternative lodging), BKNG gives good insight into travel demand trends across regions and consumer segments. BKNG posted Q1 revenue of $4.8B, up 8%, driven by room nights exceeding 300 million for the first time. Demand was stable globally, though the US saw signs of softness: shorter stays and weaker inbound travel. Alternative accommodations grew 12%, now 37% of room nights. AI innovation and vertical expansion (flights +45%, attractions +92%) powered its connected trip vision. Despite better-than-expected results, BKNG fell almost 5% after hours on 4/29, but recovered intraday on 4/30…

Continue reading our Conference Call Recap for BKNG by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Bespoke Matrix of Economic Indicators – 4/30/25

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke’s Morning Lineup – 4/30/25- The End is Near

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There are no lines in nature, only areas of colour, one against another.” – Edouard Manet

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

April may only have 30 days, but this one feels like it was the longest month in a long time. Liberation Day was on April 2nd, but it seems like months ago. Maybe that’s because we have seen market moves that usually take months to play out compressed into just a matter of weeks. Thankfully, things have started to calm down, but you can never be sure if we’re past the worst or just in the eye of the storm.

Regarding economic data, the month is closing out with a whirlwind, and it started with the ADP Payrolls report which came in weaker than expected. While economists were expecting growth of 125K payrolls, the actual reading came in at just under half that at 62K. ADP was just the first of many, though, with the first read on GDP, the GDP Price Index, Core PCE, Personal Consumption and the Employment Cost Index all coming out at 8:30. GDP showed a slightly larger than expected decline (-0.3% vs -0.2%) and Personal Consumption was higher than expected, but the inflation readings came in much higher than expected which has pushed equity futures sharply lower and yields sharply higher.

As if these reports weren’t enough, we still have Personal Income and Personal Spending at 10 AM. That’s just economic news, too. Don’t forget that we’re in the thick of earnings season, and after the close today, the focus will be on Meta (META) and Microsoft (MSFT).

Did anything happen this month? Heading into the last trading day of the month, the S&P 500 is down less than 1%, five sectors are up, and six are down. At the surface, it sounds like an uneventful month, but it was anything but. The scatter chart below shows the performance of the S&P 500 and sectors on a month to day basis through April 8th and then from the close on April 8th through yesterday’s close. It has been a wild ride!

Along with the S&P 500, six sectors fell more than 10% through 4/8 and then rallied more than 10% since. Through 4/8, all eleven sectors fell at least 6.2% (Consumer Staples) and as much as 17.9% (Energy), and since then, every sector has rallied at least 4.6% (Health Care) and as much as 16.4% (Technology). In most cases, the biggest losers in the first eight days of the month have been the biggest winners since although Energy has been the exception, as its bounce was meager relative to the size of its plunge.

After all the noise, Technology is leading the way higher with a gain of 1.2%, followed by Communication Services (0.9%), Consumer Discretionary (0.8%), and Utilities (0.5%). On the downside, there are still plenty of losers, and the magnitude of the losses is much larger than the winners. Energy has been the big outlier with a decline of over 10% while Health Care (-4.7%), Materials (-2.7%), and Financials (-2.4%) are all still down over 2%. It hasn’t been a great month for the market, but it could have been a LOT worse.

The Closer – Goods Trade, GDP Tracking, Jobs – 4/29/25

Log-in here if you’re a member with access to the Closer.

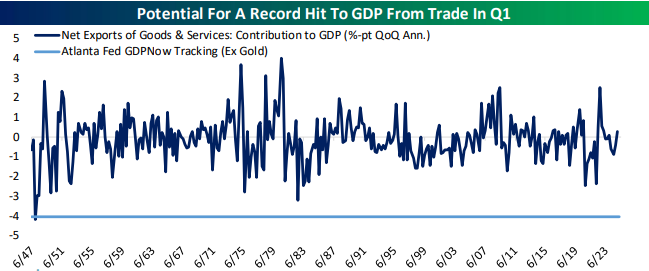

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, following earnings recaps (pages 1 and 2) we review trade figures (page 2), inventories and GDP (page 3), and the latest consumer confidence figures (page 4). We then look at the latest jobs data in the form of the JOLTS report (page 5) and Indeed job postings (pages 6 and 7)

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/29/25

Consumers Sour on Stocks

High-frequency sentiment surveys have consistently shown an overwhelming amount of bearish sentiment in recent weeks. For example, the AAII survey has registered more than 50% of responses as bearish for a record nine straight weeks per the latest release last Thursday. That negative stock market outlook is also showing up in consumer, rather than investor-focused data. Today’s release of the Conference Board’s reading on Consumer Sentiment saw broadly weaker than expected readings across categories (this will be discussed more in tonight’s Closer). In November, readings showed peak positive sentiment when the percentage of respondents expecting higher stock prices in one year hit a record high of 57.2% versus only 21.7% expecting lower prices. Fast forward to today, 48.5% of responses expect lower prices in the next year, versus 36.1% expecting higher prices. While the index for higher prices is middling relative to its historical range, the level for those expecting lower stock prices is in the 98th percentile at the highest level since October 2011.

Taking a net reading, consumers expect stock prices to fall in the next year. However, the current level was even more depressed as recently as the 2022 bear market. What is more unprecedented is how rapid the shift has been towards those negative feelings. As shown in the second chart below, the four-month change in that net reading is the most pronounced decline on record. The only two four-month declines that even come close were those ending in October 1990 and July 2002.

Q1 2025 Earnings Conference Call Recaps: Sherwin-Williams (SHW)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Sherwin-Williams’ (SHW) Q1 2025 earnings call.

Sherwin-Williams (SHW) is one of the world’s largest paint and coatings companies, serving professional painters, industrial customers, and DIY consumers across residential, commercial, and industrial markets. It operates through three main segments: Paint Stores Group (its company-operated stores), Consumer Brands Group (retail and distribution partnerships), and Performance Coatings Group (industrial applications like packaging, protective marine coatings, and auto refinishing). It offers insights into residential repainting trends, homebuilding activity, infrastructure investment, industrial production, and consumer spending resilience. Reflecting on the beginning of a year that has been choppy thus far, SHW reported that Residential Repaint remained a bright spot, posting mid-single-digit sales growth and clear market share gains. Tariffs and cost inflation were major themes, but the company expressed confidence in its ability to pass through price increases if necessary. Protective & Marine grew at a high single-digit pace, while Performance Coatings continued to face headwinds, particularly in heavy equipment and auto refinish. SHW missed revenue estimates but EPS results came in better-than-expected. The stock was up roughly 6% on 4/29…

Continue reading our Conference Call Recap for SHW by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: Spotify (SPOT)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Spotify’s (SPOT) Q1 2025 earnings call.

Spotify (SPOT) is the world’s largest audio streaming platform, offering a freemium service that provides access to music, podcasts, and audiobooks across more than 180 markets. The company serves consumers, artists, and advertisers through a dual model: a free, ad-supported tier and a paid Premium subscription. SPOT gives a unique window into global consumer entertainment habits, subscription economics, and digital advertising dynamics. SPOT Premium subscribers were up 12% YoY in Q1 to 268 million and total MAUs (Monthly Active Users) reaching 678 million, despite macroeconomic uncertainty. Subscriber growth outperformed, driven by emerging markets like Latin America and Asia-Pacific, while developed markets saw continued organic expansion and share gains. Advertising revenue grew 5%, helped by automated buying tools and DSP (Demand-Side Platform) integrations. Innovation remained a key theme, with AI accelerating product development and internal efficiency, leading to faster rollout of features like AI playlists. Content diversification through audiobooks and video podcasts boosted engagement, with video watch time up 44% YoY. Management reiterated confidence in future pricing power and signaled long-term growth opportunities through new premium tiers like Superfan offerings. SPOT missed estimates and the stock fell as much as 8.8% on 4/29…

Continue reading our Conference Call Recap for SPOT by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: Royal Caribbean (RCL)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Royal Caribbean’s (RCL) Q1 2025 earnings call.

Royal Caribbean (RCL) is one of the world’s leading cruise lines, operating globally through its well-known brands: Royal Caribbean International, Celebrity Cruises, and Silversea. The company serves millions of travelers each year. With a growing portfolio of technologically advanced ships, exclusive private destinations like Perfect Day at CocoCay, and a unified loyalty ecosystem across brands, RCL offers insight into consumer discretionary spending and experiential travel trends. Q1 was a record-breaking quarter, driven by strong consumer demand, especially in close-in bookings and onboard spending. Yields grew 5.6% YoY, fueled largely by ticket pricing. WAVE season was the best in company history, and April bookings for 2025 are pacing ahead of last year. The company is benefiting from positive consumer sentiment around leisure travel, a widening value gap versus land-based vacations, and premium pricing on new ships like Star of the Seas and Celebrity Xcel. The company beat EPS estimates but missed on the top line despite 7.3% YoY revenue growth, resulting in a +2.1% share-price move at the open on 4/29 followed by intraday weakness that wiped out the gains…

Continue reading our Conference Call Recap for RCL by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below: