Sentiment Around New Highs

In Tuesday’s Closer, we provided an update on monthly sentiment gauges, noting broad improvements since the April low. Of those inputs that have perked up is the weekly AAII survey. This week’s release saw the percentage of respondents reporting as bullish rise once again, to a two-week high of 36.7%.

The other side of the equation—the percentage of respondents reporting as bearish—had a more notable move this week. Only 33.6% of respondents were bears, which was the lowest reading since the week of January 23.

Put together, the bull-bear spread came in at 3.1, or alternatively, bulls outnumber bears by 3.1 percentage points. There was another positive reading in the spread a couple weeks ago, but this is the highest spread since the last week of January when it was at 7. In all, this indicates that investors have begun to shift more bullish rather than the consistent bearish tones from the past few months.

Also worth noting is that investors’ sentiment has made this improvement in tandem with a push in stock prices back near record highs. As the S&P 500 is about 1.5% below its February 19 peak, the current level of sentiment is actually lower than what might be expected. Historically, AAII sentiment (measured by the bull-bear spread) has averaged more bullish readings when the S&P is closer to a record, and readings become more bearish as it falls further from the highs (save for extreme drawdowns where sentiment actually begins to pivot to be more bullish). For the present distance from a high, the bull-bear spread has historically averaged in the high single digits compared to 3.1 today. In other words, sentiment does not appear to have gotten over its skis as the index attempts to break out.

Q2 2025 Earnings Conference Call Recaps: Oracle (ORCL)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Oracle’s (ORCL) Q4 2025 earnings call.

Oracle (ORCL) is a global leader in enterprise software, cloud infrastructure, and database technology. Best known for its Oracle Database, ORCL’s offerings span cloud applications (SaaS), infrastructure (IaaS), and advanced data management tools that support artificial intelligence, cybersecurity, and analytics at scale. ORCL’s Q4 results showed accelerating demand across its cloud infrastructure and applications, with total revenue rising 11% YoY to $15.9B and cloud revenue (SaaS + IaaS) jumping 27% to $6.7B. OCI (Oracle Cloud Infrastructure) revenue grew 52%, while autonomous database consumption climbed 47%. Management emphasized overwhelming demand for cloud capacity, forcing ORCL to turn customers away and ramp CapEx to $25B+ for fiscal 2026. ORCL’s vector-based AI platform (Oracle 23ai) and its ability to serve LLMs with private enterprise data were a major focus, positioning the company as a key enabler of real-world AI deployment. The $138B RPO backlog (+41% YoY) and new mega-contracts with firms like Temu reflect explosive interest in ORCL’s cloud stack and multi-cloud flexibility. Shares of ORCL hit an all-time high, up more than 14%, on 6/12 after posting better-than-expected results…

Continue reading our Conference Call Recap for ORCL by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Bespoke’s Morning Lineup – 6/12/25 – Perfect Ten

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I will never apologize for the United States of America. Ever. I don’t care what the facts are.” – George H.W. Bush

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After some modest losses on Wednesday, US equity markets remain weak this morning as S&P 500 and Nasdaq futures are indicated to open down by about 0.5%. In comparison, the Dow is even weaker with declines of about 0.70%. The added weakness in the Dow stems from an 8%+ decline in Boeing (BA) following news of an Air India 787 crash shortly after takeoff. Whether the tragedy was a Boeing issue is far from certain, but given the company’s troubles over recent years, investors aren’t waiting for details over what happened.

After yesterday’s weaker-than-expected CPI, investors are now focused on the May PPI and weekly jobless claims. PPI came in weaker than expected, but more concerning was jobless claims. Initial claims came in at 248K which was unchanged from last week’s revised reading and was the highest level since last October. Continuing Claims were more concerning as they shot up to 1.956 million and was the highest level since 2021. In response, equity futures have seen little in the way of moves, but yields have moved lower.

Investor sentiment has improved as stocks have recovered in the last several weeks, but based on the results of the AAII weekly sentiment survey, complacency has yet to set in. In this week’s survey, bullish sentiment improved from 32.7% to 36.7%, which is hardly an elevated reading. At the other end of the spectrum, just over a third of investors are still bearish (33.6%)/

In looking at the 52-week high list the last couple of days, we thought we stepped into a time machine seeing IBM on the list. The stock broke above resistance last week and continued to run higher all week, consistently closing higher than it opened.

With the gains this week, yesterday was IBM’s 9th straight day of trading higher. A nine-day streak may not sound all that impressive, but over the last 50 years, there have only been seven other streaks of nine or more days. Strangely enough, though, of the now eight streaks of nine or more positive days in a row, four have occurred in the last two years, while the prior 48 only had four!

The chart below shows where each of the prior streaks occurred on IBM’s historical chart. While two of the streaks were followed by steep declines in the days, weeks, months, and even years ahead, these streaks haven’t been indicative of any definitive forward trend.

The Closer – Testimony & Treasuries, CPI, Oil – 6/11/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with a review of what can be perceived as positive catalysts (page 1) followed by an update of the latest CPI release (page 2) including a look at the tariff impacts on prices (page 3). We also check in on real wages (page 4) and finish with a review of the latest oil supply data (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Morning Lineup – 6/11/25 – Inflation Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Too many people miss the silver lining because they’re expecting gold.” – Maurice Sendak

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

There have been some positive developments in the US-China trade talks as Commerce Secretary Howard Lutnick said that both parties agreed to a consensus in trade talks that now only have to be agreed upon by President Trump and Xi. The President just truthed that the deal is ‘done’. Despite the positive headlines, futures have been drifting lower as the terms of the deal really only bring us back to where we were after the Geneva meeting, so this drama is anything but done, even if things are moving in the right direction.

Markets are also a bit anxious heading into the release of the May CPI report. Will this be the month that the impact of tariffs starts to show up in the data, or will we once again hear that it’s a ‘next month’ story?

The S&P 500 closed within 2% of an all-time high yesterday, and overall breadth has likewise been strong. Let’s start with the cumulative advance/decline. The S&P 500’s cumulative A/D line has already hit a new high since “Liberation Day”, and after a brief dip in late May, it has rebounded right back within a hair of its high. If the market takes out its February high, it would be good to see breadth confirming the move.

One big contributor to the strong breadth in the market is the Technology sector, which has already taken out its late May high in the last few days, reaching a new high yesterday.

While the S&P 500 and Technology have seen new highs in terms of breadth as they wait for new highs in price to follow, the Industrials sector has been the opposite, as price has already made a new high, while breadth remains just shy. Back in late May, the sector’s cumulative A/D line just barely missed making a new high, and after a brief dip in late May, is now back on the rebound as it looks to take out those highs once again.

The Closer – Inflation Pricing, Ludicrous, CRE – 6/10/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, after a review of inflation pricing and forecasts of energy production and demand (page 1), we check in on investor sentiment (page 2). Next, we give an update on the “Ludicrous List”; stocks that have seen extremely large moves with extreme valuations (page 3). Next, we provide a look at CRE loan performance (page 4) and then close out with some charts on Employee Sentiment indices from Glassdoor (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

CPI on Tap

Tomorrow’s report on May CPI will help to shape the inflation narrative for the rest of the summer. A stronger-than-expected report will be quickly seized upon by the anti-tariff contingency, and if there’s a weaker-than-expected report, you can bet that President Trump will be on Truth Social singing the praises of tariffs. Earlier today, we tweeted that the Fed’s CPI Nowcast was predicting headline CPI to rise 0.13% compared to a Wall Street consensus forecast of 0.2%, so if the Nowcast is right, get ready for some Truth Social posts!

Besides the Nowcast, seasonal trends suggest that a stronger-than-expected inflation print is less likely. The table and chart below show the frequency of stronger-than-expected, weaker-than-expected, and inline headline CPI prints from 1999 through 2024. Since 1999, the May CPI report (released in June) has only been stronger than expected 31% of the time. That ranks as the fifth-highest percentage of higher-than-expected readings of any month. Weaker-than-expected reports, however, are more common at 46% of the time. The only other month with a higher frequency of lower-than-expected headline CPI reports is November (released in December) at 50%.

Bespoke’s Morning Lineup – 6/10/25 – The Negative Nine

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Too many people miss the silver lining because they’re expecting gold.” – Maurice Sendak

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

We’re not sure if it’s the summer doldrums setting in early or that investors needed a breather after the craziness of the last several months, but for the second morning in a row, the action in futures has been quiet. This morning, S&P 500 futures have been moving on either side of the unchanged line while the Nasdaq is set to open slightly higher.

US and Chinese officials are in London again this morning for the second day of trade talks, and the economic calendar is quiet with NFIB Small Business Sentiment being today’s only report. That came in better than expected, rising from 95.8 to 98.8 in May. Overnight, in Asia, Australia and Japan were higher while Hong Kong and China declined.

When it comes to the mega-cap stocks in the S&P 500 with market caps of more than or around a trillion dollars, an increasingly evident trend is that the group no longer trades as a block, where each member’s performance is no longer in line with the others. This can be seen in the year-to-date performance of the nine stocks listed below. While the average performance of the nine stocks on a YTD basis is basically unchanged (-0.01%) and the median is a gain of 5.37%, the performance of each stock ranges from 18.5% (Meta Platforms-META) to a decline of 23.6% (Tesla–TSLA). Even over the last 12 months, while all nine stocks have experienced positive returns, the magnitude of the gains ranges from 4.3% for Apple (AAPL) to a gain of 69.6% for Broadcom (AVGO). Even with every stock trading higher, they have hardly traded in unison.

Where we have seen a group of stocks trade much more in unison is at the other end of the market cap scale. The table below shows the nine stocks in the S&P 500 with the smallest market caps and how each has performed YTD and over the last 12 months. On a YTD basis, all nine stocks are lower with an average decline of 20.7% (median: -19.35). Just as notable is that the range of returns has been much closer than the largest stocks in the S&P 500. Whereas more than 42 percentage points separates the best and worst performances of the nine largest stocks in the S&P 500, for the nine stocks with the smallest market caps, the spread is just 23 percentage points. So, while the rising tide hasn’t impacted each of the nine largest stocks equally, the nine smallest stocks have been weighed down by a more similar anchor.

In terms of performance, while there may have been some concerns over the performance of the mega-cap stocks in recent months, they’re still doing much better than the nine smallest stocks.

Even on a relative strength basis, the nine stocks with the smallest market caps in the S&P 500 have consistently underperformed. Earlier this month, they even made a new low relative to the mega caps.

The Closer – IPOs, Consumers, Allotments – 6/9/25

Log-in here if you’re a member with access to the Closer.

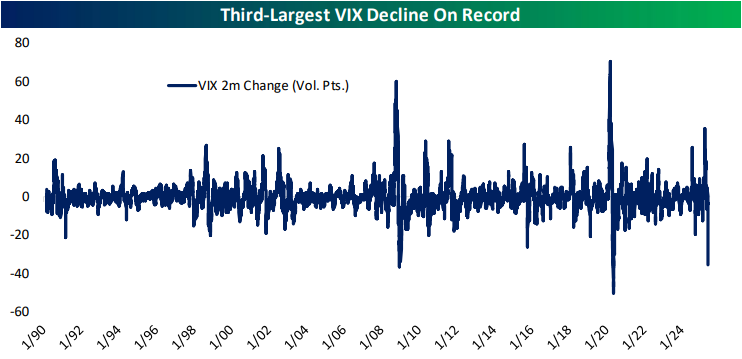

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a look at the huge drop in the VIX over the past two months (page 1). We then check in on IPO issuance (page 2) and consumer credit (page 3). Staying on the topic of the consumer, we then review their inflation expectations and other findings from the latest New York survey (pages 4 – 6). We close out with a check in on Treasury allotment figures (page 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

$1,000 in the Stock Market at Birth

There’s a real chance that newborn children in the US will begin receiving $1,000 in an investment account at birth if President Trump’s budget bill passes Congress in the months ahead. CEOs of some major public companies are actually meeting at the White House today to discuss the “$1,000 at birth” provision.

Below is a chart we created showing how much $1,000 at birth would be worth today if it were invested in the S&P 500 at the end of each month going back 50 years (with dividends re-invested).

As shown above, $1,000 invested in the S&P fifty years ago and not touched would be worth nearly $350,000 today. That number drops to roughly $127,000 if the $1,000 were invested at the end of November 1980 and $40,000 if the start date is August 1987. Even still, there are a lot of 37-year olds out there born just before the 1987 crash that wouldn’t mind having $40k in an investment account right now!

The second chart above shows the same data over just the last 25 years for better scale. Because of the Dot Com bubble and burst of the late 1990s and early 2000s and the Financial Crisis of the late 2000s, people born in various months during this period would have quite different account values right now. $1,000 invested in August 2000 just after the Dot Com peak would be worth roughly $6,200 today, while $1,000 invested nearly ten years later in February 2009 would be worth nearly $5k more at $11,000. If this provision comes to pass, we may see birth rates go up during lengthy bear markets!