Back to Back Inside Days for Semiconductors

After hitting an all-time high last Wednesday, the Philadelphia Semiconductor Index (SOX) saw a pretty rare occurrence of back to back inside days on Thursday and Friday. For those unfamiliar with the term, an inside day occurs when the intraday daily price range of a security is completely ‘inside’ the range of the prior day i.e., the day’s intraday high is lower than the prior day’s intraday high and the intraday low is higher than the prior day’s intraday low. For more information on the term, you can check out a discussion of it on Investopedia.

In yesterday’s trading, the SOX broke the pattern of inside days as the intraday low was lower than the intraday low from the prior Friday. What was especially noteworthy about last week’s inside days is that they were back to back and followed a day where the SOX traded to a 52-week high. In the entire history of the SOX daying back to 1994, there have only been four other times where there has been a similar setup. According to technicians, an inside day is generally considered to be a pause in a continuation pattern, in that the market typically follows the direction it was moving before the inside day. As most chart-watchers are well aware, however, just because a technical pattern suggests the price of a security will move in one direction doesn’t mean it always does.

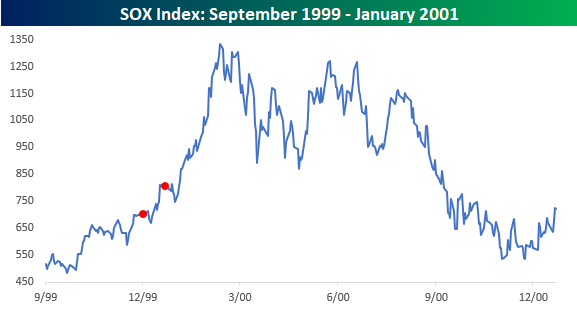

In order to put the technical pattern to the test, in the charts below we have shown each of the prior four occurrences of back to back inside days in the SOX index that followed a day where the index hit a 52-week high. Given that the SOX rallied to a 52-week high before the back to back inside days, technicals would suggest that the SOX would resume its rally following these inside days. Before going any further, though, we would stress that with a sample size of just four, we wouldn’t read too much into the results.

The first two occurrences of back to back inside days following a 52-week high for the SOX occurred within three weeks of each other in December 1999 (12/29/99) and January 2000 (1/19/00). Here you can read into what happened next as both bullish and bearish. For the bulls out there, the SOX rallied more than 60% in the six months that followed the first occurrence and was even up much more than that four months later. From the high in March 2000, though, it was all downhill from there as the dot-com bubble popped and the Nasdaq cratered. One year later, the SOX was lower than it was at the time of each of the first two occurrences by 18% and 11%, respectively.

The next time the SOX saw back to back inside days following a 52-week high was in July 2005, and here the SOX’s performance was just as mixed. After the inside days, the SOX saw a short-term peak shortly thereafter, but it more than rebounded in the six months that followed. Once again, though, a year later, the SOX was 12% lower than it was at the time of the original inside days.

Finally, the most recent occurrence prior to last week’s came in July 2007. In this period, the market never saw a higher closing print than its 52-week high from before the back to back inside days. A week later, the SOX was down 6%, and one year later it was down 33%. In fact, it wasn’t until January 2014, more than six years later, that the SOX ever closed above that level again.

Again, four occurrences isn’t exactly a large sample size, but from a broader picture, we also looked at the performance of the SOX following all back to back inside days and found that its performance was notably better following occurrences where the market was down leading up to them rather than up. That would suggest that for back to back inside days at least, the pattern is more of a reversal than a continuation pattern. Start a two-week free trial to Bespoke Institutional to stay on top of all the latest market trends using our research and investor tools.

Bespoke’s Morning Lineup – Sweating Out Some Mixed Earnings Data

US futures were up until Europe opened but have since plunged and show the S&P set to gap down 42 bps after Presidential tweets discussing ’problems’ with China. Expectations for the current round of trade talks are low. Earnings are weak in Europe, mixed in the US this morning, and data has generally been weaker than forecast over the last 12 hours of market news.

Continue reading in today’s Morning Lineup.

Bespoke Morning Lineup – 7/30/19

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Mid and Small Caps Slowly Catching Up

While small and mid-caps have been notable laggards behind large caps, which have hit multiple new highs in the last several days, rather than continuing to drift lower they are showing some signs of playing catch up. While it isn’t even testing new highs or even above its April highs, the S&P 400 Mid Cap Index has managed to break its downtrend in the last few days and is currently less than 4% from its 52-week high. Hey, it’s a start!

Small caps, however, are another story. The Russell 2000 has been trying over the last few days to break its downtrend but has come up just short. While all it will take is another couple of days to break that downtrend, 52-week, or all-time highs, however, are still a ways off; 10% to be exact. Start a two-week free trial to Bespoke Institutional to stay on top of all the latest trends using our Chart Scanner tool.

The Closer – 7/29/19 – Telecom, 5 Fed Lows, Brexit Woes

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we dive into telecoms; taking a look at price action on both a short and longer-term technicals. Next, with the Dallas Fed’s release this morning, we show a complete view of our Five Fed Manufacturing Index. We finish with a look at market reactions to recent Brexit developments including the steep drop in GBP and the underperformance of UK equities.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Stocks Reacting More Positively to Earnings

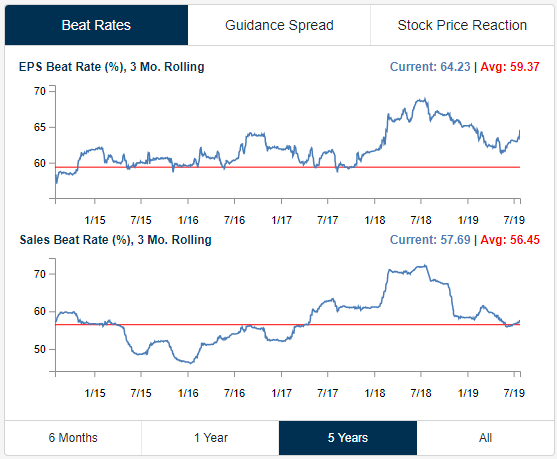

Below is an updated snapshot of earnings and revenue beat rates after factoring in the 600+ earnings reports that we’ve gotten over the last two weeks. The first chart in the snapshot below shows the rolling 3-month earnings per share beat rate over the last five years. You can see that more recently we’ve seen a bounce in bottom-line EPS beat rates. Over the last three months, 64.23% of companies reporting have beaten consensus EPS estimates, which is nearly five percentage points above the long-term average.

The second chart shows the rolling 3-month revenue beat rate, which currently stands at 57.69%. This is up ever so slightly over the last couple of months, but it’s just a bit above the long-term average and it’s well below the beat rate for EPS.

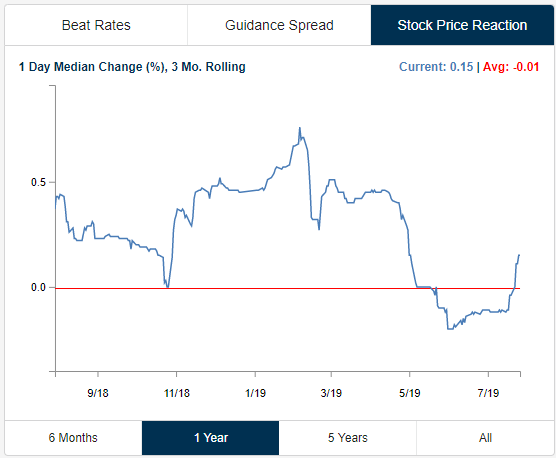

Stocks have been reacting a lot more positively to their earnings reports recently. Over the last three months, the median stock that has reported earnings has gained 0.15% on its earnings reaction day. While that’s not hugely positive on an absolute basis, it’s up big from the negative reactions we were seeing back in May and early June and comes just as the bulk of companies are reporting.

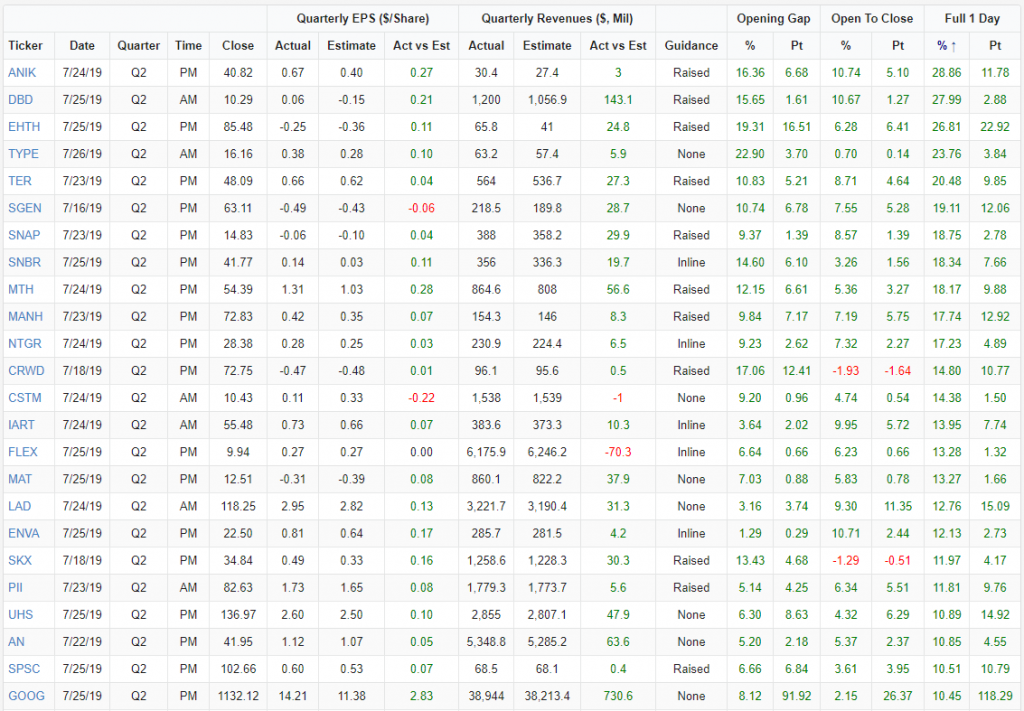

Below is a look at the stocks that have reacted the most positively to earnings over the last two weeks. ANIK has seen the biggest one-day gain on earnings this season with an upside move of 28.86% on July 25th (it reported after the close on 7/24). DBD ranks second with a one-day gain of 27.99%, followed by EHTH with a gain of 26.81%. Other notables on the list of big earnings winners include SNAP, MAT, and GOOG. Start a two-week free trial to Bespoke Institutional to access our popular Earnings Explorer tool, which features an interactive calendar of upcoming reports and a full database of historical reports for nearly every US public company.

Triple Play Acquiring Triple Play

Exact Sciences (EXAS) announced plans today to acquire another health care company, Genomic Health (GHDX). The two announced that the agreement would combine Exact Sciences with Genomic Health for $72 per share in cash and stock. That acquisition news is not the only thing the two have in common though. Both companies also reported EPS before the open today, and they were both triple plays.

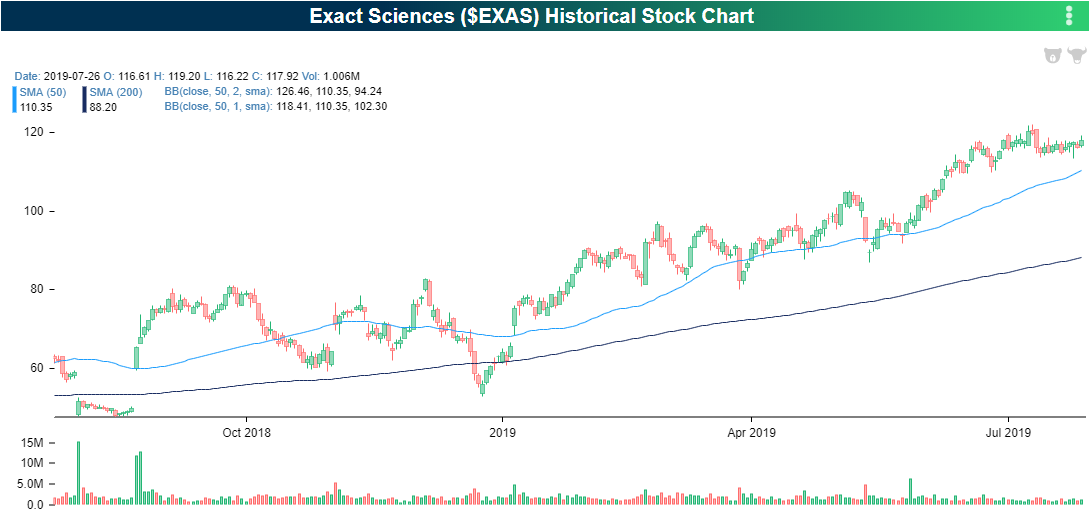

Exact Sciences (EXAS) is a cancer diagnostics company specializing in the detection of colorectal cancer with their signature product Cologuard. This was the company’s fifth triple play with the last one occurring in October 2018. The company is seeing much larger cash flows this year as it grew revenues an astounding 94.3% YoY to $199.87 million versus expectations of $182.18. This was also the 16th straight quarter with sequentially higher revenues. The company is still operating at a loss, though, with EPS at -$0.30, but that was above estimated losses of $0.56 per share. The company has still yet to post a profit for any quarter over the past 34 reports in our Earnings Explorer as costs/expenses have been growing at a high rate, similar to revenues. For example, in this most recent report, total expenses grew 67.5% YoY. Despite the triple play, EXAS is down sharply today, trading more than 10% lower due to the GHDX acquisition. The stock has been in an uptrend over the past year, so this decline brings it below the 50-DMA and near the lower end of this uptrend channel.

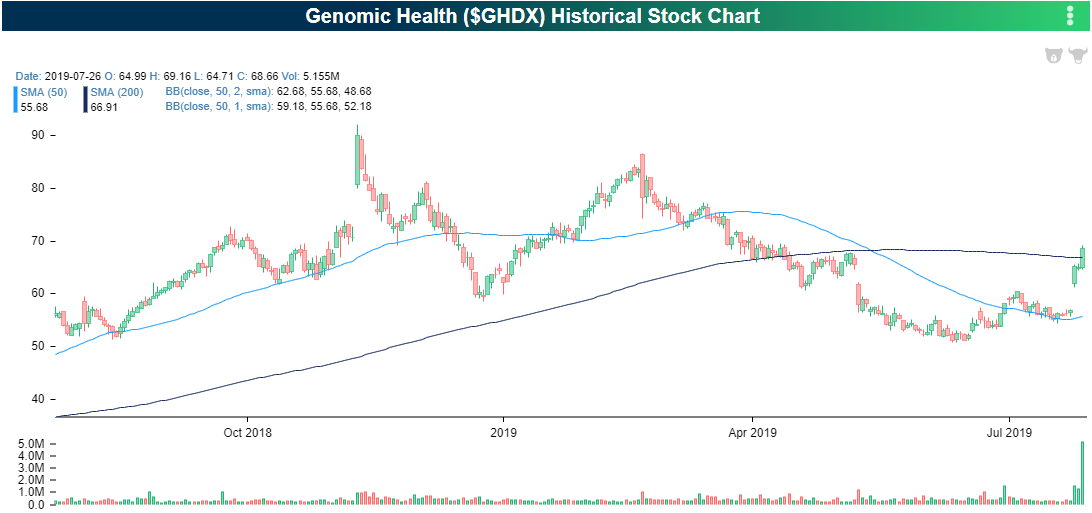

Genomic Health (GHDX) was originally scheduled to release earnings on Thursday (August 1st), but with the merger announcement, they moved up their report. Like Exact Sciences, Genomic Health also specializes in cancer diagnostics. In this earnings report, GHDX reported EPS of $0.42 versus estimates of $0.35. Revenues also came in above estimates at $114.14 million, 19.4% YoY growth. The company reported that each of the key product areas for their main product, Oncotype, saw double-digit growth YoY with the main highlight being a 42.3% growth rate for the prostate test. The stock has risen 3.28% in response today. This is after last week’s massive gains when it was announced the stock would be joining the SmallCap S&P 600 Index. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer, the 100 Most Recent Triple Plays, and much more.

High Yielders

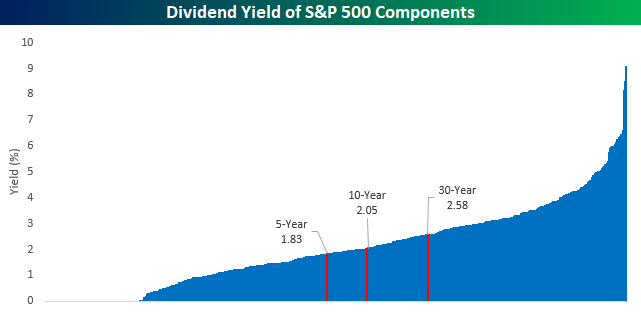

With US Treasury yields so low right now, yields on equities have become increasingly competitive. Granted, Treasuries have considerably less capital risk than equities, but from a historical perspective, it isn’t typical for stocks to yield more than Treasuries. Then again, is anything typical these days? While there have been short periods in recent history where the S&P 500 has had a higher dividend yield than the 10-year US Treasury, right now the 10-year yield (2.05%) is just under 20 bps higher than the dividend yield of the S&P 500 (1.87%).

For a large percentage of the S&P 500’s individual components, though, it’s a different story. As shown in the chart below, 225 of the S&P 500’s individual components had a dividend yield of more than 2.05% (the yield on the 10-year) while 173 of those have a higher yield than the 30-year US Treasury. Also, relative to the 5-year US Treasury, more than half (259) of the S&P 500’s components have a higher yield.

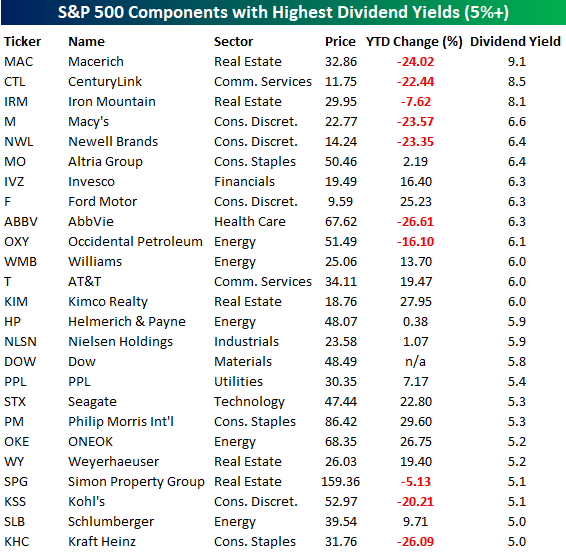

Turning to the highest yielding S&P 500 stocks, 25 of them now have a yield of 5% or more. Normally, you would expect to see stocks from the Financials and Utilities sectors comprise a large portion of a list like this, but each of these sectors only has one stock on the list. The two stocks with the greatest representation are Energy and Real Estate, each with five. Perhaps the most notable aspect of the list is that all eleven of the S&P 500’s sectors are represented on the list – even Technology (Seagate)!

While high dividend yields sound attractive, it’s important to be careful with these types of names as they often have high yields for a reason. Just look at the five highest yielders; they’re all down YTD and by an average of 20% compared to the S&P 500 which is up over 20%. Year to date, the 25 names listed below are up an average of just 1.11%.

One theme that stands out on the list is just how out of favor brick and mortar retail is. Not only is that evident with names like Macy’s (M) and Kohl’s (KSS) but more importantly the retail-related REITs like Kimco (KIM), Macerich (MAC), and Simon Property (SPG) that own much of the real estate that the brick and mortar retailers lease.

Of all the names listed below, a year or two from now a number of these names will likely be big winners, but there will also undoubtedly be a number of names that either cut their dividends substantially or simply go out of business. Start a two-week free trial to Bespoke Institutional to access our full research suite.

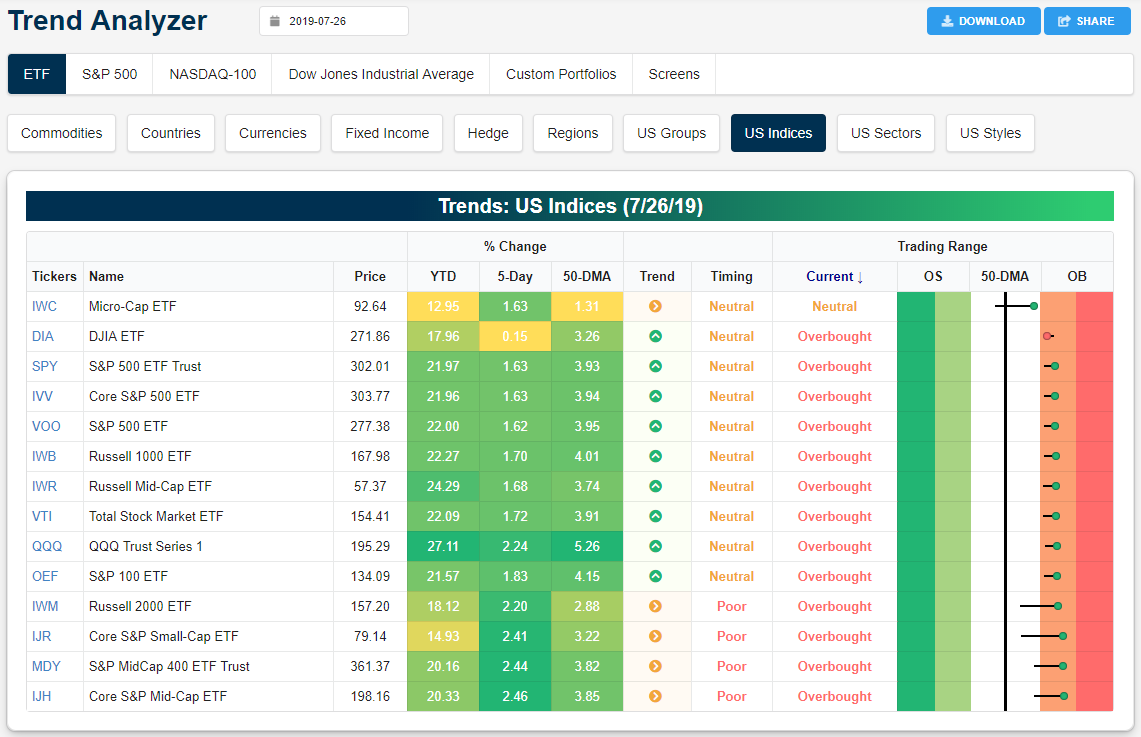

Trend Analyzer – 7/29/19 – Small Caps Surge, Large Caps Mixed

Small and mid-caps have surged in the past week as the Russell 2000 (IWM) and Core S&P Mid-Cap (IJH) gained well over 2%. These strong gains came in spite of their sideways trends; except for the Russell Mid-Cap (IWR) which saw more middling gains and is also in an uptrend. Last week’s gains also resulted in sizable movements within each ETFs’ respective trading ranges. While they were in neutral territory last week, many have moved to overbought levels. Although it has gotten close, the only one of the index ETFs not at overbought levels the Micro-Cap (IWC).

No major index ETFs finished lower last week, but the Dow (DIA) was a significant laggard with a gain of only 15 bps. While DIA underperformed (largely due to Boeing), the Nasdaq 100 (QQQ) surged 2.24% and the S&P 500 (SPY) rallied 1.63%. Whith these gains, the S&P 500 and Nasdaq managed to finish last week at new all-time highs, but the Dow still has some progress to make until it can do the same. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

Bespoke’s Morning Lineup – Small Gains to Start to a Big Week

Premarket futures couldn’t be much quieter ahead of the first opening bell of the week, but that doesn’t mean there isn’t any news. While the economic calendar is quiet today, there’s already been major deal news, and the pace of economic activity will pick up as the week goes on. Also, don’t forget this Wednesday’s FOMC meeting! The dollar is up for a 6th day out of the last 7, crude oil is continuing to consolidate with little movement in the past week and a half, and rates are lower across the curve.

Continue reading in today’s Morning Lineup.

Bespoke Morning Lineup – 7/29/19

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 7/28/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Food

No One Knows Why a Mystery In-N-Out Burger Was Found Abandoned in Queens, 1,500 Miles from Home by Morgan Phillips (Mediaite)

How on earth did a fresh In-N-Out Burger make it from Kansas City (if not much further afield) to the streets of Queens early in the morning? [Link]

Chicago’s Real Signature Pizza Is Crispy, Crunchy, and Nothing Like Deep Dish by Jason Diamond (Bon Appétit)

You’ve been getting pizza all wrong. Specifically, the thick, deep dish sausage and cheese cakes are less genuine than thin, cheap, and crunchy bar snacks. [Link]

Investing

The Patsy, Revisited by Rusty Guinn (Epsilon Theory)

An ode to the combined importance and utter impossibility of knowing who else owns the assets you own, be they stocks, bonds, or anything else. [Link]

The Cannabis Opportunity by Meb Faber (Meb Faber Research)

A long read on the investing approach that might lead to owning cannabis stocks and why that bet may well be correct in the long term. [Link]

Mercy Withheld

Businessman: Wyoming Valley West board president denied 22K school lunch debt donation offer by Bob Kalinowski (The Citizens’ Voice)

After a Pennsylvania school board received national attention for its zero-tolerance approach to school lunch debt, a Philadelphia businessman offered to cover the debt but was rebuffed by school board officials. [Link]

Trump administration proposed rule would cut 3 million people from food stamps by Tom Polansek and Humera Pamuk (Reuters)

In 43 states, residents can become eligible for SNAP (commonly referred to as food stamps) if they already qualify for another benefit program, the Temporary Assistance for Needy Families. A new rule would end that practice. [Link]

Media

Inside the Democrats’ Podcast Presidential Primary, Where Marianne Williamson and Andrew Yang Rule by Oar Sanchez (The Wrap)

With more than 20 Democrats running for the top of the Presidential ticket, they’ve collectively logged more than 1200 podcast appearances. [Link]

22 Books That Expand Your Mind and Change The Way You Live by Darius Foroux (Pocket)

A range of interesting reads ranging from novels to history to philosophy that open up new worlds for readers. [Link]

The moon landing was a giant leap for movies, too by Jake Coyle (AP)

Touching down on the moon stimulated the national imagination in all kinds of ways, but the wave of movies before and after the moon landing drove a public fascination with space that has continued to this day. [Link]

Autos

Citroën Sabotaged Wartime Nazi Truck Production in a Simple and Brilliant Way by Jason Torchinsky (Jalopnik)

One small change to oil dipsticks meant French-produced trucks broke down at the worst times, but it was such a small change that it was easy to effect and basically undetectable. [Link]

Ford F-150 EV pickup prototype tows more than 1 million pounds by Dalvin Brown (USA Today)

An electric version of Ford’s classic pickup has demonstrated epic torque capable of moving a million pounds 1000 feet, a performance that would be literally impossible with traditional fuels. [Link]

Regulation & Competition

Equifax Data Breach Settlement (Federal Trade Commission)

A settlement with the FTC has created a series of benefits for the nearly 150mm consumers impacted by the Equifax Data Breach. [Link]

Justice Department to Open Broad, New Antitrust Review of Big Tech Companies by Brent Kendall (WSJ)

Facebook, Google, Amazon, and Apple are all in the crosshairs of Washington, reversing a light-touch regulatory approach to competition that has prevailed inside the Beltway for years. [Link; paywall]

Asia

In Hong Kong Protests, Faces Become Weapons by Paul Mozur (NYT)

In a war fought between protestors and authorities, identification and correlation between what’s said online and offline are key battlegrounds. [Link; soft paywall]

The #NoMarriage Movement Is Adding to Korea’s Economic Woes by Jihye Lee (Bloomberg)

Korea’s government has tried to boost birth rates, but more citizens are dying than being born, but many women feel the patronizing and sexist approach is making motherhood even less attractive. [Link; soft paywall, auto-playing video]

Wealth

Billionaire Behind Victoria’s Secret Built His Version of the American Heartland by Sophie Alexander (Bloomberg)

There’s a certain kind of rich that sparks a taste for buying things far beyond what most can imagine. For instance: an entire town. [Link; soft paywall, auto-playing video]

Yacht Owners Ditch Life on Land for the High Seas by Emily Nonko (WSJ)

For some retirees, no fixed address and constant access to the open ocean means cutting ties with land and moving permanently into the nautical world. [Link; paywall]

Economics

Why dynamic and personalized pricing strategies haven’t taken over retail — yet by Ben Unglesbee (Retail Dive)

E-commerce has allowed companies to show consumers different prices in order to maximize the revenue from sales, but there still isn’t much of that in the real world. [Link]

Internal Trade in Canada: Case for Liberalization by Jorge Alvarez, Ivo Krznar, and Trevor Tombe (IMF)

A quantification of the barriers to trade between Canadian provinces, which unlike American states are not governed by a uniform commercial scheme. [Link]

Sports

The World’s 50 Most Valuable Sports Teams 2019 by Kurt Badenhausen (Forbes)

More than half of the most valuable franchises are American football teams, which are magnets for valuation in a way that global soccer teams just can’t manage to match. [Link]

Central Banking

The New York Fed Has a Black Swan Hunter by Craig Torres (Bloomberg)

A special unit inside the New York Fed is charged with questioning orthodoxy, arguing against convention, and trying to pick out the biggest threats to the economy before they become visible. [Link; soft paywall]

Swiss policymakers caught in crossfire over franc by Eva Szalay (FT)

Efforts to reduce the value of the Swiss franc may catalyze an international reaction against the exchange rate-obsessed Swiss National Bank. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!