July 2019 Asset Class Performance

July ended with a thud after Chair Powell’s presser this afternoon sent the S&P 500 lower by 1.09% at the close. Even with today’s 1% declines, though, US equities posted solid returns during the month.

Below is our asset class performance matrix showing total returns for various ETFs today, in July, and year-to-date.

Interestingly, Consumer Staples was the sector that got hit hardest today with a decline of more than 2%. Consumer Discretionary, Materials, Industrials, and Technology also fell more than 1%.

For the month of July, most country ETFs ended up struggling badly even though the US gained 1%+. France, Germany, Hong Kong, India, Mexico, Spain, and the UK all fell more than 2% in July. Silver was the best asset class in July with a gain of more than 6%.

Year to date, the best performer in the entire matrix is the US Tech sector with a gain of more than 30%. Russia ranks second at +25%. Start a two-week free trial to Bespoke Premium to receive our best equity research on a daily basis.

The Closer – Burn After Cutting – 7/31/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we provide our commentary on today’s FOMC rate decision and subsequent press conference by Fed Chair Powell. We go over the broadly negative reaction across assets before turning to some of today’s macroeconomic data including the employment cost index and EIA petroleum data.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

“Make Fed Days Great Again!”

President Trump has raised a lot of eyebrows recently with his comments saying that despite all the good going on in the economy and stock market, the DJIA would be “10,000 points higher than already a very high number” were it not for the Fed. While it is hard to believe that the DJIA would be 10,000 points higher had the Fed not hiked rates, it is interesting to note that on FOMC days since Powell became the Fed Chair, that the DJIA has seen a cumulative decline of over 1,000 points. Throughout history, Fed days have historically been positive market days, but under Powell, they have been nothing of the sort. Start a two-week free trial to Bespoke Institutional, and receive full access to all of our must-read content.

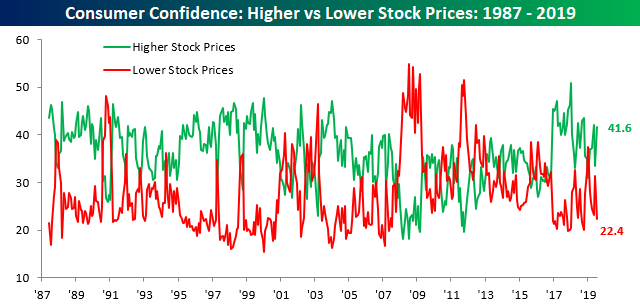

Americans Still Not All In on Equities

Maybe they’re still feeling the sting of January 2018 when they basically went ‘all-in’ on stocks (and bitcoin for that matter) and then saw prices crater for two months, but despite more new highs for equities, US consumers haven’t been really quick to embrace the market. In Tuesday’s Consumer Confidence Report, for the question which asks consumers for their views on the direction of US equities, 41.6% expect prices to continue rising, while only 22.4% expect lower prices. Granted, the 41.6% reading is a relatively big increase from June when the reading was at 33.5%, but it’s still below the 42.1% reading from May and the peak reading of 51.0% from January 2018. As shown in the green line of the chart, ever since the peak reading in January 2018, we have been seeing lower highs in the percentage of consumers expecting higher stock prices.

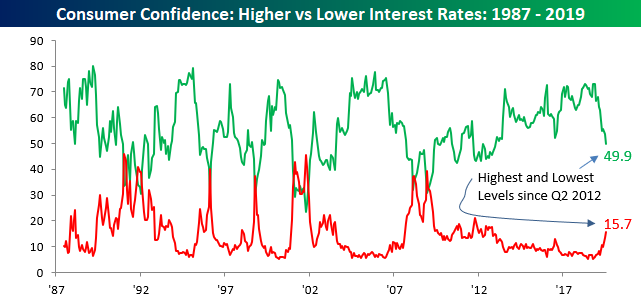

Consumers are also asked to give their views on interest rates in each month’s Consumer Confidence Report, and here we’ve seen some interesting moves over the last few months. Ever since the Fed started to pivot towards lower rates at the start of the year, the percentage of consumers expecting higher interest rates has declined rapidly. From a recent high of over 70% in late 2018, less than half of consumers now expect higher interest rates. Meanwhile, the percentage of investors expecting lower rates has risen from near historic lows up to 15.7%. For both of these series, July’s readings were the most extreme since late 2012. Keep in mind too, that this comes as long-term treasury yields are close to historic lows. Start a two-week free trial to Bespoke Institutional, and receive full access to all of our must-read content.

Bespoke Market Calendar — August 2019

Please click the image below to view our August 2019 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three premium research levels.

Bespoke’s Consumer Pulse Report — August 2019

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Fixed Income Weekly – 7/31/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss falling real yields around the world economy.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 7/31/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Triple Plays Galore

When a company reports earnings with EPS and sales above analyst estimates while also raising guidance, we label it a triple play. This can be considered a signal of a strong fundamental and growth picture for a company. Now in the heart of earnings season (with tomorrow being the busiest day of reports this quarter), there have been 15 triple plays just since last night’s close. That is the most for any day so far this earnings season. Some notable names that reported triple plays include Apple (AAPL), Humana (HUM), and Paycom (PAYC). Apple (AAPL) has been no stranger to triple plays recently as last night’s report marked its second straight triple play. In the past ten reports (including yesterday’s) it has seen a triple play half the time. Similarly, for Humana (HUM) this quarter marked the third straight year with a triple play on its Q2 report. Paycom (PAYC) also adds onto a long list of triple plays with last night’s report. Since its first report in May of 2014, PAYC has now seen 11 triple plays. Most of these triple plays are trading higher headed into the open with Enphase Energy (ENPH) up the most, over 26%. Start a two-week free trial to Bespoke Institutional to access our Earnings Explorer, Triple Plays Tool, and much more.

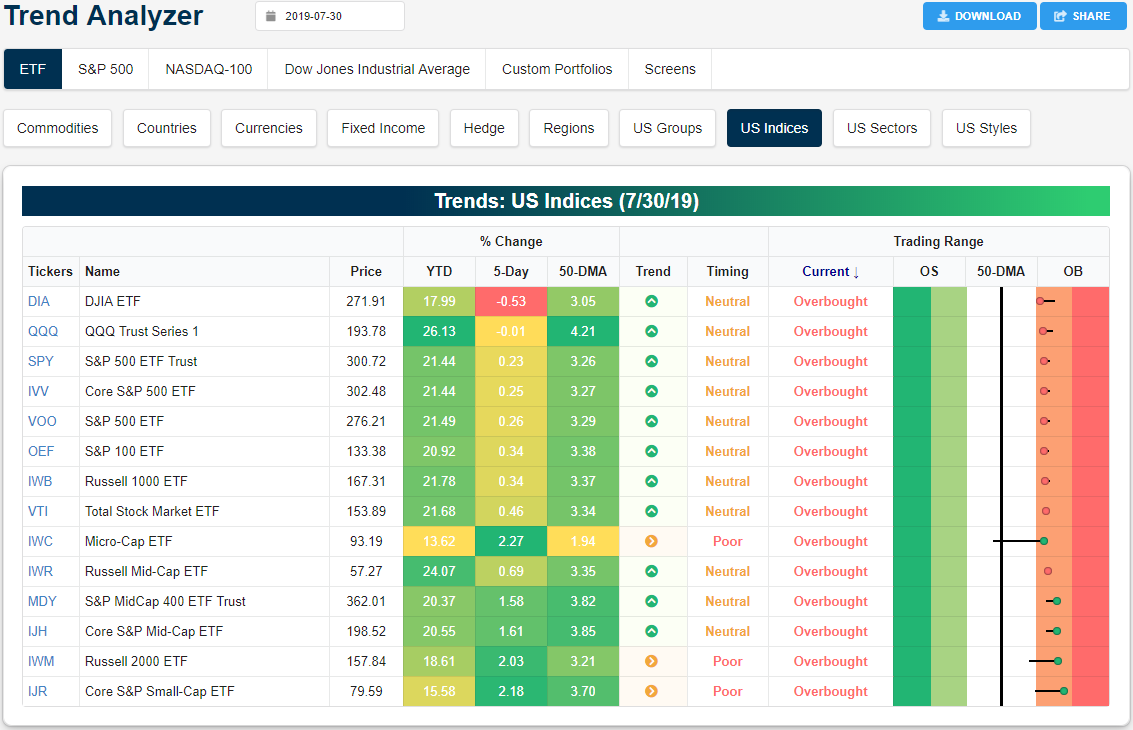

Trend Analyzer – 7/31/19 – Everything Overbought

With yesterday’s gains further adding onto the past week’s surge from below the 50-DMA, the Micro-Cap ETF (IWC) is now overbought for the first time since the first week of May. As IWC makes this move, there is no longer a single major index ETF that is not overbought. We have been making note of small and mid-caps outperformance over the past week, and as the Dow (DIA) and Nasdaq (QQQ) both sit lower over the past five days, this trend has only been exacerbated. In the past week, small caps have risen over 2% while mid-caps have likewise tacked on an over 1.5% gain. This stronger performance has also helped to change the trends of mid-caps to once again show uptrends.

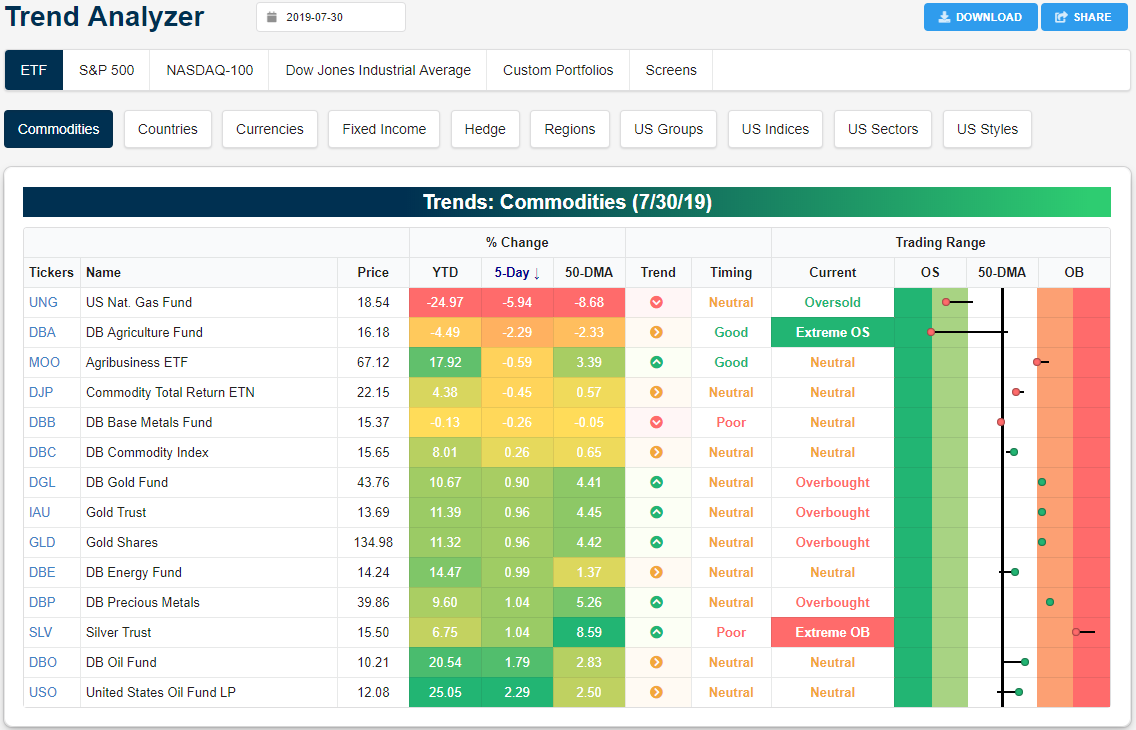

While every major index ETF is now overbought, the trends for commodities are looking a bit different. Natural Gas (UNG) has taken a beating this year, losing almost 25% year-to-date. This week alone it has fallen 5.94% and is now several percentage points below its 50-day moving average. Likewise, while it has been in a long-term downtrend for some time, recent losses have also brought the DB Agriculture Fund (DBA) into extreme oversold territory. Only a week ago DBA was above its 50-DMA. Meanwhile, precious metals remain overbought with solid gains both YTD and over the past five days. After its significant rally in the past weeks, Silver (SLV) in particular has become the most extended as it is currently at extreme overbought levels. But it has also been moving lower within this trading range. The best performing commodity in the past week has been oil. The DB Oil Fund (DBO) and US Oil Fund LP (USO) have both outperformed with gains of 1.79% and 2.29%, respectively. One week ago, these two ETFs were only at their50-DMA so these gains over the past week have not yet brought them into overbought territory. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.